Question

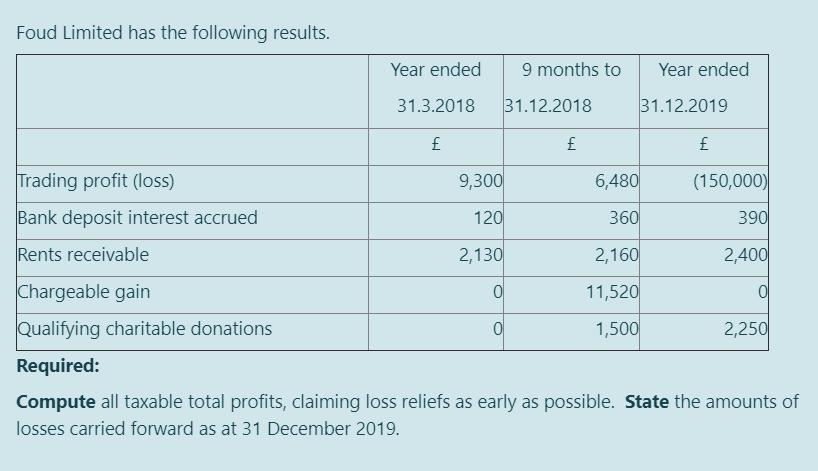

Foud Limited has the following results. Trading profit (loss) Bank deposit interest accrued Rents receivable Year ended 31.3.2018 9,300 120 2,130 9 months to

Foud Limited has the following results. Trading profit (loss) Bank deposit interest accrued Rents receivable Year ended 31.3.2018 9,300 120 2,130 9 months to 31.12.2018 0 0 6,480 360 2,160 11,520 1,500 Year ended 31.12.2019 (150,000) 390 2,400 0 Chargeable gain Qualifying charitable donations Required: Compute all taxable total profits, claiming loss reliefs as early as possible. State the amounts of losses carried forward as at 31 December 2019. 2,250

Step by Step Solution

3.44 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

The taxable total profits are as follows Trading profit ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial and Managerial Accounting the basis for business decisions

Authors: Jan Williams, Susan Haka, Mark Bettner, Joseph Carcello

16th edition

0077664078, 978-0077664077, 78111048, 978-0078111044

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App