Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Fourth Level (FL) manufactures and sells 3D Printers. Each of its printers sells for $8,000 each. manufacturing cost is $4,300 per printer At the

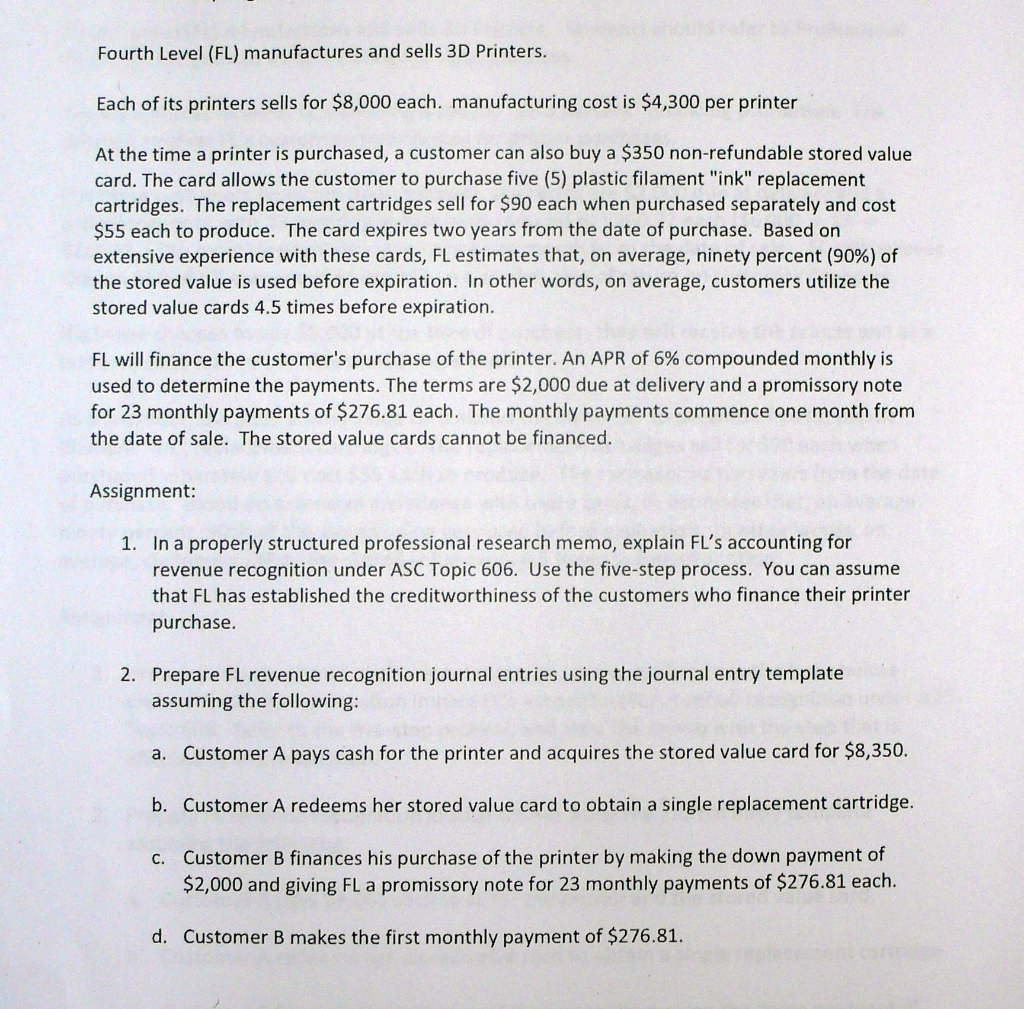

Fourth Level (FL) manufactures and sells 3D Printers. Each of its printers sells for $8,000 each. manufacturing cost is $4,300 per printer At the time a printer is purchased, a customer can also buy a $350 non-refundable stored value card. The card allows the customer to purchase five (5) plastic filament "ink" replacement cartridges. The replacement cartridges sell for $90 each when purchased separately and cost $55 each to produce. The card expires two years from the date of purchase. Based on extensive experience with these cards, FL estimates that, on average, ninety percent (90%) of the stored value is used before expiration. In other words, on average, customers utilize the stored value cards 4.5 times before expiration. FL will finance the customer's purchase of the printer. An APR of 6% compounded monthly is used to determine the payments. The terms are $2,000 due at delivery and a promissory note for 23 monthly payments of $276.81 each. The monthly payments commence one month from the date of sale. The stored value cards cannot be financed. Assignment: 1. In a properly structured professional research memo, explain FL's accounting for revenue recognition under ASC Topic 606. Use the five-step process. You can assume that FL has established the creditworthiness of the customers who finance their printer purchase. 2. Prepare FL revenue recognition journal entries using the journal entry template assuming the following: a. Customer A pays cash for the printer and acquires the stored value card for $8,350. b. Customer A redeems her stored value card to obtain a single replacement cartridge. c. Customer B finances his purchase of the printer by making the down payment of $2,000 and giving FL a promissory note for 23 monthly payments of $276.81 each. d. Customer B makes the first monthly payment of $276.81.

Step by Step Solution

★★★★★

3.26 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

Amount in a Cash 8350 Contract Liability 350 Revenue 8000 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started