Answered step by step

Verified Expert Solution

Question

1 Approved Answer

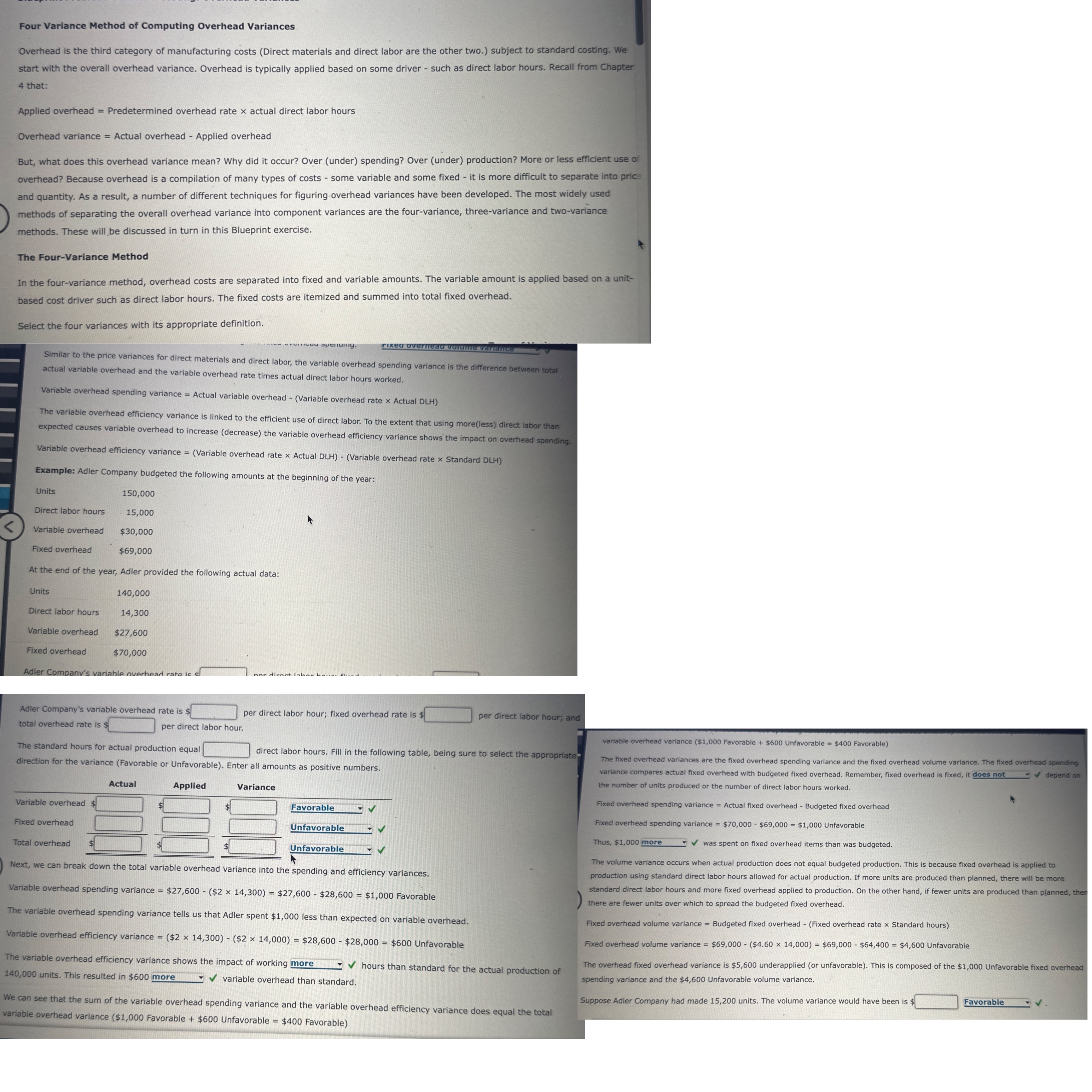

Four variance method of computing overhead variances Four Variance Method of Computing Overhead Variances Overhead is the third category of manufacturing costs (Direct materials and

Four variance method of computing overhead variances

Four Variance Method of Computing Overhead Variances Overhead is the third category of manufacturing costs (Direct materials and direct labor are the other two.) subject to standard costing. We start with the overall overhead variance. Overhead is typically applied based on some driver - such as direct labor hours. Recall from Chapter 4 that: Applied overhead = Predetermined overhead rate x actual direct labor hours Overhead variance = Actual overhead - Applied overhead But, what does this overhead variance mean? Why did it occur? Over (under) spending? Over (under) production? More or less efficient use of overhead? Because overhead is a compilation of many types of costs - some variable and some fixed - it is more difficult to separate into price and quantity. As a result, a number of different techniques for figuringoverhead variances have been developed. The most widely used methods of separating the overall overhead variance into component variances are the four-variance, three-variance and two-variance methods. These will_be discussed in turn in this Blueprint exercise. The Four-Variance Method In the four-variance method, overhead costs are separated into fixed and variable amounts. The variable amount is applied based on a unit- based cost driver such as direct labor hours. The fixed costs are itemized and summed into total fixed overhead. Select the four variances with its appropriate definition. Similar to the price variances for direct materials and direct labor, the variable overhead spending variance is the difference between total actual variable overhead and the variable overhead rate times actual direct labor hours worked, Variable overhead spending variance = Actual variable overhead - (Variable overhead rate x Actual DLH) The variable overhead efficiency variance is linked to the efficient use of direct labor. To the extent that using more(less) direct labor than expected causes variable overhead to increase (decrease) the variable overhead efficiency variance shows the impact on overhead spending. Variable overhead efficiency variance = (Variable overhead rate x Actual DLH) - (Variable overhead rate x Standard DLH) Example: Adler Company budgeted the following amounts at the beginning of the year: Units 150,000 Direct labor hours 15,000 Variable overhead $30,000 Fixed overhead $69,000 At the end of the year, Adler provided the following actual data: units Direct labor hours Variable overhead Fixed overhead 140,000 14,300 $27,600 $70,000 Adler Company's variable overhead rate is per direct labor hour; fixed. overhead rate is total overhead rate is per direct labor hour. The standard hours for actual production equal direct labor hours. Fill in the following table, direction for the variance (Favorable or Unfavorable). Enter all amounts as positive numbers. per direct labor hour; and variable overhead variance ($1,000 Favorable + $600 Unfavorable $400 Favorable) being sure to select the appropriate Actual Variable overhead fixed overhead Total overhead Applied Variance Favorable Unfavorable Unfavorable Next, we can break down the total variable overhead Variance into the spending and efficiency variances. Variable overhead spending variance = $27,600 - ($2 x 14,300) = $27,600 - $28,600 = $1,000 Favorable The variable overhead spending variance tells us that Adler spent $1,000 less than expected on variable overhead. Variable overhead efficiency variance = ($2 x 14,300) - ($2 x 14,000) = $28,600 - $28,000 = $600 Unfavorable The variable overhead efficiency variance shows the impact of working more hours than standard for the actual production of 140,000 units. This resulted in $600 more variable overhead than standard. We can see that the sum of the variable overhead spending variance and the variable overhead efficiency variance does equal the total variable overhead variance ($1,000 Favorable + $600 Unfavorable $400 Favorable) The fixed overhead variances are the fixed overhead spending variance and the fixed overhead volume variance. The fixed overhead spending variance compares actual fixed overhead with budgeted fixed overhead. Remember, fixed overhead is fixed, it does not depend on the number of units produced or the number of direct labor hours worked. fixed overhead spending variance = Actual fixed overhead - Budgeted fixed overhead fixed overhead spending variance = $70,000 - $69,000 = $1,000 Unfavorable v/ was spent on fixed overhead items than was budgeted. Thus, $1,000 more The volume variance occurs when actual production does not equal budgeted production. This is because fixed overhead is applied to production using standard direct labor hours allowed for actual production. If more units are produced than planned, there will be more standard direct labor hours and more fixed overhead applied to production. On the other hand, if fewer units are produced than there are fewer units over which to spread the budgeted fixed overhead. Fixed overhead volume variance = Budgeted fixed overhead - (Fixed overhead rate x Standard hours) Fixed overhead volume variance = $69,000 - ($4.60 x 14,000) = $69,000 - $64,400 = $4,600 Unfavorable The overhead fixed overhead variance is $5,600 underapplied (or unfavorable). This is composed of the $1,000 Unfavorable fixed ov spending variance and the $4,600 Unfavorable volume variance. Suppose Adler Company had made 15,200 units. The volume variance would have been is Favorable

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started