Answered step by step

Verified Expert Solution

Question

1 Approved Answer

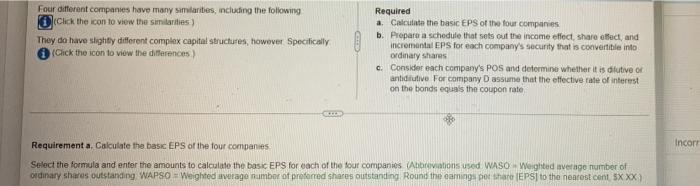

Four different companies have many similarities, including the following 1 (Click the icon to view the similarities) They do have slightly different complex capital

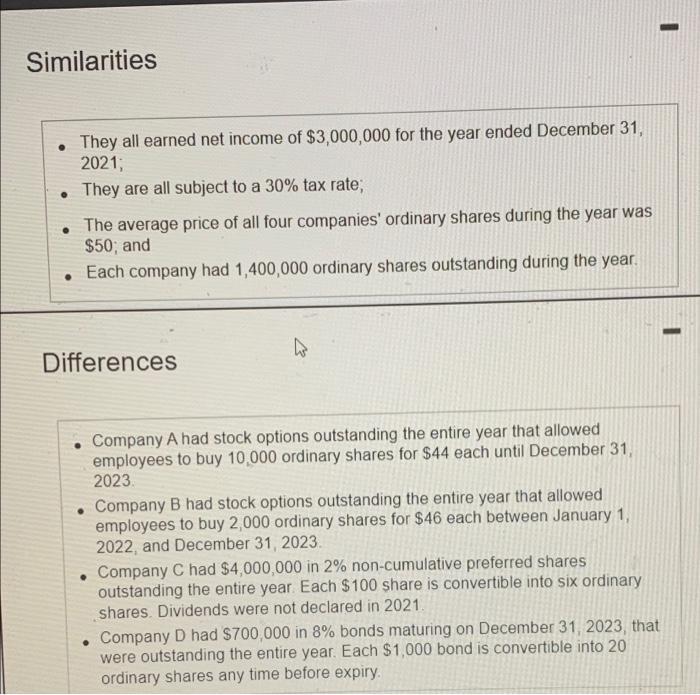

Four different companies have many similarities, including the following 1 (Click the icon to view the similarities) They do have slightly different complex capital structures, however Specifically (Click the icon to view the differences) Required a. Calculate the basic EPS of the four companies b. Prepare a schedule that sets out the income effect, share offect, and incremental EPS for each company's security that is convertible into ordinary shares c. Consider each company's POS and determine whether it is dilutive or antidutive For company D assume that the effective rate of interest on the bonds equals the coupon rate Requirement a. Calculate the basic EPS of the four companies. Select the formula and enter the amounts to calculate the basic EPS for each of the four companies (Abbreviations used WASO-Weighted average number of ordinary shares outstanding WAPSO Weighted average number of preferred shares outstanding Round the camings por share (EPS) to the nearest cent SX XX) Incorr JORNS Similarities They all earned net income of $3,000,000 for the year ended December 31, 2021; They are all subject to a 30% tax rate; The average price of all four companies' ordinary shares during the year was $50; and Each company had 1,400,000 ordinary shares outstanding during the year. Differences W . Company A had stock options outstanding the entire year that allowed employees to buy 10,000 ordinary shares for $44 each until December 31, 2023 Company B had stock options outstanding the entire year that allowed employees to buy 2,000 ordinary shares for $46 each between January 1, 2022, and December 31, 2023. Company C had $4,000,000 in 2% non-cumulative preferred shares outstanding the entire year. Each $100 share is convertible into six ordinary shares. Dividends were not declared in 2021. - . Company D had $700,000 in 8% bonds maturing on December 31, 2023, that were outstanding the entire year. Each $1,000 bond is convertible into 20 ordinary shares any time before expiry. -

Step by Step Solution

★★★★★

3.45 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Basic Earnings per Share For A 214 For B 214 For C 209 For D 214 Explanation Basic earnings per sh...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started