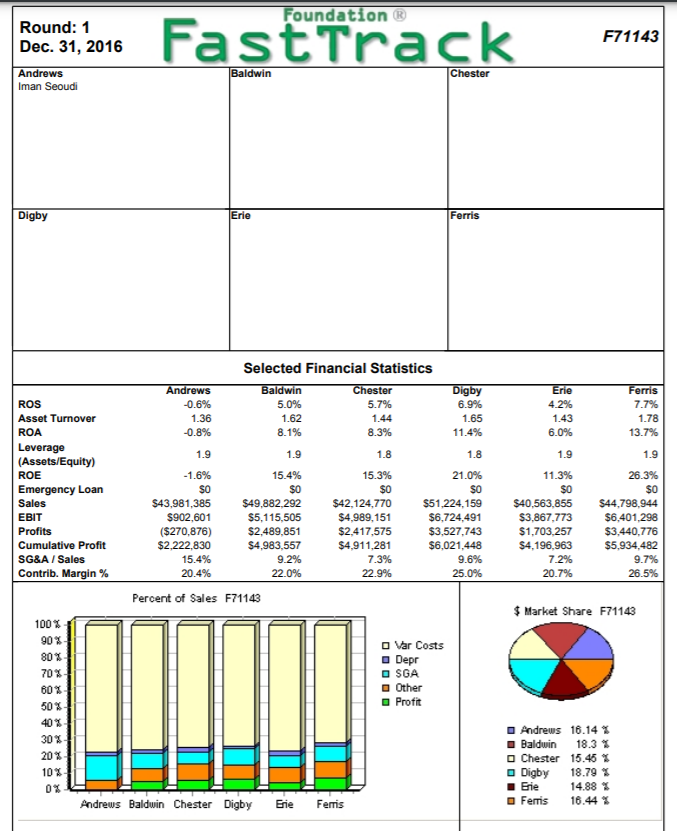

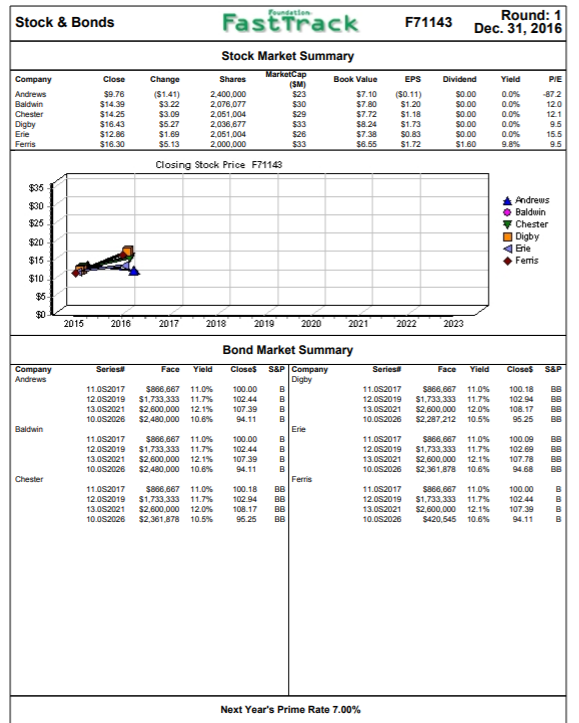

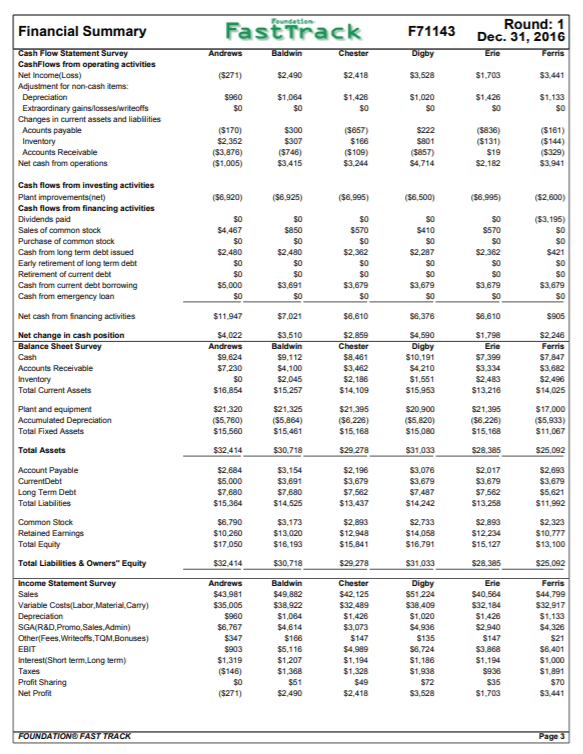

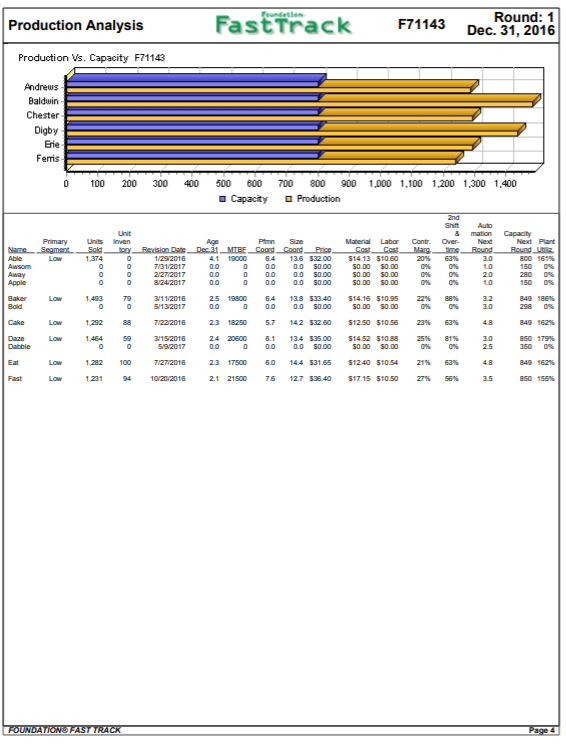

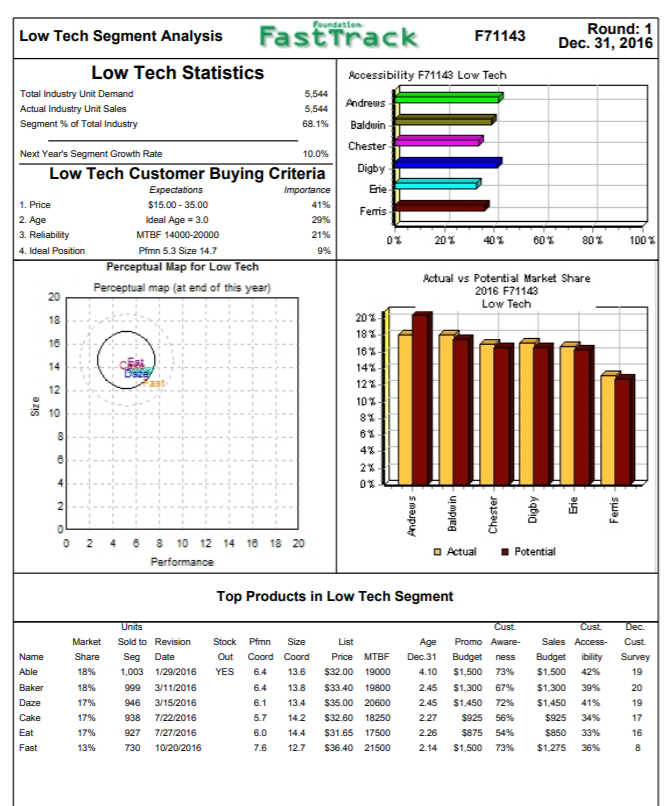

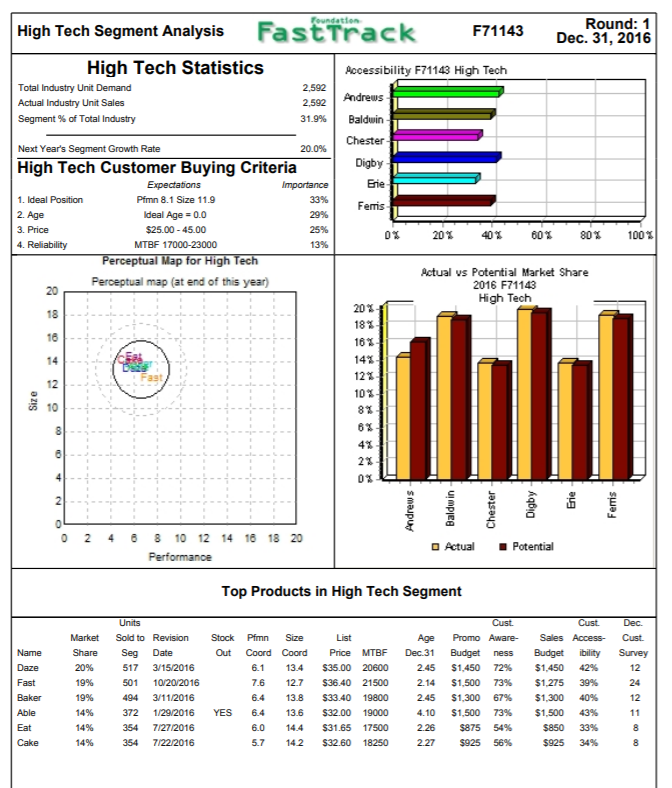

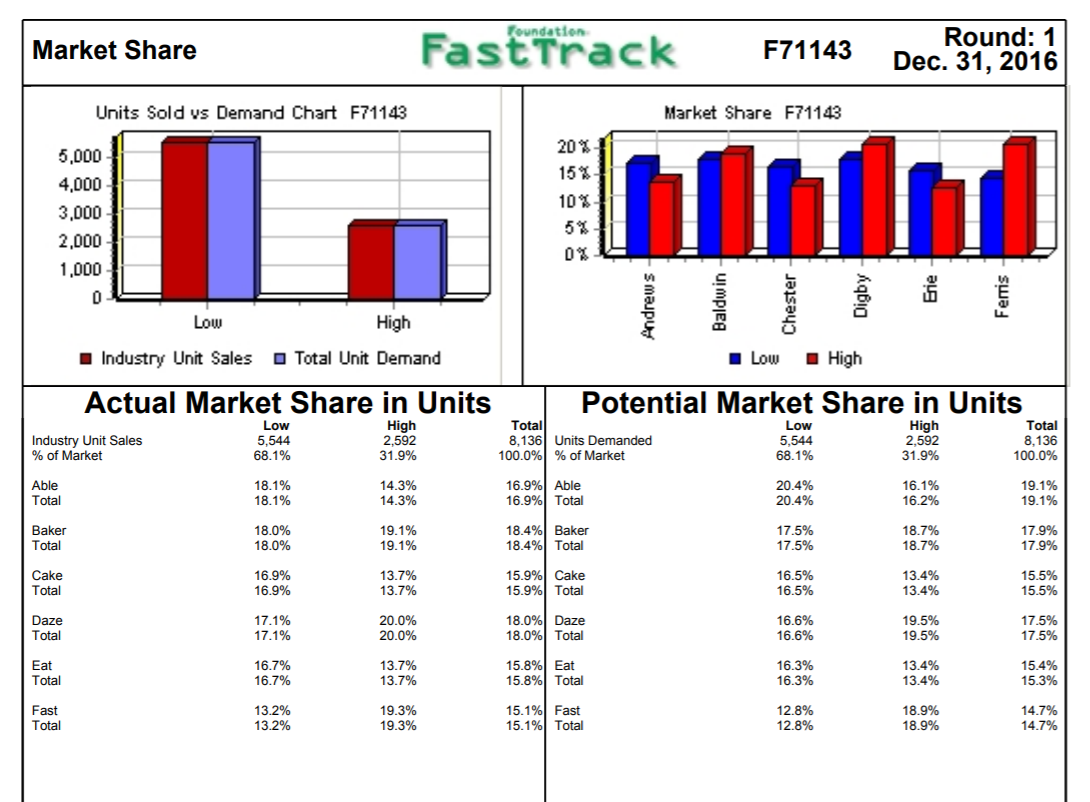

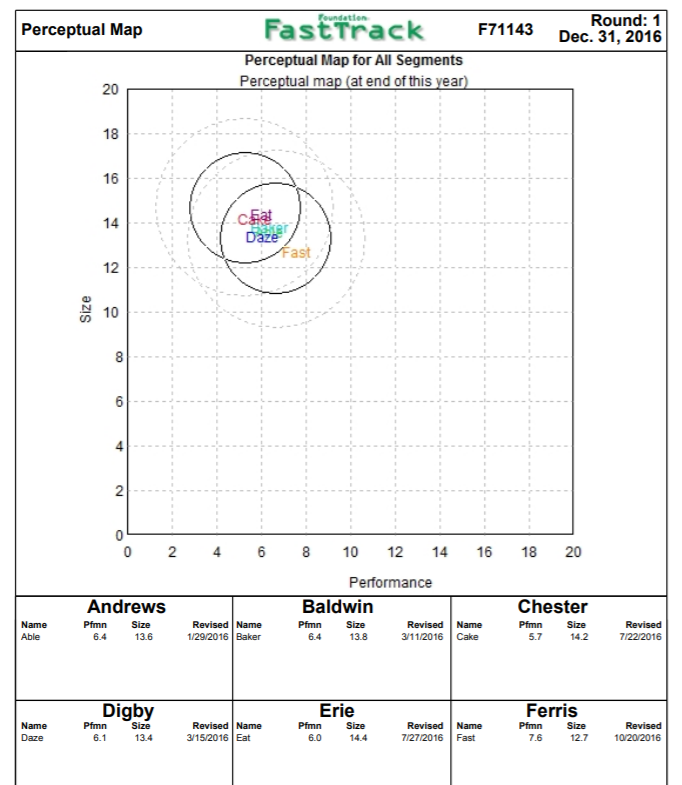

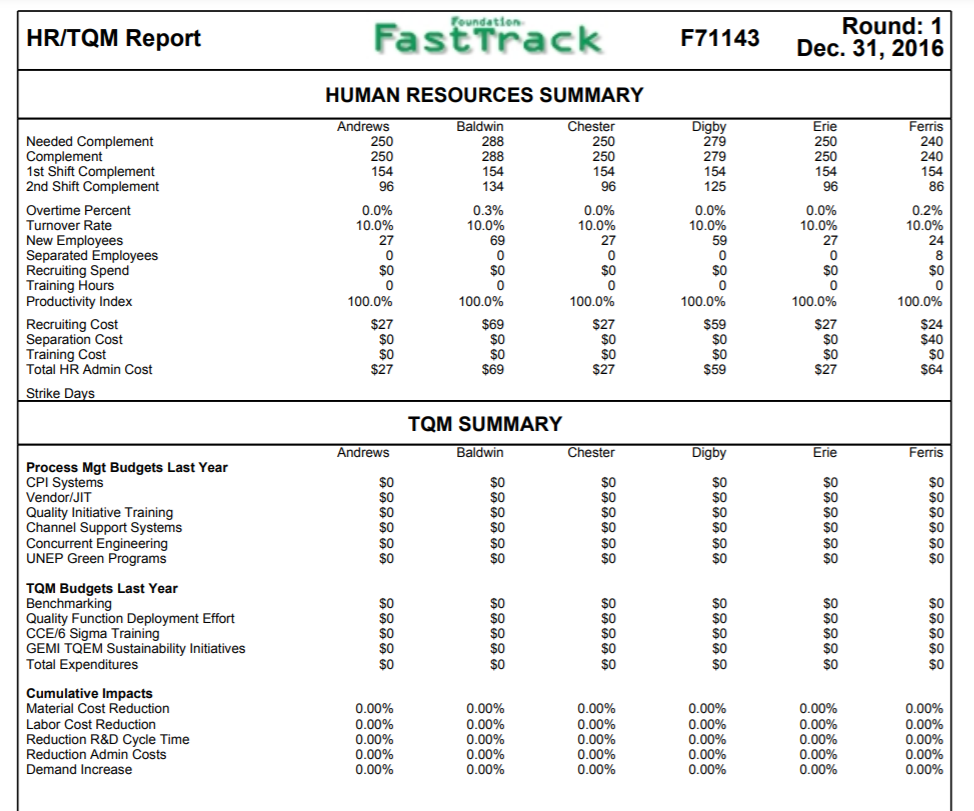

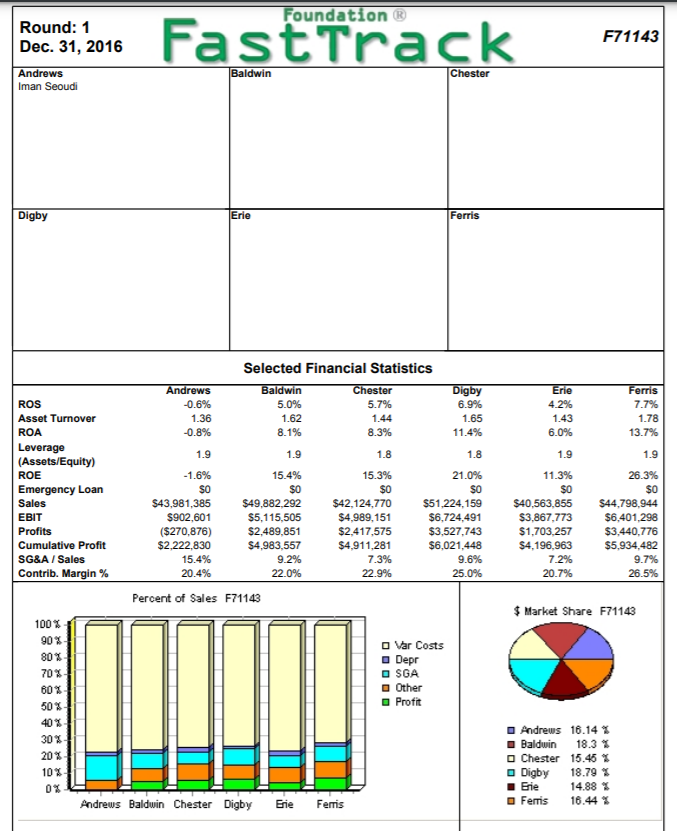

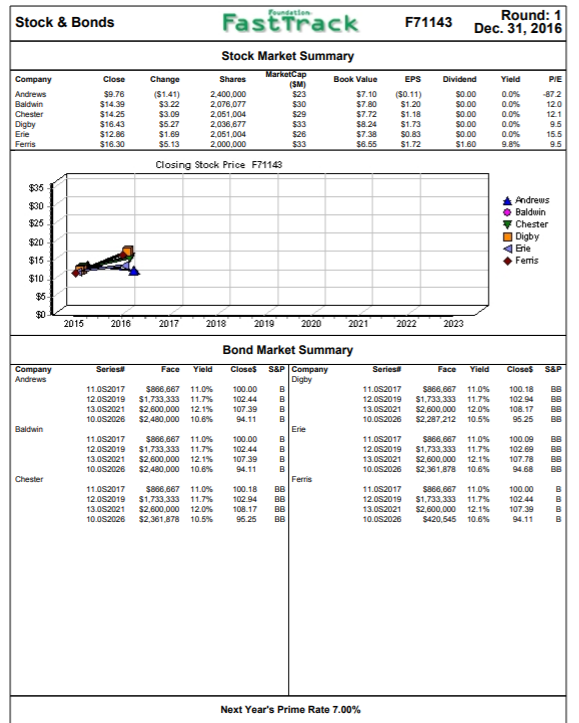

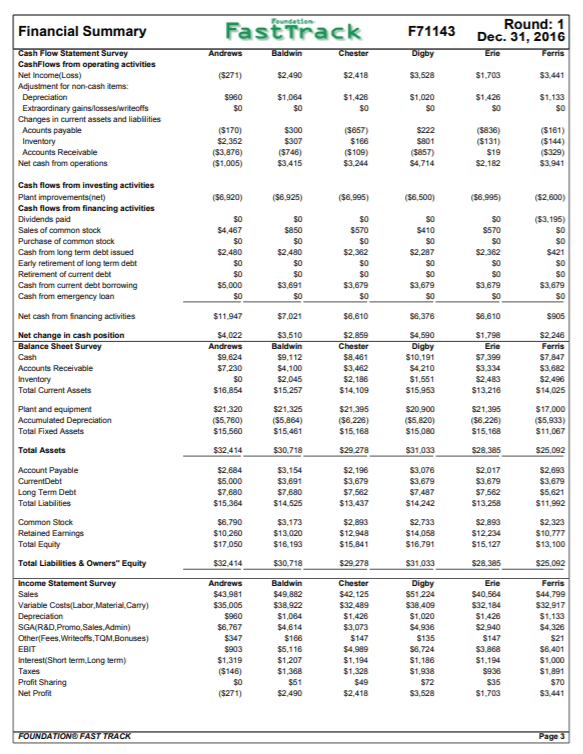

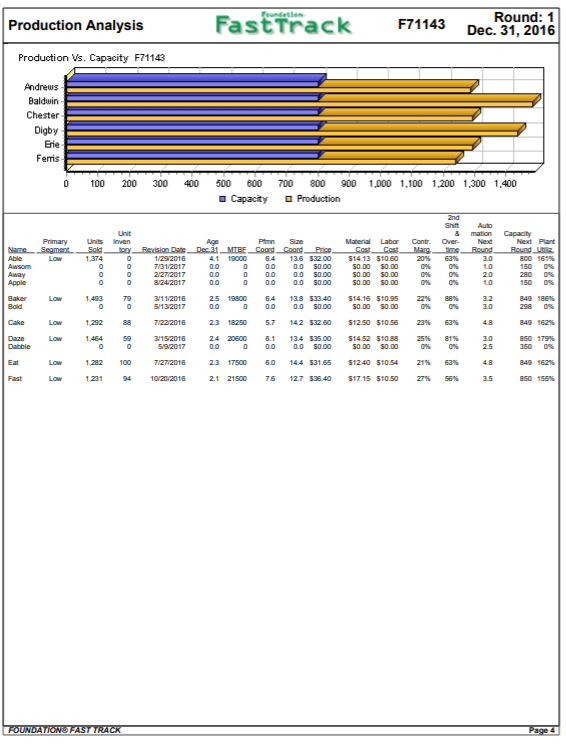

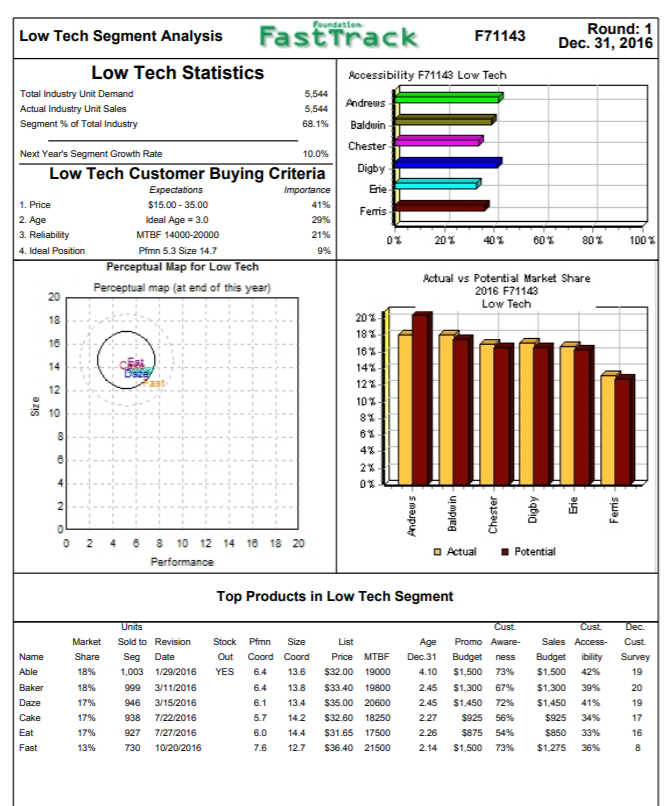

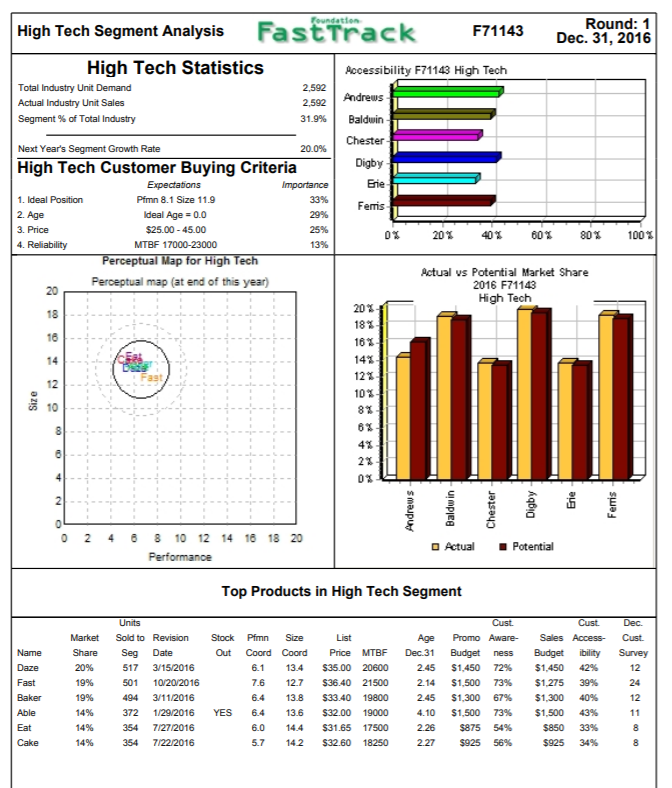

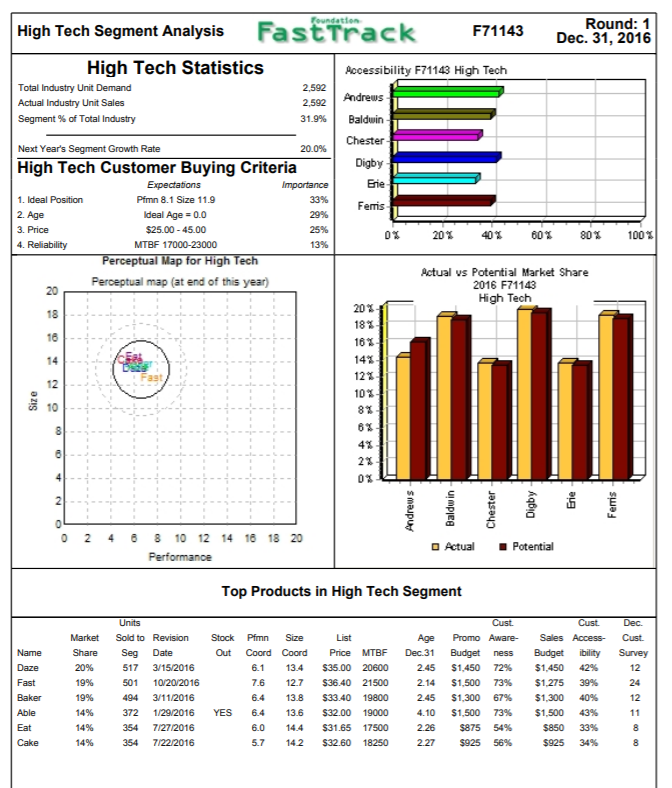

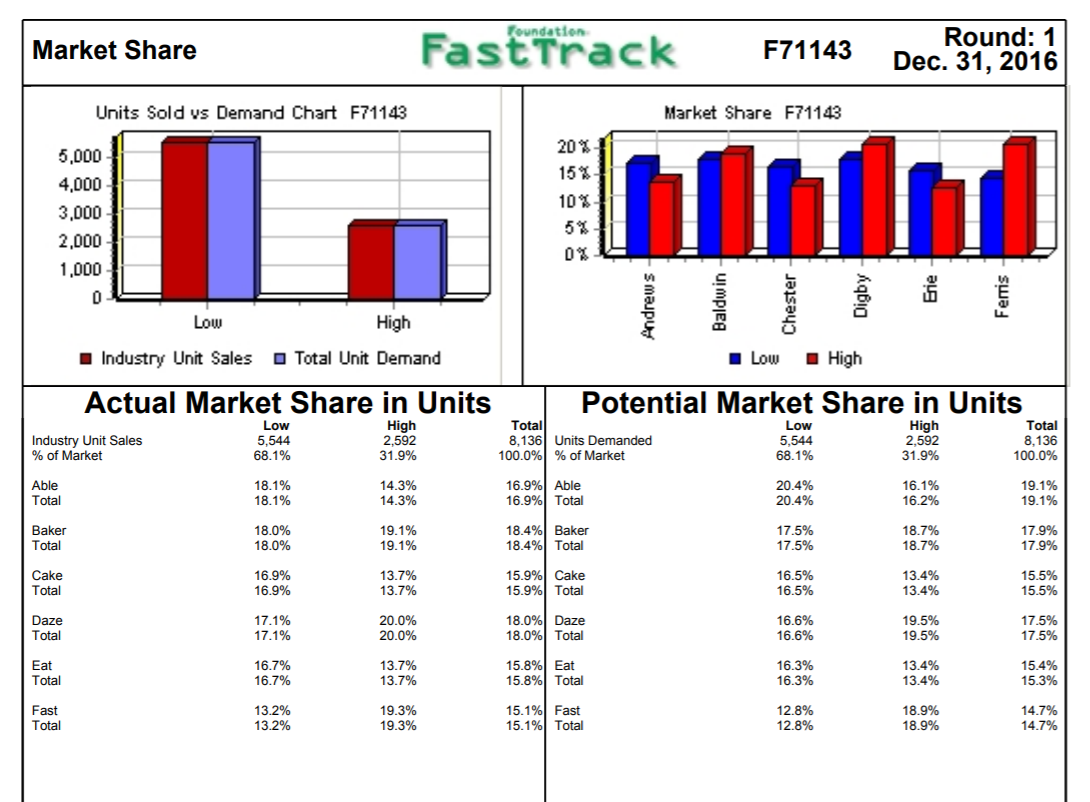

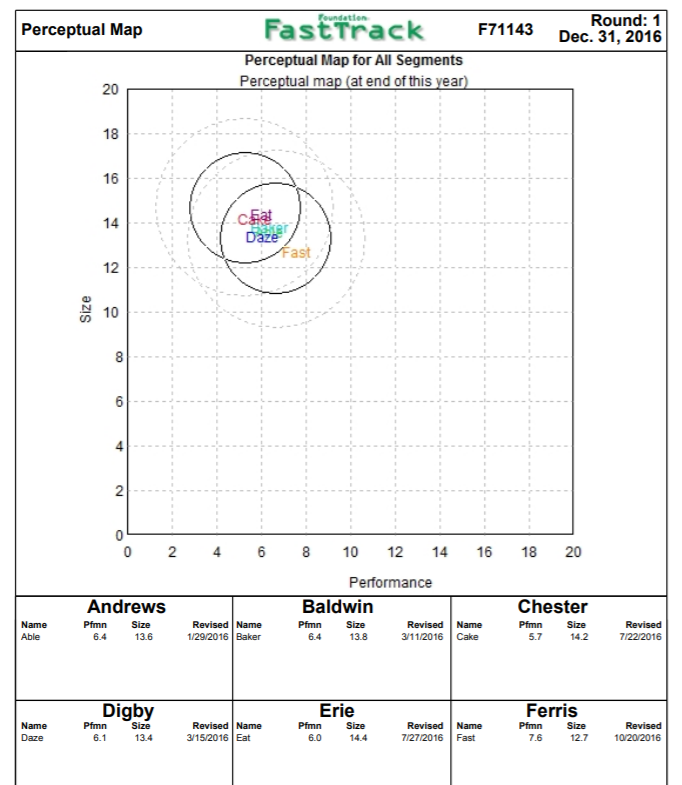

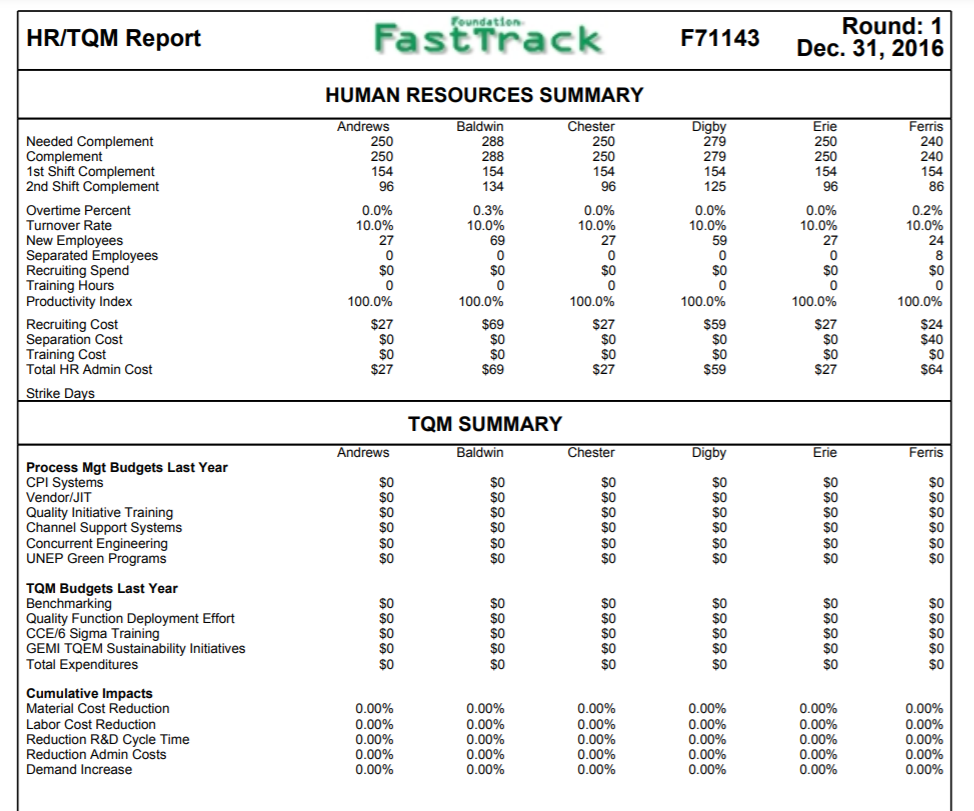

Foundation Round: 1 Dec. 31, 2016 FastTrack F71143 Andrews Iman Seoudi Baldwin Chester Digby Erie Ferris Andrews -0.6% 1.36 -0.8% Selected Financial Statistics Baldwin Chester 5.0% 5.7% 1.62 1.44 8.1% 8.3% Digby 6.9% 1.65 11.4% Erie 4.2% 1.43 6.0% Ferris 7.7% 1.78 13.7% 1.9 1.9 1.8 1.8 1.9 1.9 ROS Asset Turnover ROA Leverage (Assets/Equity) ROE Emergency Loan Sales EBIT Profits Cumulative Profit SG&A / Sales Contrib. Margin% -1.6% SO 543,981,385 $902,601 ($270,876) $2,222,830 15.4% 20.4% 15.4% $0 $49,882,292 $5,115,505 $2,489,851 $4,983,557 9.2% 22.0% 15.3% $0 $42,124,770 $4,989, 151 $2,417,575 $4,911,281 7.3% 22.9% 21.0% SO $51,224,159 $6.724,491 $3,527,743 $6,021,448 9.6% 25.0% 11.3% $0 $40,563,855 $3,867,773 $1,703,257 $4,196,963 7.2% 20.7% 26.3% $0 $44,798,944 $6,401,298 $3,440,776 $5,934,482 9.7% 26.5% Percent of Sales F71143 $ Market Share F71143 100% 90 % 80% 70% 60% 50% 40% 30% 20% 10% 0% Var Costs Depr SGA Other Profit Andrews 16.14% Baldwin 18.32 Chester 15.45 Digby 18.79% Erie 14.88 % Ferris 16.44% Andrews Baldwin Chester Digby Erie Ferris Stock & Bonds Fast Track F71143 Round: 1 Dec. 31, 2016 Close $30 Company Andrews Baldwin Chester Digby Erie Ferris $9.76 $14.39 $14.25 $16.43 $12.86 $16.30 Stock Market Summary Change Shares MarketCap Book Value (SM) ($1.41) 2.400,000 $23 $7.10 $3.22 2.076,077 $7.80 $3.09 2,061,004 $29 $7.72 $5.27 2,036,677 $33 58.24 $1.89 2.051.004 $26 $7.38 $5.13 2,000,000 $8.55 Closing Stock Price F71143 EPS (30.11) $1.20 $1.18 $1.73 S0.83 $1.72 Dividend $0.00 $0.00 S0.00 $0.00 S0.00 $1.60 Yield 0.0% 0.0% 0.0% 0.0% 0.0% 9.8% PIE -872 120 121 9.5 15.5 9.5 $35 $30 $26 Andrews Baldwin Chester Digby Erie Ferris $20 $15 $10 $5 $0 2015 2016 2017 2018 2019 2020 2021 2022 2023 Series Face Yield Series Face Yield Close$ S&P Company Andrews Bond Market Summary Closes S&P Company Digby 100.00 102.44 107.39 B 11.0S2017 12.082019 13.0S2021 10.082026 $866,667 11.0% $1,733.333 11.7% $2,600.000 12.1% $2.480.000 10.6% 11.082017 12.082019 13.0S2021 10.02026 $866,687 11.0% $1,733,333 11.7% $2.600.000 12.0% $2,287,212 10.5% 100.18 102.94 108.17 95.25 BB BB BB BB Baldwin Erie B 11.082017 12.082019 13.0S2021 10.052028 $886,667 11.0% $1,733,333 11.7% $2,600.000 12.1% $2.480.000 10.6% 100.00 102.44 107.39 94.11 11.05.2017 12.05.2019 13.05.2021 10.02026 $866,667 11.0% $1,733,333 11.7% $2,600,000 12.19 $2,361,878 10.6% 100.09 102.69 107.78 94.68 BB BB BB BB Chester Ferris B 11.0S2017 12.082019 13.082021 10.02026 $886,667 11.0% $1,733,333 11.7% $2.600.000 12.0% $2,381,878 10.5% 100.18 102.94 108.17 95.25 BB BB BB BB 11.0S2017 $868,667 11.0% 12.082019 $1,733,333 11.7% 13.0S2021 $2,600,000 12.15 10.0S2026 $420,545 10.6% 100.00 102.44 107.39 94.11 B Next Year's Prime Rate 7.00% Foundation Fast Track F71143 Round: Dec. 31, 2016 Andrews Baldwin Chester Digby Erie Ferris (3271) $2,490 $2.418 $3.528 $1,703 $3.441 5960 50 $1.064 $0 $1,426 50 $1,020 SO $1.428 50 $1,133 SO ($170) $2,352 ($3.876) ($1.005) $300 $307 ($746) $3.415 ($857) $166 ($109) $3.244 S222 $801 (5857) $4.714 (5838) ($131) $19 S2.182 ($161) ($144) ($329) $3.941 ($6,920) ($6.925) ($6.995) (58,500) ($6.995) ($2.600) Financial Summary Cash Flow Statement Survey CashFlows from operating activities Net Income Loss) Adjustment for non-cash items: Depreciation Extraordinary gains losses/writeoffs Changes in current assets and liabilities Acounts payable Inventory Accounts Receivable Net cash from operations Cash flows from investing activities Plant improvements(net) Cash flows from financing activities Dividends paid Sales of common stock Purchase of common stock Cash from long term debt issued Early retirement of long term debt Retirement of current debt Cash from current debt borrowing Cash from emergency loan Net cash from financing activities Net change in cash position Balance Sheet Survey Cash Accounts Receivable Inventory Total Current Assets Plant and equipment Accumulated Depreciation Total Fixed Assets Total Assets $0 $4,467 SO $2.480 SO $0 $5,000 SO $0 $850 SO $2.480 SO 50 $3,691 $0 SO $570 SO $2,382 SO $0 $3,679 SO SO $410 SO $2,287 SO SO $3.679 SO SO $570 SO $2.362 SO SO $3.679 SO ($3,196) SO SO $421 SO SO $3.679 SO $11.947 $7,021 $8.610 58,376 58.610 S905 $4,022 Andrews 59,624 $7.230 $0 $16.854 $3,510 Baldwin 59,112 $4,100 $2,045 $15.257 $2.859 Chester $8,481 $3,482 $2,186 $14.109 $4,590 Digby $10.191 $4.210 $1,551 $15.953 $20.900 (55,820) $15.080 $1,798 Erie $7399 $3,334 $2.483 $13.216 $2.246 Ferris $7.847 $3.682 $2.496 $14,025 $21,320 ($5.760) $15.560 $21.325 ($5.864) $15.461 $21,395 ($6.226) $15,168 $21.395 ($6.226) $15, 168 $17,000 ($5.933) $11,067 $32.414 $30.718 $29.278 $31.033 $25,092 $2684 $5,000 $7.680 $15.364 $3,154 $3,691 $7,680 $14.525 $2.196 $3.679 $7,562 $13.437 $28,385 S2.017 $3.679 $7.562 $13,258 $2.693 $3.679 $5.621 $11.992 $3.076 $3,679 57.487 S14 242 $2.733 $14,058 $16.791 $6.790 $10.260 $17,050 $3,173 $13.020 $16.193 $2,893 $12.948 $15.841 $2.893 S12 234 $15,127 $28.385 S2 323 $10.777 $13.100 $32.414 $30.718 $29.278 $31.033 $25.092 Account Payable CurrentDebt Long Term Debt Total Liabilities Common Stock Retained Earnings Total Equity Total Liabilities & Owners" Equity Income Statement Survey Sales Variable Costs/Labor Material Carry) Depreciation SGA/R&D Promo, Sales, Admin) OtherfFees, Writeoffs TOM.Bonuses) EBIT interest(Short term, Long term) Taxes Profit Sharing Net Profit Andrews $43.981 $35.006 5960 $8,767 $347 5903 $1,319 ($146) $0 (3271) Baldwin $49.882 $38.922 $1.064 $4,814 $166 $5,116 $1.207 $1,368 $51 $2.490 Chester $42.125 $32.489 $1,426 $3,073 $147 $4.989 $1,194 $1,328 $49 $2.418 Digby $51.224 $38.409 $1,020 $4.936 $135 $8,724 $1,186 $1,938 $72 $3,528 Erie $40,564 $32.184 $1.426 S2 940 $147 $3.868 $1,194 Ferris $44.799 $32.917 $1,133 $4326 $21 $8,401 $1.000 $1.891 $936 $70 $35 $1.703 $3.441 FOUNDATION FAST TRACK Page 3 Production Analysis Fast Track F71143 Round: 1 Dec. 31, 2016 Production Vs. Capacity F71143 Andrews Baldwin Chester Digby Erie Ferris D 100 200 300 400 1,000 1,100 1,200 1,300 1,400 500 600 o Capacity 700 800 900 Production 2nd Shirt Material Next Contr Over Margins 20% 0% Bowd Capacity Next Plant Round 800 161% Primary NameSegment Able Low Awsom Away Apple Baker Bold Cake BAN Unit Units inven Sold Bension Date 1/29/2016 7/31/2017 0 2/27/2017 0 o 8/24/2017 79 3/11/2016 0 5/13/2017 1.292 7122/2016 3/15/2016 5/9/2017 1007127/2016 1.231 10/20/2016 849 186% Age Pin Size MTBE CoordCoord Price 136 $32.00 0.0 $0.00 o 0.0 50.00 0.0 0.0 $0.00 25 19800 6.4 13.8 533.40 0.0 $0.00 23 18250 5.7 142 532.50 24 20600 6.1 13.4 $35.00 0.0 50.00 23 17500 14.4 $31.65 21 21500 76 12.7 $36.40 $14.13 $10.50 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $14.16 $10.95 $0.00 $0.00 $12.50 $10:56 $14.52 $10.88 50.00 50.00 $12.40 $10:54 $17.15 $10.50 3.0 1.0 20 1.0 3.2 3.0 48 3.0 25 849 1629 23 63 25% 81% Dabble 21% 83% Low Low 850 1794 350 849 162 350 155 Fast 35 FOUNDATIONOFAST TRACK Page 4 5,544 Foundation Low Tech Segment Analysis Fast Track F71143 Round: 1 Dec. 31, 2016 Low Tech Statistics Hocessibility F71143 Low Tech Total Industry Unit Demand 5,544 Actual Industry Unit Sales Andrews Segment % of Total Industry 68.1% Baldwin Next Year's Segment Growth Rate Chester 10.0% Low Tech Customer Buying Criteria Digby Expectations Importance Erie 1. Price $15.00 - 35.00 41% Femis 2. Age Ideal Age = 3.0 29% 3. Reliability MTBF 14000-20000 21% 0% 20% 60% 80% 100% 4. Ideal Position Pfmn 5.3 Size 14.7 9% Perceptual Map for Low Tech Perceptual map (at end of this year) Actual vs Potential Market Share 20 2016 F71143 Low Tech 18 20% 18% 16 16% 14 142 12 12% 10% 10 8% 6% 4% 2% 0% Size 8 4 2 Andrews Baldwin 0 0 2 4 6 8 10 12 14 16 18 20 Performance Actual Potential Top Products in Low Tech Segment Cust. Name Able Market Share 18% 18% 17% Stock Out YES ness Pfmn Size Coord Coord 13.6 Baker Daze Cake Eat Fast Units Sold to Revision Seg Date 1,003 1/29/2016 999 3/11/2016 946 3/15/2016 938 7/22/2016 927 7/27/2016 730 10/20/2016 6.4 6.1 5.7 6.0 7.6 List Price MTBF $32.00 19000 $33.40 19800 $35.00 20600 $32.60 18250 $31.65 17500 $36.40 21500 13.8 13.4 14.2 14.4 12.7 Age Dec. 31 4.10 2.45 2.45 2.27 2.26 2.14 Promo Aware- Budget $1,500 73% $1,300 67% $1.450 72% 56% $875 54% $1,500 73% Cust Sales Access- Budget ibility $1,500 42% $1,300 39% $1.450 41% $925 34% $850 33% $1,275 36% 17% Dec. Cust Survey 19 20 19 17 16 8 $925 17% 13% Foundation High Tech Segment Analysis FastTrack F71143 Round: 1 Dec. 31, 2016 High Tech Statistics Accessibility F71143 High Tech Total Industry Unit Demand 2,592 Andrews Actual Industry Unit Sales 2,592 Segment % of Total Industry 31.9% Baldwin Chester Next Year's Segment Growth Rate 20.0% High Tech Customer Buying Criteria Digby Expectations Importance Erie 1. Ideal Position Pfmn 8.1 Size 11.9 33% Femis 2. Age Ideal Age=0.0 29% 3. Price $25.00 - 45.00 25% 0% 20% 60% 80% 4. Reliability 100% MTBF 17000-23000 13% Perceptual Map for High Tech Perceptual map (at end of this year) Actual vs Potential Market Share 20 2016 F71143 High Tech 18 20% 18% 16 16% 14 14% 12% 12 10% 10 8% Size 8 6% 4% 8 0% 0 4 6 8 10 12 14 16 18 20 Performance Actual Potential Top Products in High Tech Segment Cust. Stock Out Name Daze Fast Baker Able Eat Cake Market Share 20% 19% 19% 14% 14% 14% Units Sold to Revision Seg Date 517 3/15/2016 501 10/20/2016 494 3/11/2016 372 1/29/2016 354 7/27/2016 354 7/22/2016 Pfmn Size Coord Coord 6.1 13.4 7.6 12.7 13.8 6.4 13.6 6.0 14.4 5.7 142 List Price MTBF $35.00 20600 $36.40 21500 $33.40 19800 $32.00 19000 $31.65 17500 $32.60 18250 Age Dec. 31 2.45 2.14 2.45 4.10 2.26 2.27 Cust Promo Aware- Budget ness $1,450 72% $1,500 73% $1,300 67% $1,500 73% $875 54% $925 56% Sales Access- Budget ibility $1.450 42% $1,275 39% $1,300 40% $1,500 43% $850 33% $925 34% Dec Cust Survey 12 24 12 11 8 YES Foundation High Tech Segment Analysis FastTrack F71143 Round: 1 Dec. 31, 2016 High Tech Statistics Accessibility F71143 High Tech Total Industry Unit Demand 2,592 Andrews Actual Industry Unit Sales 2,592 Segment % of Total Industry 31.9% Baldwin Chester Next Year's Segment Growth Rate 20.0% High Tech Customer Buying Criteria Digby Expectations Importance Erie 1. Ideal Position Pfmn 8.1 Size 11.9 33% Femis 2. Age Ideal Age=0.0 29% 3. Price $25.00 - 45.00 25% 0% 20% 60% 80% 4. Reliability 100% MTBF 17000-23000 13% Perceptual Map for High Tech Perceptual map (at end of this year) Actual vs Potential Market Share 20 2016 F71143 High Tech 18 20% 18% 16 16% 14 14% 12% 12 10% 10 8% Size 8 6% 4% 8 0% 0 4 6 8 10 12 14 16 18 20 Performance Actual Potential Top Products in High Tech Segment Cust. Stock Out Name Daze Fast Baker Able Eat Cake Market Share 20% 19% 19% 14% 14% 14% Units Sold to Revision Seg Date 517 3/15/2016 501 10/20/2016 494 3/11/2016 372 1/29/2016 354 7/27/2016 354 7/22/2016 Pfmn Size Coord Coord 6.1 13.4 7.6 12.7 13.8 6.4 13.6 6.0 14.4 5.7 142 List Price MTBF $35.00 20600 $36.40 21500 $33.40 19800 $32.00 19000 $31.65 17500 $32.60 18250 Age Dec. 31 2.45 2.14 2.45 4.10 2.26 2.27 Cust Promo Aware- Budget ness $1,450 72% $1,500 73% $1,300 67% $1,500 73% $875 54% $925 56% Sales Access- Budget ibility $1.450 42% $1,275 39% $1,300 40% $1,500 43% $850 33% $925 34% Dec Cust Survey 12 24 12 11 8 YES Foundation Market Share Fast Track F71143 Round: 1 Dec. 31, 2016 Units Sold vs Demand Chart F71143 Market Share F71143 5,000 4,000 3,000 2,000 1,000 0 20% 1 15% 10% 5% Andrews Baldwin Chester Low High Industry Unit Sales Total Unit Demand Low High Actual Market Share in Units Potential Market Share in Units Industry Unit Sales % of Market Low 5,544 68.1% High 2,592 31.9% Total 8,136 Units Demanded 100.0% % of Market Low 5,544 68.1% High 2,592 31.9% Total 8,136 100.0% Able Total 18.1% 18.1% 14.3% 16.9% Able 16.9% Total 20.4% 20.4% 16.1% 16.2% 19.1% 19.1% 14.3% Baker Total 18.0% 18.0% 19.1% 19.1% 18.4%) Baker 18.4% Total 17.5% 17.5% 18.7% 18.7% 17.9% 17.9% Cake Total 16.9% 16.9% 13.7% 13.7% 15.9% Cake 15.9% Total 16.5% 16.5% 13.4% 13.4% 15.5% 15.5% Daze 17.1% 17.1% 20.0% 20.0% 18.0% Daze 18.0% Total 16.6% 16.6% 19.5% 19.5% 17.5% 17.5% Total Eat Total 16.7% 16.7% 13.7% 13.7% 15.8% Eat 15.8% Total 16.3% 16.3% 13.4% 13.4% 15.4% 15.3% Fast Total 13.2% 13.2% 19.3% 19.3% 15.1% Fast 15.1% Total 12.8% 12.8% 18.9% 18.9% 14.7% 14.7% Perceptual Map Round: 1 Dec. 31, 2016 Fast Track F71143 Perceptual Map for All Segments Perceptual map (at end of this year) 20 18 16 14 .cat Fast 12 Size 10 8 6 4 2. 0 0 4 6 6 8 10 12 14 16 18 20 N Performance Baldwin Pfmn Size Revised Name 6.4 13.8 3/11/2016 Cake Andrews Pfmn Size 6.4 Name Able Chester Pfmn Size 14.2 Revised Name 1/29/2016 Baker 13.6 Revised 7/22/2016 5.7 Digby Erie Ferris Pfmn Pfmn Name Daze Size 13.4 Revised Name 3/15/2016 Eat Pfmn 6.0 Size 14.4 Revised 7/27/2016 Name Fast Size 12.7 Revised 10/20/2016 6.1 7.6 Foundation HR/TQM Report Fast Track F71143 Round: 1 Dec. 31, 2016 HUMAN RESOURCES SUMMARY Digby Baldwin 288 288 154 134 Chester 250 250 154 96 279 279 154 125 Ferris 240 240 154 86 Andrews 250 250 154 96 0.0% 10.0% 27 0 $0 0 100.0% $27 $0 $0 $27 0.3% 10.0% 69 0 Needed Complement Complement 1st Shift Complement 2nd Shift Complement Overtime Percent Turnover Rate New Employees Separated Employees Recruiting Spend Training Hours Productivity Index Recruiting Cost Separation Cost Training Cost Total HR Admin Cost Strike Days 0.0% 10.0% 59 0 Erie 250 250 154 96 0.0% 10.0% 27 0 O 0 100.0% $27 $0 $0 $27 0.2% 10.0% 24 8 $0 0 100.0% $0 0.0% 10.0% 27 0 $0 0 100.0% $27 $0 $0 $27 $0 0 100.0% $69 $0 $0 $69 0 100.0% $59 $0 $0 $59 $24 $40 $0 $64 TQM SUMMARY Andrews Baldwin Chester Erie Ferris Process Mgt Budgets Last Year CPI Systems Vendor/JIT Quality Initiative Training Channel Support Systems Concurrent Engineering UNEP Green Programs TQM Budgets Last Year Benchmarking Quality Function Deployment Effort CCE/6 Sigma Training GEMI TQEM Sustainability Initiatives Total Expenditures $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Digby $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 SO $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 SO $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Cumulative Impacts Material Cost Reduction Labor Cost Reduction Reduction R&D Cycle Time Reduction Admin Costs Demand Increase 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% Look at the accompanying FastTrack, which shows the results for Round1 for a Foundation industry. Answer the following questions, explaining the reasons and justification for your answers. 1) Which company had the biggest difference between actual and potential market share in the Low Tech segment? (Look at pages 5 & 7) 2) Why did this difference happen? In other words, is the difference a result of stock-outs and therefore lost sales? Or is the difference due to selling more than the company's fair share? 3) Calculate the quantity (in units) of lost sales/extra sales. 4) How could the company you named Q (1) have avoided this situation? 5) Which company is selling the top product (in terms of customer appeal) in the Low tech segment? What is the product's name? Foundation Round: 1 Dec. 31, 2016 FastTrack F71143 Andrews Iman Seoudi Baldwin Chester Digby Erie Ferris Andrews -0.6% 1.36 -0.8% Selected Financial Statistics Baldwin Chester 5.0% 5.7% 1.62 1.44 8.1% 8.3% Digby 6.9% 1.65 11.4% Erie 4.2% 1.43 6.0% Ferris 7.7% 1.78 13.7% 1.9 1.9 1.8 1.8 1.9 1.9 ROS Asset Turnover ROA Leverage (Assets/Equity) ROE Emergency Loan Sales EBIT Profits Cumulative Profit SG&A / Sales Contrib. Margin% -1.6% SO 543,981,385 $902,601 ($270,876) $2,222,830 15.4% 20.4% 15.4% $0 $49,882,292 $5,115,505 $2,489,851 $4,983,557 9.2% 22.0% 15.3% $0 $42,124,770 $4,989, 151 $2,417,575 $4,911,281 7.3% 22.9% 21.0% SO $51,224,159 $6.724,491 $3,527,743 $6,021,448 9.6% 25.0% 11.3% $0 $40,563,855 $3,867,773 $1,703,257 $4,196,963 7.2% 20.7% 26.3% $0 $44,798,944 $6,401,298 $3,440,776 $5,934,482 9.7% 26.5% Percent of Sales F71143 $ Market Share F71143 100% 90 % 80% 70% 60% 50% 40% 30% 20% 10% 0% Var Costs Depr SGA Other Profit Andrews 16.14% Baldwin 18.32 Chester 15.45 Digby 18.79% Erie 14.88 % Ferris 16.44% Andrews Baldwin Chester Digby Erie Ferris Stock & Bonds Fast Track F71143 Round: 1 Dec. 31, 2016 Close $30 Company Andrews Baldwin Chester Digby Erie Ferris $9.76 $14.39 $14.25 $16.43 $12.86 $16.30 Stock Market Summary Change Shares MarketCap Book Value (SM) ($1.41) 2.400,000 $23 $7.10 $3.22 2.076,077 $7.80 $3.09 2,061,004 $29 $7.72 $5.27 2,036,677 $33 58.24 $1.89 2.051.004 $26 $7.38 $5.13 2,000,000 $8.55 Closing Stock Price F71143 EPS (30.11) $1.20 $1.18 $1.73 S0.83 $1.72 Dividend $0.00 $0.00 S0.00 $0.00 S0.00 $1.60 Yield 0.0% 0.0% 0.0% 0.0% 0.0% 9.8% PIE -872 120 121 9.5 15.5 9.5 $35 $30 $26 Andrews Baldwin Chester Digby Erie Ferris $20 $15 $10 $5 $0 2015 2016 2017 2018 2019 2020 2021 2022 2023 Series Face Yield Series Face Yield Close$ S&P Company Andrews Bond Market Summary Closes S&P Company Digby 100.00 102.44 107.39 B 11.0S2017 12.082019 13.0S2021 10.082026 $866,667 11.0% $1,733.333 11.7% $2,600.000 12.1% $2.480.000 10.6% 11.082017 12.082019 13.0S2021 10.02026 $866,687 11.0% $1,733,333 11.7% $2.600.000 12.0% $2,287,212 10.5% 100.18 102.94 108.17 95.25 BB BB BB BB Baldwin Erie B 11.082017 12.082019 13.0S2021 10.052028 $886,667 11.0% $1,733,333 11.7% $2,600.000 12.1% $2.480.000 10.6% 100.00 102.44 107.39 94.11 11.05.2017 12.05.2019 13.05.2021 10.02026 $866,667 11.0% $1,733,333 11.7% $2,600,000 12.19 $2,361,878 10.6% 100.09 102.69 107.78 94.68 BB BB BB BB Chester Ferris B 11.0S2017 12.082019 13.082021 10.02026 $886,667 11.0% $1,733,333 11.7% $2.600.000 12.0% $2,381,878 10.5% 100.18 102.94 108.17 95.25 BB BB BB BB 11.0S2017 $868,667 11.0% 12.082019 $1,733,333 11.7% 13.0S2021 $2,600,000 12.15 10.0S2026 $420,545 10.6% 100.00 102.44 107.39 94.11 B Next Year's Prime Rate 7.00% Foundation Fast Track F71143 Round: Dec. 31, 2016 Andrews Baldwin Chester Digby Erie Ferris (3271) $2,490 $2.418 $3.528 $1,703 $3.441 5960 50 $1.064 $0 $1,426 50 $1,020 SO $1.428 50 $1,133 SO ($170) $2,352 ($3.876) ($1.005) $300 $307 ($746) $3.415 ($857) $166 ($109) $3.244 S222 $801 (5857) $4.714 (5838) ($131) $19 S2.182 ($161) ($144) ($329) $3.941 ($6,920) ($6.925) ($6.995) (58,500) ($6.995) ($2.600) Financial Summary Cash Flow Statement Survey CashFlows from operating activities Net Income Loss) Adjustment for non-cash items: Depreciation Extraordinary gains losses/writeoffs Changes in current assets and liabilities Acounts payable Inventory Accounts Receivable Net cash from operations Cash flows from investing activities Plant improvements(net) Cash flows from financing activities Dividends paid Sales of common stock Purchase of common stock Cash from long term debt issued Early retirement of long term debt Retirement of current debt Cash from current debt borrowing Cash from emergency loan Net cash from financing activities Net change in cash position Balance Sheet Survey Cash Accounts Receivable Inventory Total Current Assets Plant and equipment Accumulated Depreciation Total Fixed Assets Total Assets $0 $4,467 SO $2.480 SO $0 $5,000 SO $0 $850 SO $2.480 SO 50 $3,691 $0 SO $570 SO $2,382 SO $0 $3,679 SO SO $410 SO $2,287 SO SO $3.679 SO SO $570 SO $2.362 SO SO $3.679 SO ($3,196) SO SO $421 SO SO $3.679 SO $11.947 $7,021 $8.610 58,376 58.610 S905 $4,022 Andrews 59,624 $7.230 $0 $16.854 $3,510 Baldwin 59,112 $4,100 $2,045 $15.257 $2.859 Chester $8,481 $3,482 $2,186 $14.109 $4,590 Digby $10.191 $4.210 $1,551 $15.953 $20.900 (55,820) $15.080 $1,798 Erie $7399 $3,334 $2.483 $13.216 $2.246 Ferris $7.847 $3.682 $2.496 $14,025 $21,320 ($5.760) $15.560 $21.325 ($5.864) $15.461 $21,395 ($6.226) $15,168 $21.395 ($6.226) $15, 168 $17,000 ($5.933) $11,067 $32.414 $30.718 $29.278 $31.033 $25,092 $2684 $5,000 $7.680 $15.364 $3,154 $3,691 $7,680 $14.525 $2.196 $3.679 $7,562 $13.437 $28,385 S2.017 $3.679 $7.562 $13,258 $2.693 $3.679 $5.621 $11.992 $3.076 $3,679 57.487 S14 242 $2.733 $14,058 $16.791 $6.790 $10.260 $17,050 $3,173 $13.020 $16.193 $2,893 $12.948 $15.841 $2.893 S12 234 $15,127 $28.385 S2 323 $10.777 $13.100 $32.414 $30.718 $29.278 $31.033 $25.092 Account Payable CurrentDebt Long Term Debt Total Liabilities Common Stock Retained Earnings Total Equity Total Liabilities & Owners" Equity Income Statement Survey Sales Variable Costs/Labor Material Carry) Depreciation SGA/R&D Promo, Sales, Admin) OtherfFees, Writeoffs TOM.Bonuses) EBIT interest(Short term, Long term) Taxes Profit Sharing Net Profit Andrews $43.981 $35.006 5960 $8,767 $347 5903 $1,319 ($146) $0 (3271) Baldwin $49.882 $38.922 $1.064 $4,814 $166 $5,116 $1.207 $1,368 $51 $2.490 Chester $42.125 $32.489 $1,426 $3,073 $147 $4.989 $1,194 $1,328 $49 $2.418 Digby $51.224 $38.409 $1,020 $4.936 $135 $8,724 $1,186 $1,938 $72 $3,528 Erie $40,564 $32.184 $1.426 S2 940 $147 $3.868 $1,194 Ferris $44.799 $32.917 $1,133 $4326 $21 $8,401 $1.000 $1.891 $936 $70 $35 $1.703 $3.441 FOUNDATION FAST TRACK Page 3 Production Analysis Fast Track F71143 Round: 1 Dec. 31, 2016 Production Vs. Capacity F71143 Andrews Baldwin Chester Digby Erie Ferris D 100 200 300 400 1,000 1,100 1,200 1,300 1,400 500 600 o Capacity 700 800 900 Production 2nd Shirt Material Next Contr Over Margins 20% 0% Bowd Capacity Next Plant Round 800 161% Primary NameSegment Able Low Awsom Away Apple Baker Bold Cake BAN Unit Units inven Sold Bension Date 1/29/2016 7/31/2017 0 2/27/2017 0 o 8/24/2017 79 3/11/2016 0 5/13/2017 1.292 7122/2016 3/15/2016 5/9/2017 1007127/2016 1.231 10/20/2016 849 186% Age Pin Size MTBE CoordCoord Price 136 $32.00 0.0 $0.00 o 0.0 50.00 0.0 0.0 $0.00 25 19800 6.4 13.8 533.40 0.0 $0.00 23 18250 5.7 142 532.50 24 20600 6.1 13.4 $35.00 0.0 50.00 23 17500 14.4 $31.65 21 21500 76 12.7 $36.40 $14.13 $10.50 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $14.16 $10.95 $0.00 $0.00 $12.50 $10:56 $14.52 $10.88 50.00 50.00 $12.40 $10:54 $17.15 $10.50 3.0 1.0 20 1.0 3.2 3.0 48 3.0 25 849 1629 23 63 25% 81% Dabble 21% 83% Low Low 850 1794 350 849 162 350 155 Fast 35 FOUNDATIONOFAST TRACK Page 4 5,544 Foundation Low Tech Segment Analysis Fast Track F71143 Round: 1 Dec. 31, 2016 Low Tech Statistics Hocessibility F71143 Low Tech Total Industry Unit Demand 5,544 Actual Industry Unit Sales Andrews Segment % of Total Industry 68.1% Baldwin Next Year's Segment Growth Rate Chester 10.0% Low Tech Customer Buying Criteria Digby Expectations Importance Erie 1. Price $15.00 - 35.00 41% Femis 2. Age Ideal Age = 3.0 29% 3. Reliability MTBF 14000-20000 21% 0% 20% 60% 80% 100% 4. Ideal Position Pfmn 5.3 Size 14.7 9% Perceptual Map for Low Tech Perceptual map (at end of this year) Actual vs Potential Market Share 20 2016 F71143 Low Tech 18 20% 18% 16 16% 14 142 12 12% 10% 10 8% 6% 4% 2% 0% Size 8 4 2 Andrews Baldwin 0 0 2 4 6 8 10 12 14 16 18 20 Performance Actual Potential Top Products in Low Tech Segment Cust. Name Able Market Share 18% 18% 17% Stock Out YES ness Pfmn Size Coord Coord 13.6 Baker Daze Cake Eat Fast Units Sold to Revision Seg Date 1,003 1/29/2016 999 3/11/2016 946 3/15/2016 938 7/22/2016 927 7/27/2016 730 10/20/2016 6.4 6.1 5.7 6.0 7.6 List Price MTBF $32.00 19000 $33.40 19800 $35.00 20600 $32.60 18250 $31.65 17500 $36.40 21500 13.8 13.4 14.2 14.4 12.7 Age Dec. 31 4.10 2.45 2.45 2.27 2.26 2.14 Promo Aware- Budget $1,500 73% $1,300 67% $1.450 72% 56% $875 54% $1,500 73% Cust Sales Access- Budget ibility $1,500 42% $1,300 39% $1.450 41% $925 34% $850 33% $1,275 36% 17% Dec. Cust Survey 19 20 19 17 16 8 $925 17% 13% Foundation High Tech Segment Analysis FastTrack F71143 Round: 1 Dec. 31, 2016 High Tech Statistics Accessibility F71143 High Tech Total Industry Unit Demand 2,592 Andrews Actual Industry Unit Sales 2,592 Segment % of Total Industry 31.9% Baldwin Chester Next Year's Segment Growth Rate 20.0% High Tech Customer Buying Criteria Digby Expectations Importance Erie 1. Ideal Position Pfmn 8.1 Size 11.9 33% Femis 2. Age Ideal Age=0.0 29% 3. Price $25.00 - 45.00 25% 0% 20% 60% 80% 4. Reliability 100% MTBF 17000-23000 13% Perceptual Map for High Tech Perceptual map (at end of this year) Actual vs Potential Market Share 20 2016 F71143 High Tech 18 20% 18% 16 16% 14 14% 12% 12 10% 10 8% Size 8 6% 4% 8 0% 0 4 6 8 10 12 14 16 18 20 Performance Actual Potential Top Products in High Tech Segment Cust. Stock Out Name Daze Fast Baker Able Eat Cake Market Share 20% 19% 19% 14% 14% 14% Units Sold to Revision Seg Date 517 3/15/2016 501 10/20/2016 494 3/11/2016 372 1/29/2016 354 7/27/2016 354 7/22/2016 Pfmn Size Coord Coord 6.1 13.4 7.6 12.7 13.8 6.4 13.6 6.0 14.4 5.7 142 List Price MTBF $35.00 20600 $36.40 21500 $33.40 19800 $32.00 19000 $31.65 17500 $32.60 18250 Age Dec. 31 2.45 2.14 2.45 4.10 2.26 2.27 Cust Promo Aware- Budget ness $1,450 72% $1,500 73% $1,300 67% $1,500 73% $875 54% $925 56% Sales Access- Budget ibility $1.450 42% $1,275 39% $1,300 40% $1,500 43% $850 33% $925 34% Dec Cust Survey 12 24 12 11 8 YES Foundation High Tech Segment Analysis FastTrack F71143 Round: 1 Dec. 31, 2016 High Tech Statistics Accessibility F71143 High Tech Total Industry Unit Demand 2,592 Andrews Actual Industry Unit Sales 2,592 Segment % of Total Industry 31.9% Baldwin Chester Next Year's Segment Growth Rate 20.0% High Tech Customer Buying Criteria Digby Expectations Importance Erie 1. Ideal Position Pfmn 8.1 Size 11.9 33% Femis 2. Age Ideal Age=0.0 29% 3. Price $25.00 - 45.00 25% 0% 20% 60% 80% 4. Reliability 100% MTBF 17000-23000 13% Perceptual Map for High Tech Perceptual map (at end of this year) Actual vs Potential Market Share 20 2016 F71143 High Tech 18 20% 18% 16 16% 14 14% 12% 12 10% 10 8% Size 8 6% 4% 8 0% 0 4 6 8 10 12 14 16 18 20 Performance Actual Potential Top Products in High Tech Segment Cust. Stock Out Name Daze Fast Baker Able Eat Cake Market Share 20% 19% 19% 14% 14% 14% Units Sold to Revision Seg Date 517 3/15/2016 501 10/20/2016 494 3/11/2016 372 1/29/2016 354 7/27/2016 354 7/22/2016 Pfmn Size Coord Coord 6.1 13.4 7.6 12.7 13.8 6.4 13.6 6.0 14.4 5.7 142 List Price MTBF $35.00 20600 $36.40 21500 $33.40 19800 $32.00 19000 $31.65 17500 $32.60 18250 Age Dec. 31 2.45 2.14 2.45 4.10 2.26 2.27 Cust Promo Aware- Budget ness $1,450 72% $1,500 73% $1,300 67% $1,500 73% $875 54% $925 56% Sales Access- Budget ibility $1.450 42% $1,275 39% $1,300 40% $1,500 43% $850 33% $925 34% Dec Cust Survey 12 24 12 11 8 YES Foundation Market Share Fast Track F71143 Round: 1 Dec. 31, 2016 Units Sold vs Demand Chart F71143 Market Share F71143 5,000 4,000 3,000 2,000 1,000 0 20% 1 15% 10% 5% Andrews Baldwin Chester Low High Industry Unit Sales Total Unit Demand Low High Actual Market Share in Units Potential Market Share in Units Industry Unit Sales % of Market Low 5,544 68.1% High 2,592 31.9% Total 8,136 Units Demanded 100.0% % of Market Low 5,544 68.1% High 2,592 31.9% Total 8,136 100.0% Able Total 18.1% 18.1% 14.3% 16.9% Able 16.9% Total 20.4% 20.4% 16.1% 16.2% 19.1% 19.1% 14.3% Baker Total 18.0% 18.0% 19.1% 19.1% 18.4%) Baker 18.4% Total 17.5% 17.5% 18.7% 18.7% 17.9% 17.9% Cake Total 16.9% 16.9% 13.7% 13.7% 15.9% Cake 15.9% Total 16.5% 16.5% 13.4% 13.4% 15.5% 15.5% Daze 17.1% 17.1% 20.0% 20.0% 18.0% Daze 18.0% Total 16.6% 16.6% 19.5% 19.5% 17.5% 17.5% Total Eat Total 16.7% 16.7% 13.7% 13.7% 15.8% Eat 15.8% Total 16.3% 16.3% 13.4% 13.4% 15.4% 15.3% Fast Total 13.2% 13.2% 19.3% 19.3% 15.1% Fast 15.1% Total 12.8% 12.8% 18.9% 18.9% 14.7% 14.7% Perceptual Map Round: 1 Dec. 31, 2016 Fast Track F71143 Perceptual Map for All Segments Perceptual map (at end of this year) 20 18 16 14 .cat Fast 12 Size 10 8 6 4 2. 0 0 4 6 6 8 10 12 14 16 18 20 N Performance Baldwin Pfmn Size Revised Name 6.4 13.8 3/11/2016 Cake Andrews Pfmn Size 6.4 Name Able Chester Pfmn Size 14.2 Revised Name 1/29/2016 Baker 13.6 Revised 7/22/2016 5.7 Digby Erie Ferris Pfmn Pfmn Name Daze Size 13.4 Revised Name 3/15/2016 Eat Pfmn 6.0 Size 14.4 Revised 7/27/2016 Name Fast Size 12.7 Revised 10/20/2016 6.1 7.6 Foundation HR/TQM Report Fast Track F71143 Round: 1 Dec. 31, 2016 HUMAN RESOURCES SUMMARY Digby Baldwin 288 288 154 134 Chester 250 250 154 96 279 279 154 125 Ferris 240 240 154 86 Andrews 250 250 154 96 0.0% 10.0% 27 0 $0 0 100.0% $27 $0 $0 $27 0.3% 10.0% 69 0 Needed Complement Complement 1st Shift Complement 2nd Shift Complement Overtime Percent Turnover Rate New Employees Separated Employees Recruiting Spend Training Hours Productivity Index Recruiting Cost Separation Cost Training Cost Total HR Admin Cost Strike Days 0.0% 10.0% 59 0 Erie 250 250 154 96 0.0% 10.0% 27 0 O 0 100.0% $27 $0 $0 $27 0.2% 10.0% 24 8 $0 0 100.0% $0 0.0% 10.0% 27 0 $0 0 100.0% $27 $0 $0 $27 $0 0 100.0% $69 $0 $0 $69 0 100.0% $59 $0 $0 $59 $24 $40 $0 $64 TQM SUMMARY Andrews Baldwin Chester Erie Ferris Process Mgt Budgets Last Year CPI Systems Vendor/JIT Quality Initiative Training Channel Support Systems Concurrent Engineering UNEP Green Programs TQM Budgets Last Year Benchmarking Quality Function Deployment Effort CCE/6 Sigma Training GEMI TQEM Sustainability Initiatives Total Expenditures $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Digby $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 SO $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 SO $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Cumulative Impacts Material Cost Reduction Labor Cost Reduction Reduction R&D Cycle Time Reduction Admin Costs Demand Increase 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% Look at the accompanying FastTrack, which shows the results for Round1 for a Foundation industry. Answer the following questions, explaining the reasons and justification for your answers. 1) Which company had the biggest difference between actual and potential market share in the Low Tech segment? (Look at pages 5 & 7) 2) Why did this difference happen? In other words, is the difference a result of stock-outs and therefore lost sales? Or is the difference due to selling more than the company's fair share? 3) Calculate the quantity (in units) of lost sales/extra sales. 4) How could the company you named Q (1) have avoided this situation? 5) Which company is selling the top product (in terms of customer appeal) in the Low tech segment? What is the product's name