Question

Fourteen years ago, the U.S. Aluminum Corporation borrowed $6.5 million. Since then, cumulative inflation has been 98 percent (a compound rate of approximately 65 percent

Fourteen years ago, the U.S. Aluminum Corporation borrowed $6.5 million. Since then, cumulative inflation has been 98 percent (a compound rate of approximately 65 percent per year).

a. When the firm repays the original $6.5 million loan this year, what will be the effective purchasing power of the $6.5 million? (Hint: Divide the loan amount by one plus cumulative inflation.)

b. To maintain the original $6.5 million purchasing power, how much should the lender be repaid? (Hint: Multiply the loan amount by one plus cumulative inflation.)

c. If the lender knows he will receive $6.5 million in payment after 14 years, how might he be compensated for the loss in purchasing power? A descriptive answer is acceptable.

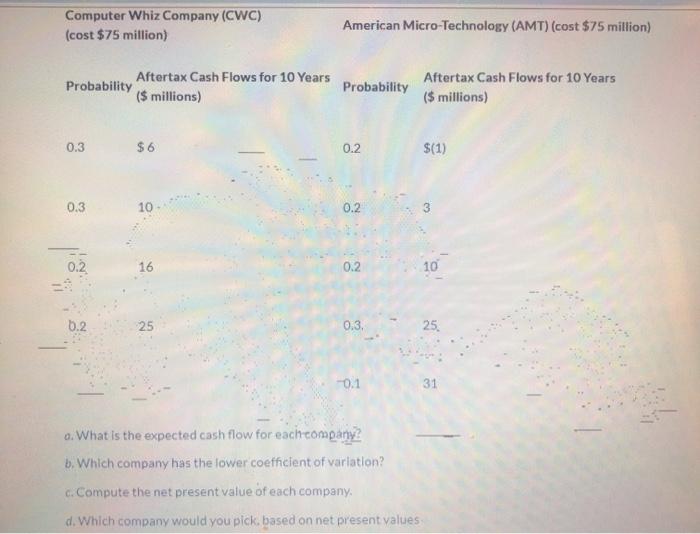

3) Tobacco Company of America is a very stable billion-dollar company with sales growth of about 5 percent per year in good or bad economic conditions. Because of this stability (a correlation coefficient with the economy of +.3 and a standard deviation of sales of about 5 percent from the mean), Mr. Weed, the vice-president of finance, thinks the company could absorb some small risky company that could add quite a bit of return without increasing the company's risk very much. He is trying to decide which of the two companies he will buy. Tobacco Company of America's cost of capital is 10 percent.

Step by Step Solution

3.58 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

In this problem we see a change in purchasing power due to a change in the inflation With the given ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started