Answered step by step

Verified Expert Solution

Question

1 Approved Answer

FR Berhad has 6.5 million shares of common stock outstanding with a market price of RM14 per share. This company has a market value

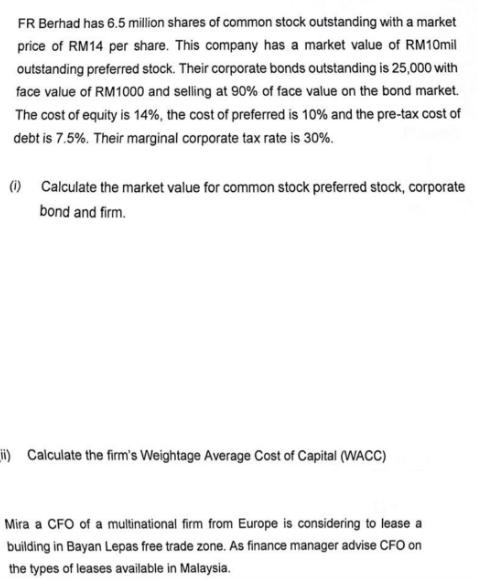

FR Berhad has 6.5 million shares of common stock outstanding with a market price of RM14 per share. This company has a market value of RM10mil outstanding preferred stock. Their corporate bonds outstanding is 25,000 with face value of RM1000 and selling at 90% of face value on the bond market. The cost of equity is 14%, the cost of preferred is 10% and the pre-tax cost of debt is 7.5%. Their marginal corporate tax rate is 30%. (1) Calculate the market value for common stock preferred stock, corporate bond and firm. ii) Calculate the firm's Weightage Average Cost of Capital (WACC) Mira a CFO of a multinational firm from Europe is considering to lease a building in Bayan Lepas free trade zone. As finance manager advise CFO on the types of leases available in Malaysia.

Step by Step Solution

★★★★★

3.37 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the market value of the common stock preferred stock corporate bond and firm we need to use the given information 1 Market value of commo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started