Answered step by step

Verified Expert Solution

Question

1 Approved Answer

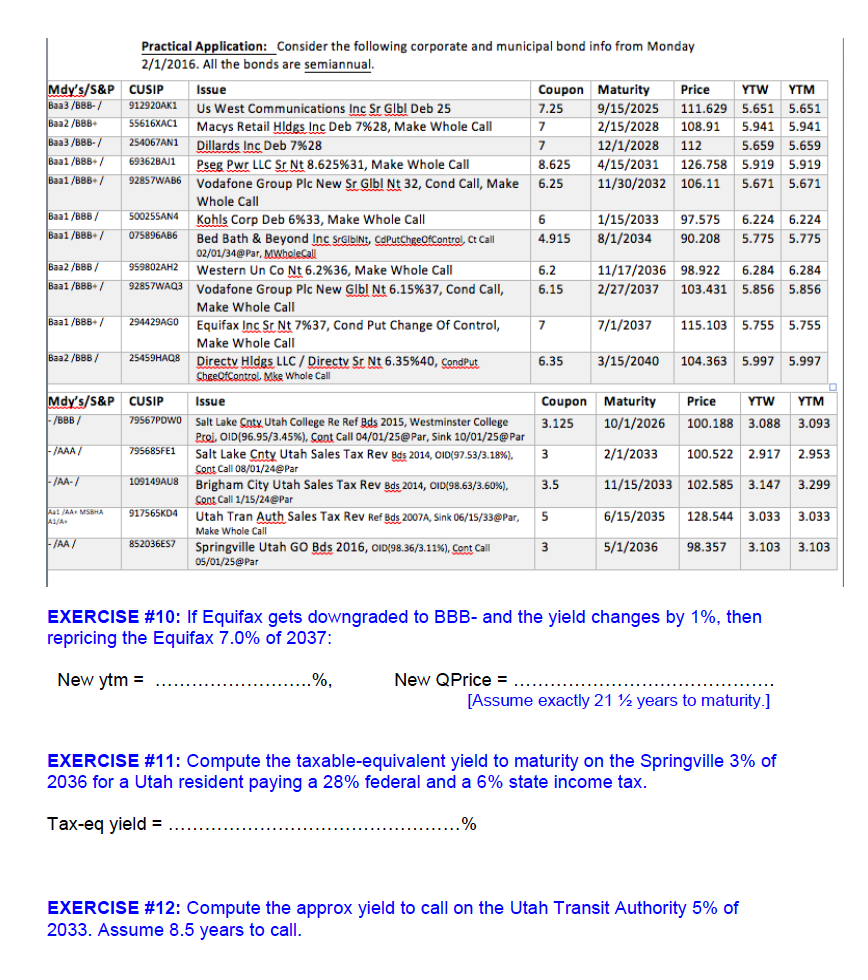

four decimal places please Practical Application Consider the following corporate and municipal bond info from Monday 2/1/2016. All the bonds are semiannual Md S&P CUSIP

four decimal places please

Practical Application Consider the following corporate and municipal bond info from Monday 2/1/2016. All the bonds are semiannual Md S&P CUSIP SSue Coupon Maturity Price YTW YTM Baa3 /B88- 912920AK1 7.25 9/15/2025 111.629 5.651 5.651 Us West Communications Inc Sr Glbl Deb 25 7 2/15/2028 108.91 5.941 5.941 16XAC1 Macys Retail Hldgs c Deb 7%28, Make Whole Call 7 12/1/2028 112 5.659 5.659 Dillards Inc Deb 7%28 8.625 4/15/2031 126.758 5.919 5.919 BAi Pseg Pwr LLC Sr Nt 8.625%31, Make Whole Call Baal /B88 928STWAB6 Vodafone Group Plc New Sr Glbl Nt 32, Cond Call, Make 6.25 11/30/2032 106.11 5.671 5.671 6 1/15/2033 97.575 6.224 6.224 Kohls Corp Deb 6%33, Make Whole Call Baa1 /BBB 07S896AB6 4.915 8/1/2034 90.208 5.775 5.775 Bed Bath & Beyond Inc srGubINt, gdPutchgeofcontrol. Ct Call 02/01/34 i 6.2 11/17/2036 98.922 6.284 6.284 802AH2 Western Un Co Nt 6.29636, Make Whole Ca Baal /BBB 92857WAa3 Vodafone Group Plc New Glbl Nt 6.15%37, cond Ca 5.856 Make Whole Call Baal /BBB 2944 29AG0 7/1/2037 115.103 5.755 5.755 Equifax Inc Sr Nt 7%37, Cond Put Change Of Control Make Whole Call Baa2 B8B 25459 HAQB Directv Hldgs LLC Directv Sr Nt 6.35%40, gondPut 6.35 3/15/2040 104.363 5.997 5.997 Chee01Control Mike Whole Call Mdy's/S&P CUSIP Issue Coupon Maturity Price YTW Powo Salt Lake Cnty Utah College Re Ref Bds 2015, Westminster College 79567 3.125 10/1/2026 100.188 3.088 3.093 Proj, OID(96.95/3.45%), Cont Call 04/01/25 Par, Sink 10/01/25 Par 3 79568SFE1 2/1/2033 100.522 2.917 2.953 Salt Lake Cnty Utah Sales Tax Rev Bds 2014 oID(97.53/3.18% Cont Call 08/01/24 Par 109149AU8 11/15/2033 102.585 3.147 3.299 Brigham City Utah Sales Tax Rev Bds 2014, oIDX9863/3 60% 3.5 Cont Call 1/15/24 Pa 917565KD4 Utah Tran Auth Sales Tax Rev Ref Bds 2007A Sink o6/15/33epar, AAA MSBHA 6/15/2035 128.544 3.033 3.033 Make Whole Cal 85203 6ES7 Spring ville Utah Go Bds 2016, oID(98.36/3.11%),contCall 05/01/25@Par EXERCISE #10: If Equifax gets downgraded to BBB- and the yield changes by 1%, then repricing the Equifax 7.0% of 2037 New ytm New QPrice F [Assume exactly 21 years to maturity.] EXERCISE #11: Compute the taxable-equivalent yield to maturity on the Springville 3% of 2036 for a Utah resident paying a 28% federal and a 6% state income tax. Tax-eq yield EXERCISE 2: Compute the approx yield to call on the Utah Transit Authority 5 of 2033. Assume 8.5 years to callStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started