Answered step by step

Verified Expert Solution

Question

1 Approved Answer

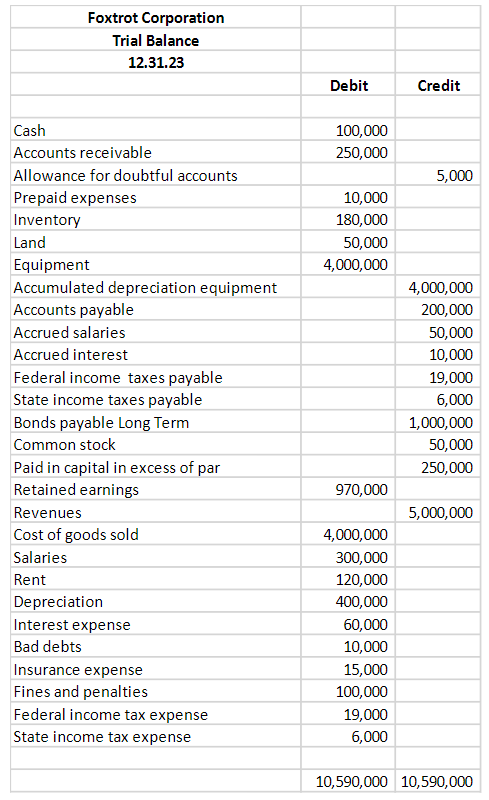

Foxtrot Corporation Trial Balance 12.31.23 Debit Credit Cash 100,000 Accounts receivable 250,000 Allowance for doubtful accounts 5,000 Prepaid expenses 10,000 Inventory 180,000 Land 50,000

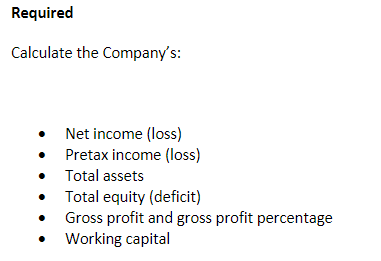

Foxtrot Corporation Trial Balance 12.31.23 Debit Credit Cash 100,000 Accounts receivable 250,000 Allowance for doubtful accounts 5,000 Prepaid expenses 10,000 Inventory 180,000 Land 50,000 Equipment 4,000,000 Accumulated depreciation equipment 4,000,000 Accounts payable Accrued salaries Accrued interest 200,000 50,000 10,000 Federal income taxes payable 19,000 State income taxes payable 6,000 Bonds payable Long Term 1,000,000 Common stock 50,000 Paid in capital in excess of par 250,000 Retained earnings 970,000 Revenues 5,000,000 Cost of goods sold 4,000,000 Salaries Rent Depreciation Interest expense Bad debts 300,000 120,000 400,000 60,000 10,000 Insurance expense 15,000 Fines and penalties 100,000 Federal income tax expense 19,000 State income tax expense 6,000 10,590,000 10,590,000 Required Calculate the Company's: Net income (loss) Pretax income (loss) Total assets Total equity (deficit) Gross profit and gross profit percentage Working capital

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Okay my apologies Here are the calculations without question marks Net income loss Reve...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started