Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Fox Pty Ltd (Fox) is a listed company on ASX and is aiming to invest $500,000 into a new product line. The residual value

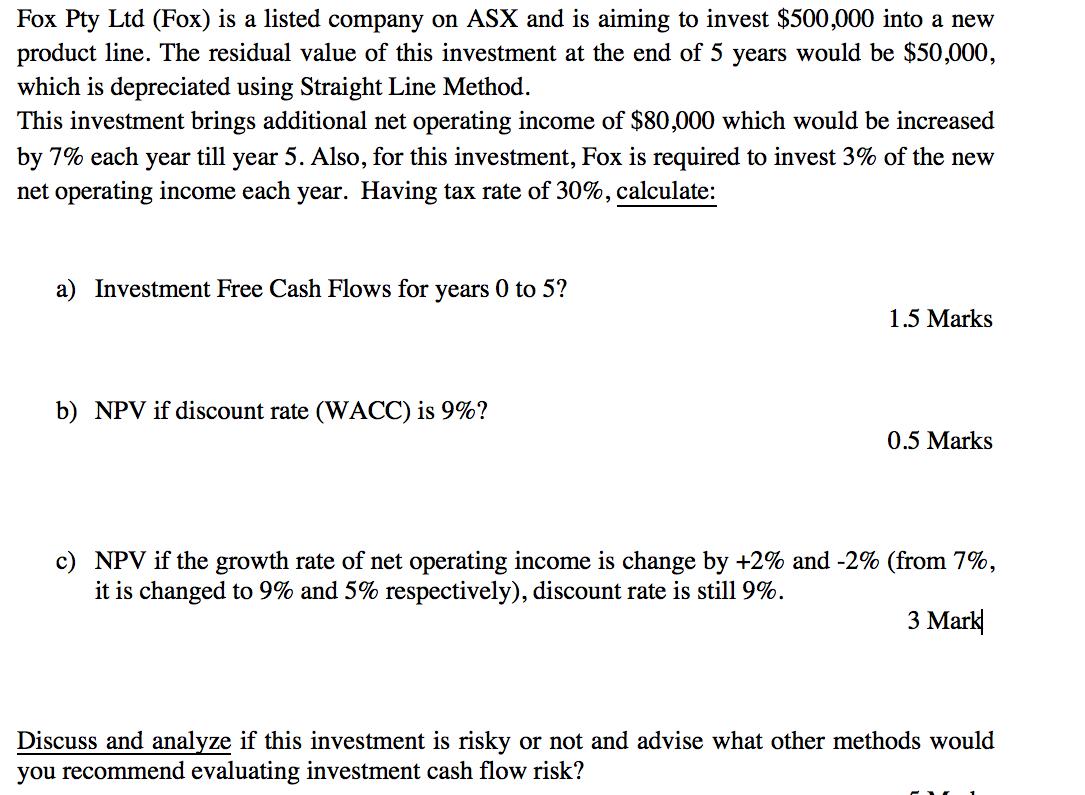

Fox Pty Ltd (Fox) is a listed company on ASX and is aiming to invest $500,000 into a new product line. The residual value of this investment at the end of 5 years would be $50,000, which is depreciated using Straight Line Method. This investment brings additional net operating income of $80,000 which would be increased by 7% each year till year 5. Also, for this investment, Fox is required to invest 3% of the new net operating income each year. Having tax rate of 30%, calculate: a) Investment Free Cash Flows for years 0 to 5? b) NPV if discount rate (WACC) is 9%? 1.5 Marks 0.5 Marks c) NPV if the growth rate of net operating income is change by +2% and -2% (from 7%, it is changed to 9% and 5% respectively), discount rate is still 9%. 3 Mark Discuss and analyze if this investment is risky or not and advise what other methods would you recommend evaluating investment cash flow risk? C

Step by Step Solution

★★★★★

3.47 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

a growth rate 7 9 5 required investment 3 3 3 net increase 4 6 2 GROWTH 7 year PVF9 TAXES DEP Cash F...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started