Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Founded in 1960, the Arpeggio Music Company is a family-owned and operated firm specializing in the educational music market. Located in the U.S. Middle

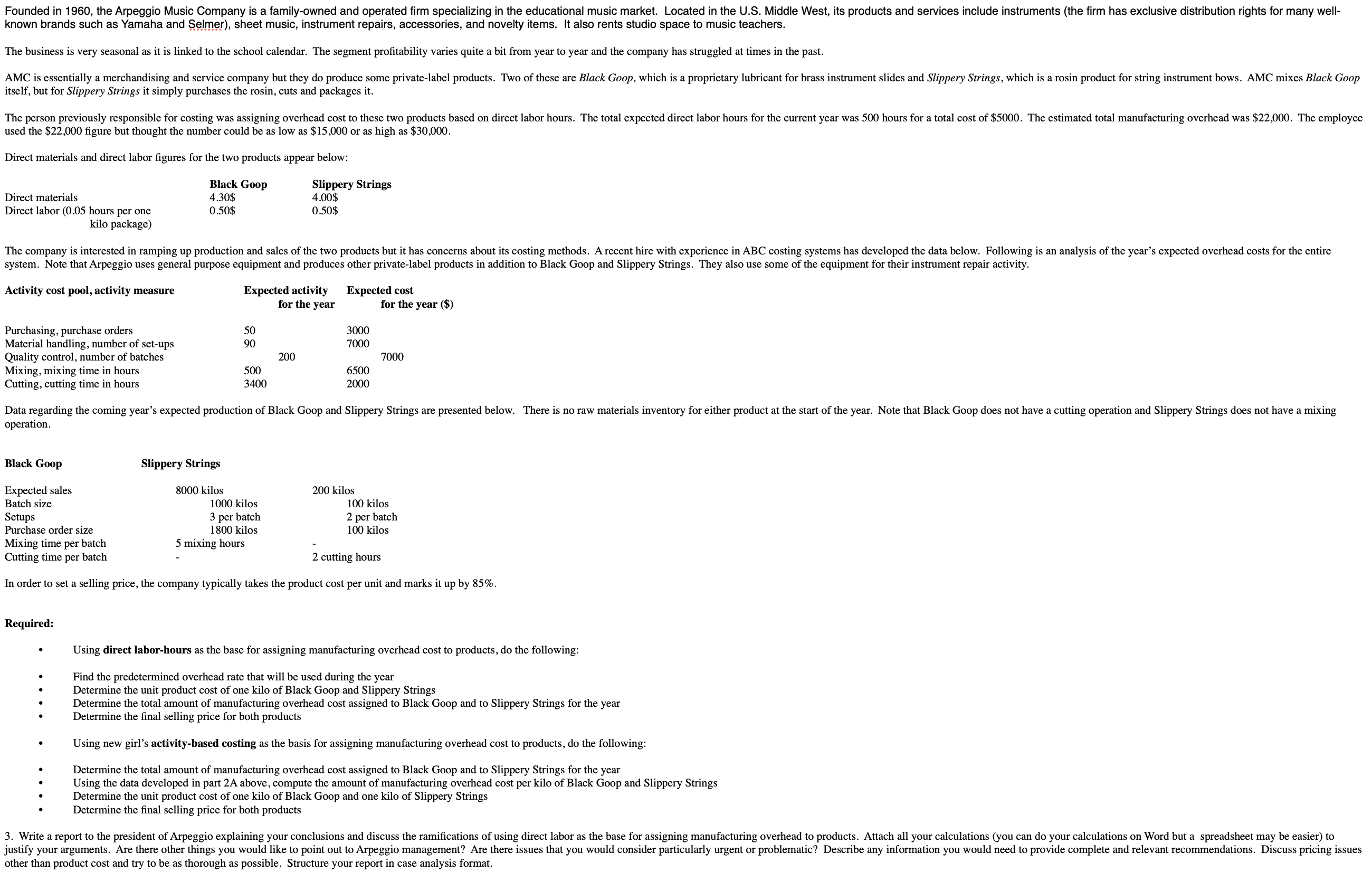

Founded in 1960, the Arpeggio Music Company is a family-owned and operated firm specializing in the educational music market. Located in the U.S. Middle West, its products and services include instruments (the firm has exclusive distribution rights for many well- known brands such as Yamaha and Selmer), sheet music, instrument repairs, accessories, and novelty items. It also rents studio space to music teachers. The business is very seasonal as it is linked to the school calendar. The segment profitability varies quite a bit from year to year and the company has struggled at times in the past. AMC is essentially a merchandising and service company but they do produce some private-label products. Two of these are Black Goop, which is a proprietary lubricant for brass instrument slides and Slippery Strings, which is a rosin product for string instrument bows. AMC mixes Black Goop itself, but for Slippery Strings it simply purchases the rosin, cuts and packages it. The person previously responsible for costing was assigning overhead cost to these two products based on direct labor hours. The total expected direct labor hours for the current year was 500 hours for a total cost of $5000. The estimated total manufacturing overhead was $22,000. The employee used the $22,000 figure but thought the number could be as low as $15,000 or as high as $30,000. Direct materials and direct labor figures for the two products appear below: Direct materials Direct labor (0.05 hours per one Black Goop 4.30$ 0.50$ kilo package) Slippery Strings 4.00$ 0.50$ The company is interested in ramping up production and sales of the two products but it has concerns about its costing methods. A recent hire with experience in ABC costing systems has developed the data below. Following is an analysis of the year's expected overhead costs for the entire system. Note that Arpeggio uses general purpose equipment and produces other private-label products in addition to Black Goop and Slippery Strings. They also use some of the equipment for their instrument repair activity. Activity cost pool, activity measure Expected activity Expected cost for the year for the year ($) Purchasing, purchase orders 50 3000 Material handling, number of set-ups Quality control, number of batches 90 7000 200 7000 Mixing, mixing time in hours 500 3400 6500 2000 Cutting, cutting time in hours Data regarding the coming year's expected production of Black Goop and Slippery Strings are presented below. There is no raw materials inventory for either product at the start of the year. Note that Black Goop does not have a cutting operation and Slippery Strings does not have a mixing operation. Black Goop Expected sales Batch size Setups Purchase order size Mixing time per batch Cutting time per batch Slippery Strings 8000 kilos 200 kilos 1000 kilos 100 kilos 3 per batch 5 mixing hours 1800 kilos 2 per batch 100 kilos 2 cutting hours In order to set a selling price, the company typically takes the product cost per unit and marks it up by 85%. Required: Using direct labor-hours as the base for assigning manufacturing overhead cost to products, do the following: Find the predetermined overhead rate that will be used during the year Determine the unit product cost of one kilo of Black Goop and Slippery Strings Determine the total amount of manufacturing overhead cost assigned to Black Goop and to Slippery Strings for the year Determine the final selling price for both products Using new girl's activity-based costing as the basis for assigning manufacturing overhead cost to products, do the following: Determine the total amount of manufacturing overhead cost assigned to Black Goop and to Slippery Strings for the year Using the data developed in part 2A above, compute the amount of manufacturing overhead cost per kilo of Black Goop and Slippery Strings Determine the unit product cost of one kilo of Black Goop and one kilo of Slippery Strings Determine the final selling price for both products 3. Write a report to the president of Arpeggio explaining your conclusions and discuss the ramifications of using direct labor as the base for assigning manufacturing overhead to products. Attach all your calculations (you can do your calculations on Word but a spreadsheet may be easier) to justify your arguments. Are there other things you would like to point out to Arpeggio management? Are there issues that you would consider particularly urgent or problematic? Describe any information you would need to provide complete and relevant recommendations. Discuss pricing issues other than product cost and try to be as thorough as possible. Structure your report in case analysis format.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Using Direct LaborHours for Assigning Manufacturing Overhead 1 Predetermined Overhead Rate Predetermined overhead rate Estimated total manufacturing overhead Estimated total direct labor hours Predete...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started