Question

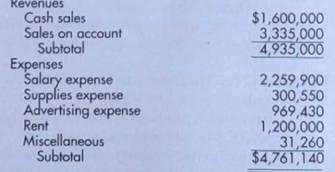

Four Square Computer Company has provided the following (partial) income statement for the year ended December 31, 2001: Required a. Calculate income before taxes, tax

Four Square Computer Company has provided the following (partial) income statement for the year ended December 31, 2001:

Required

a. Calculate income before taxes, tax expense (at 28%), and net income after taxes.

b. About half of the sales on account have still not been collected and are expected to be collected in January of the next fiscal year. On what basis are they included in this year's income statement?

c. Given that about half of this years sales have not yet been collected and rep resent all the accounts receivable that are still outstanding, evaluate Four Square's profitability. On the basis of this limited information, what would you conclude about its operating cash flows?

d. Assuming that all the non-salary expenses have been paid as incurred, and assuming that salaries for December have not been paid or accrued, evaluate Four Square's profitability and its operating cash outflows. Assume that salaries were earned by employees evenly throughout the year.

e. Now, assume that half of the advertising expense was incurred in December for a promotional campaign that was designed to boost sales in the post-holiday period. Should these expenses have been omitted from this year’s income statement and deferred until the following year? Why? If GAAP required that such advertising costs be expensed (that is, shown in this year's income statement), how might Four Square's managers now view the results of 2001's operations? Why?

f. On December 31, Four Square purchased 1,000 shares of Microcell (a computer software company) at $ 121 per share. Why isn’t this purchase reflected in the income statement?

g. In November, Four Square purchased 100,000 disk drive units at $12 per unit. These are very advanced disk drives that have not yet been sold. Why isn’t this purchase shown on the income statement?

h. When the outstanding accounts receivable are collected in the next year, should those collections be shown on next year's income statement? Why?

i. When the disk drives are used to manufacture computers, should their cost be shown on the income statement for the month and year in which they are assembled into the finished product? Or should they be shown on the income statement in the month and year when the computers (and their associated disk drives) are sold? Why?

kevenues Cash sales Sales on account Subtotal Expenses Salary expense Supplies expense Advertising expense Rent Miscellaneous Subtotal $1,600,000 3,335,000 4,935,000 2,259,900 300,550 969,430 1,200,000 31,260 $4,761,140

Step by Step Solution

3.46 Rating (169 Votes )

There are 3 Steps involved in it

Step: 1

a Income Before Taxes 1173860 Tax Expense at 28 32864720 Net Income After Taxes 84521280 Revenues Cash sales 1600000 Sales on account 3335000 Subtotal 4935000 Expenses Salary expense 2259900 Supplies ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started