Answered step by step

Verified Expert Solution

Question

1 Approved Answer

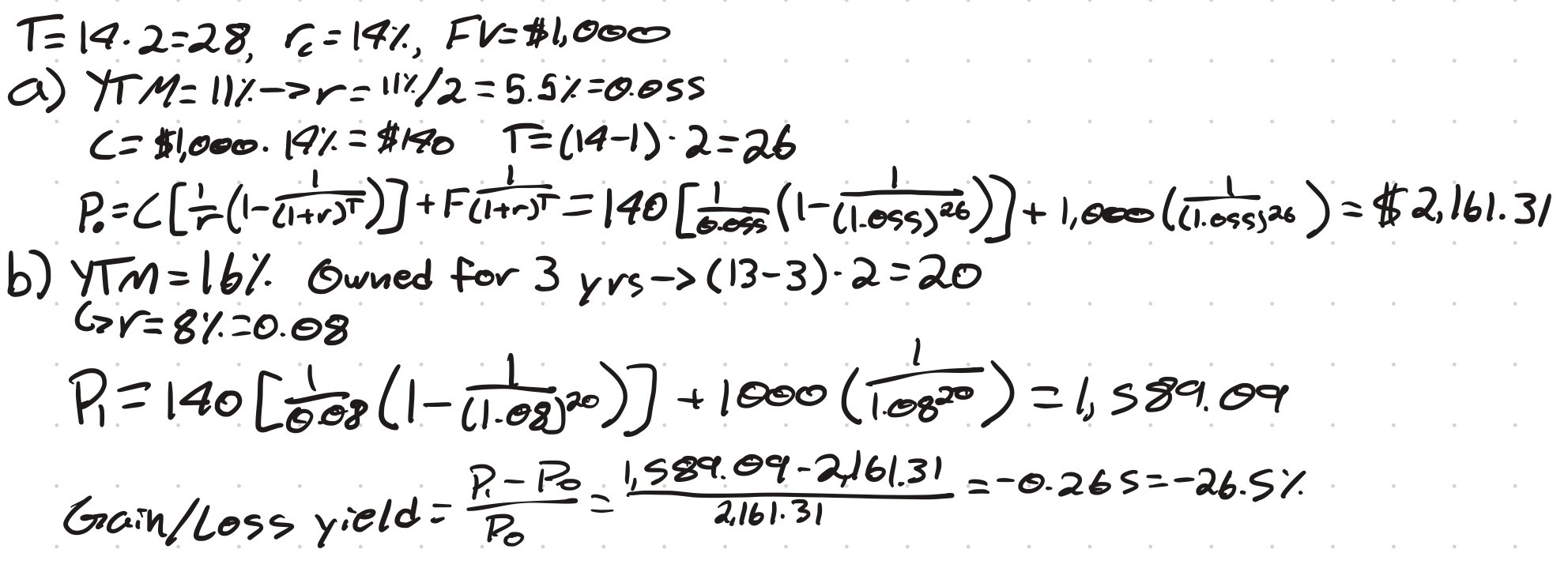

Four years ago, S . Goodman Corp. issued a bond with a 1 4 % coupon rate, semi - annual coupon payments, $ 1 ,

Four years ago, S Goodman Corp. issued a bond with a coupon rate, semiannual coupon payments, $ face value, and years until maturity.

a

You bought this bond three years ago right after the bond made its coupon payment when the yieldtomaturity was How much did you pay for the bond?

answers: a b c d be f g h

b

Suppose todays yieldtomaturity of the bond is and the next coupon payment is exactly in months from today. If you sell the bond today, after you have owned it for three years, what would be your capital gainloss yield? Remember, the capital gainloss yield is the return resulting from price changes of your investment.

answers: a b c d e f g h

c

Suppose two years from now right after the bond made its coupon payment the bond has a value of $ What would be the yieldtomaturity of the bond APR semiannually compounded Use Excel or a financial calculator to solve this question.

answers: a b c d e f g h

I feel pretty confident in my answer for part a but I keep getting an answer not listed for part b So Im attaching my work so far, please try to help me find out where Im going wrong here

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started