Question

Worksheet. Suppose that the $54,000 Additional paid-in capital balance at December 31, 2011, comes from two ledger accounts: $42,000 from Paid-in capital in excess of

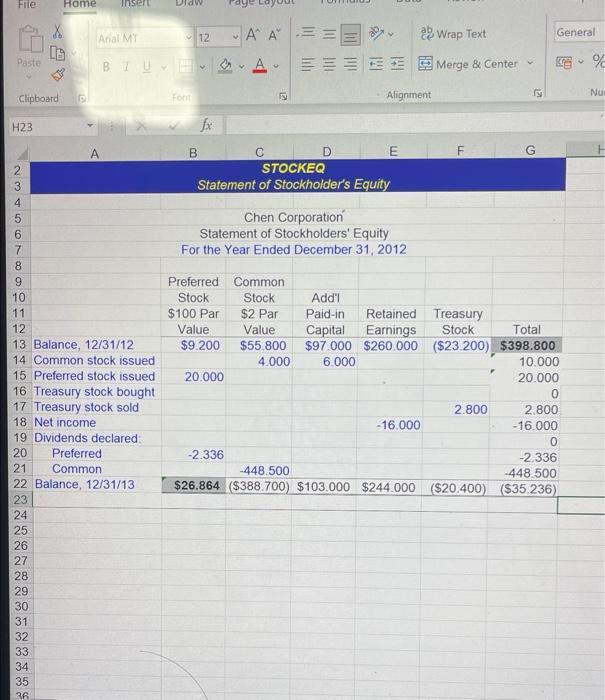

Worksheet. Suppose that the $54,000 "Additional paid-in capital" balance at December 31, 2011, comes from two ledger accounts: $42,000 from Paid-in capital in excess of par and $12,000 from Paid-in capital from treasury stock transactions. Revise the STOCKEQ2 worksheet to show a column for each of these accounts instead of the single column for Additional paid-in capital. Then redo the 2012 transactions using the new columns. Preview the printout to make sure that the worksheet will print neatly on one page, and then print the worksheet. Save the file as STOCKEQT.

Chart. Using the STOCKEQ4 file, prepare a column chart showing the dollar amount of each of the stockholders' equity account balances at December 31, 2013. Treasury stock can be shown as a negative value. Enter your name somewhere on the chart. Save the file again as STOCKEQ4. Print the chart.

File n Paste Clipboard H23 23456789 10 C 11 25 26 27 28 29 30 31 32 33 Home X 34 35 36 12 13 Balance, 12/31/12 14 Common stock issued 15 Preferred stock issued 16 Treasury stock bought 17 Treasury stock sold 18 Net income 19 Dividends declared: 20 Preferred 21 Common 22 Balance, 12/31/13 23 24 S Insert Arial MT BIU A Fort 12 B V fx V AA === 20.000 C 4 -2.336 Preferred Common Stock Stock $100 Par $2 Par Value Value $9.200 $55.800 4.000 M STOCKEQ Statement of Stockholder's Equity Alignment Chen Corporation Statement of Stockholders' Equity For the Year Ended December 31, 2012 E Wrap Text Merge & Center -16.000 LL S Add'l Paid-in Retained Treasury Capital Earnings Stock Total $97.000 $260.000 ($23.200) $398.800 6.000 10.000 20.000 2.800 General 0 2.800 -16.000 0 -2.336 -448.500 -448.500 $26.864 ($388.700) $103.000 $244.000 ($20.400) ($35.236) 4 % Nu

Step by Step Solution

3.27 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Worksheet The updated STOCKEQ2 worksheet is displayed below STOCKEQTxlsx Account1231112012123112 Com...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started