Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Foundry equipment for a new product line will cost $350,000, and can be sold after year 5 for after-tax proceeds of $75,000. Net working

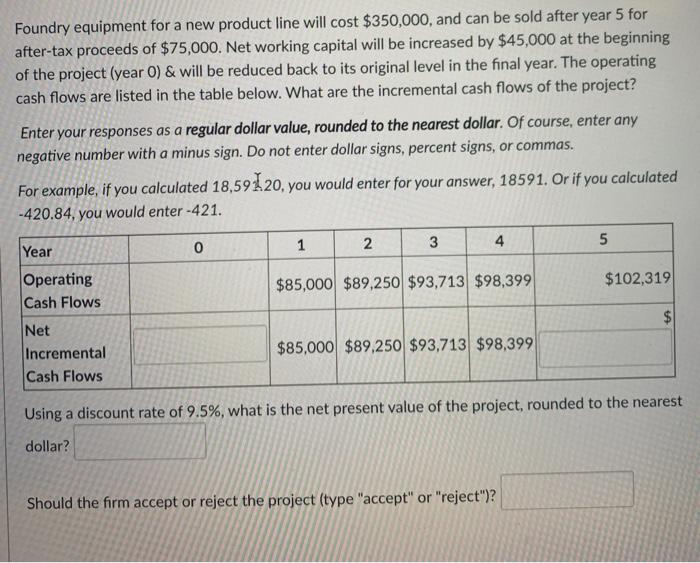

Foundry equipment for a new product line will cost $350,000, and can be sold after year 5 for after-tax proceeds of $75,000. Net working capital will be increased by $45,000 at the beginning of the project (year 0) & will be reduced back to its original level in the final year. The operating cash flows are listed in the table below. What are the incremental cash flows of the project? Enter your responses as a regular dollar value, rounded to the nearest dollar. Of course, enter any negative number with a minus sign. Do not enter dollar signs, percent signs, or commas. For example, if you calculated 18,59120, you would enter for your answer, 18591. Or if you calculated -420.84, you would enter-421. Year Operating Cash Flows Net Incremental Cash Flows 0 1 2 3 4 $85,000 $89,250 $93,713 $98,399 $85,000 $89,250 $93,713 $98,399 5 Should the firm accept or reject the project (type "accept" or "reject")? $102,319 $ Using a discount rate of 9.5%, what is the net present value of the project, rounded to the nearest dollar?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Net Incremental Cash Flows The net incremental cash flow for each year is the operating cash flow fo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started