Question

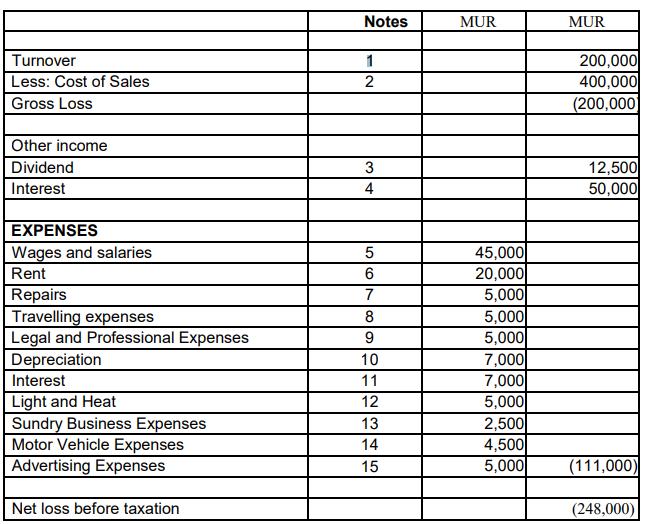

FPSL is a domestic company incorporated in Mauritius. Its draft Income Statement for the year ended 31 December 2020 is as follows: NOTES 1. Turnover

FPSL is a domestic company incorporated in Mauritius. Its draft Income Statement for the year ended 31 December 2020 is as follows:

NOTES 1. Turnover includes an invoice of MUR 1,000 that was booked twice.

2. Cost of Sales includes depreciation of plant amounting to MUR 100,000. The base value of the assets is MUR 200,000.

3. Dividends have been received from SIT.

4. Interest Income was generated from the bank balance in Mauritius. Page 5 of 8

5. Salary excludes a special bonus of MUR 5,000 paid to employees.

6. The Company’s rent of MUR 20,000 includes a prepayment of MUR 5,000.

7. Repairs were made during the year due to pipe busting and insurance has been fully refunded.

8. Travelling expenses relate to taxi fares for those working overtime.

9. Professional fees refer to legal costs to recover an amount from debtors.

10. Depreciation of MUR 7,000 is for a laptop purchase of MUR 30,000 during the year.

11. Interest expenses related to the company credit card used by the CEO during official trips.

12. MUR 5,000 cost for light and Heat includes the expense for CEO house amounting to MUR 2,000.

13. Included in sundry business expenses are MUR 1,000 dinners for the CEO daughters birthday.

14. During the year, the company paid the CEO MUR 4,500 for the use of his car for work purposes.

15. Advertising expenses relate to the promotion of the company’s activities.

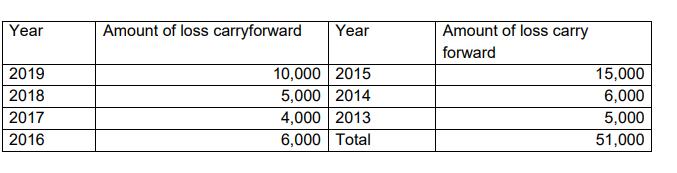

16. The Company has the following loss in the previous years:

REQUIRED

From the above information compute the amount of income tax payable under the Income Tax Act 1995 for the income year ended 31 December 2020.

Turnover Less: Cost of Sales Gross Loss Other income Dividend Interest EXPENSES Wages and salaries Rent Repairs Travelling expenses Legal and Professional Expenses Depreciation Interest Light and Heat Sundry Business Expenses Motor Vehicle Expenses Advertising Expenses Net loss before taxation Notes 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 MUR 45,000 20,000 5,000 5,000 5,000 7,000 7,000 5,000 2,500 4,500 5,000 MUR 200,000 400,000 (200,000 12,500 50,000 (111,000) (248,000)

Step by Step Solution

3.54 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Sollution calculation of taxable profit perticulers Amount Net lo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started