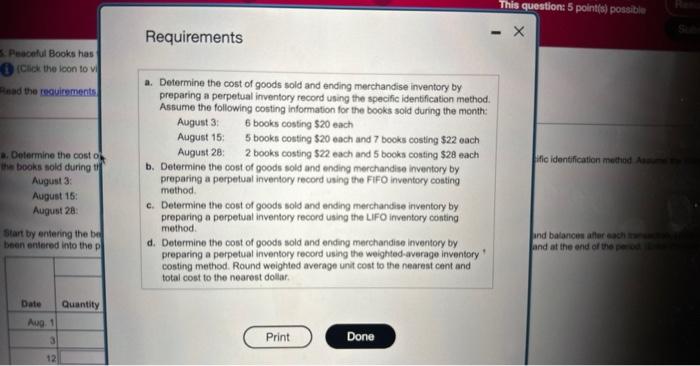

four parts to question A B C D

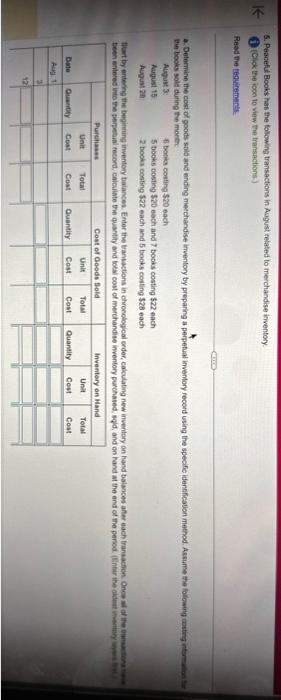

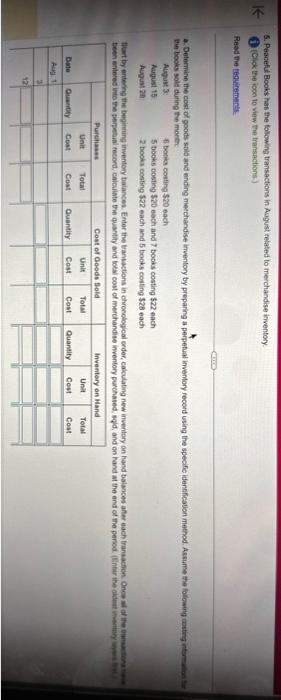

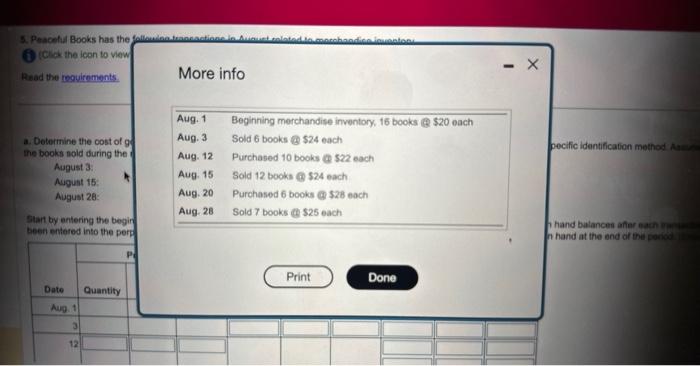

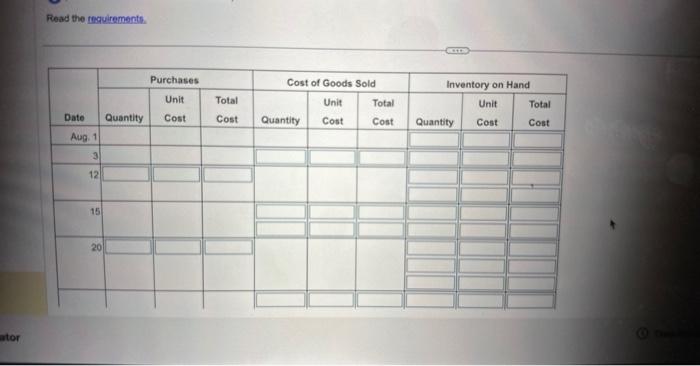

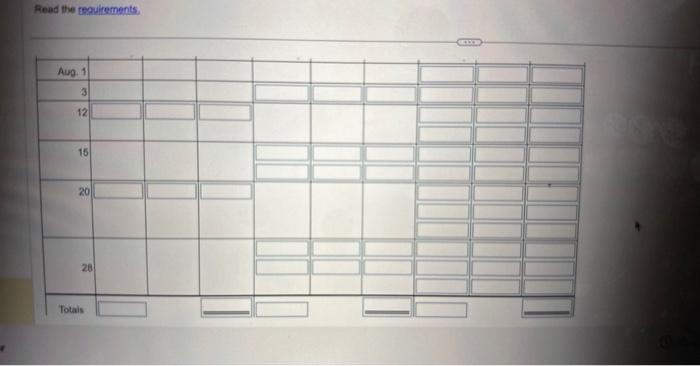

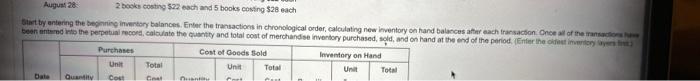

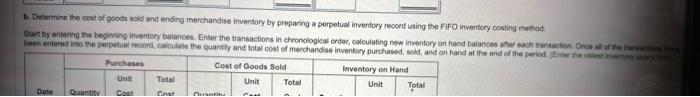

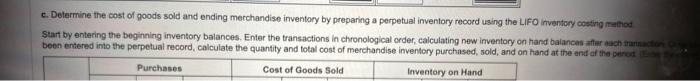

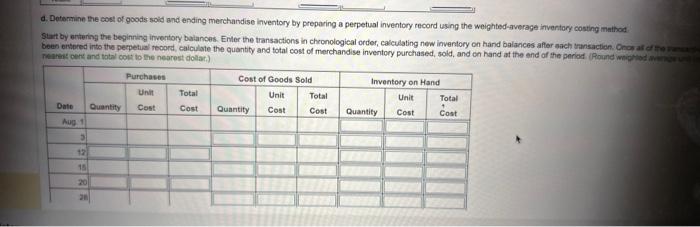

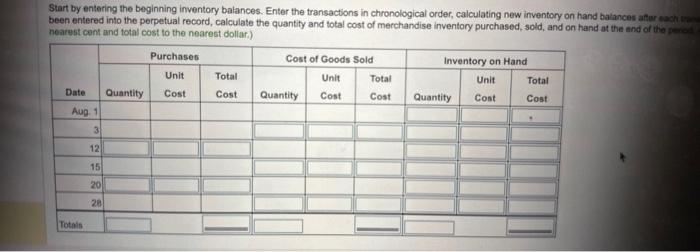

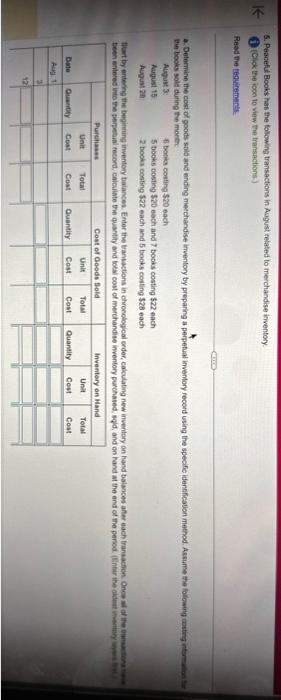

5. Peacelud Books has the following transactions in Aagust telated to merchandise imventory. C (Ciok the icon to view the transactionsis) Reas the resuinemerts Ein books sold duing the mores. Requirements a. Determine the cost of goods sold and ending merchandise inventory by preparing a perpetual inventory record using the specific identification method. Assume the following costing information for the books sold during the month: August 3 : 6 books costing $20 each August 15: 5 books costing $20 each and 7 books costing $22 each August 28: 2 books costing $22 each and 5 books costing $28 each b. Determine the cost of goods sold and ending merchandise inventory by preparing a perpetual inventory record using the FIFO inventory costing method c. Determine the cost of goods sold and ending merchandise inventory by preparing a perpetual inventory record using the LIFO inventory conting method. d. Determine the cost of goods sold and ending merchandise inventory by preparing a perpetual inventory record using the weighted-average inventory " costing method. Round weighted average unit cost to the nearest cent and total cost to the nearest dollar. More info pecific identification method As Read the fequirements. Read the tegulrements. Aumyet 28: 2 beoks costing $22 each and 5 books cosing $28 each b. Detirmine the cont of goods sold and ending merchandise inventory by preparing a perpetual inventory record using the FIFO inventory costing imetiod been entered inte the perpetuai resord, calculase the quants and lotal cost of merchandise inventory purchased, sold, and on hand at ine end of the period. \begin{tabular}{|c|c|c|c|c|c|c|c|c|} \hline \multicolumn{4}{|c|}{ Purchases } & \multicolumn{3}{c|}{ Cost of Goods Sold } & \multicolumn{3}{|c|}{ laventory on Hand } \\ \hline & Dente & Total & & Unit & Total & & Unit & Total \\ \hline \end{tabular} c. Determine the cost of goods sold and ending merchandiso inventory by preparing a perpetual inventory reoord using the LiFO inventory costing itathod Start by entering the beginning inventory balances. Enter the transactions in chronological order, calculating new inventory on hand baiancas after auch itur been entered into the perpetual record, calculate the quantity and total cost of merchandise inventory purchased, sold, and on hand at ihe and af the perwi a. Determine the cost of goods sold and ending merchandise inventory by preparing a perpetual inventory record using the weighted-average inventary costing mathod been entered into the pemetial tecord, caiculate the quantity and total cost of merchandise inventory purchased, sold, and on hand at the end of the period ifound wipe itod a Teatest oens and total colt to fhe nearest dolar.) Start by entering the beginning inventory balances. Enter the transactions in chronological order, calculating new inventory on hand balances atue rash bis. been entered into the perpetual record, calculate the quantify and total cost of merchandise inventory purchased, sold, and on hand at the and of the Es: nearest cent and total cost to the nearest dollar.)