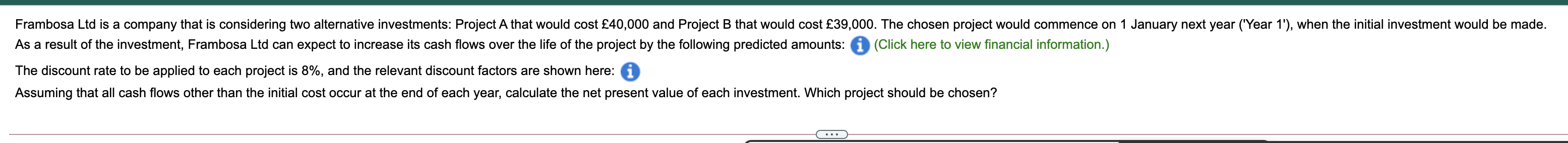

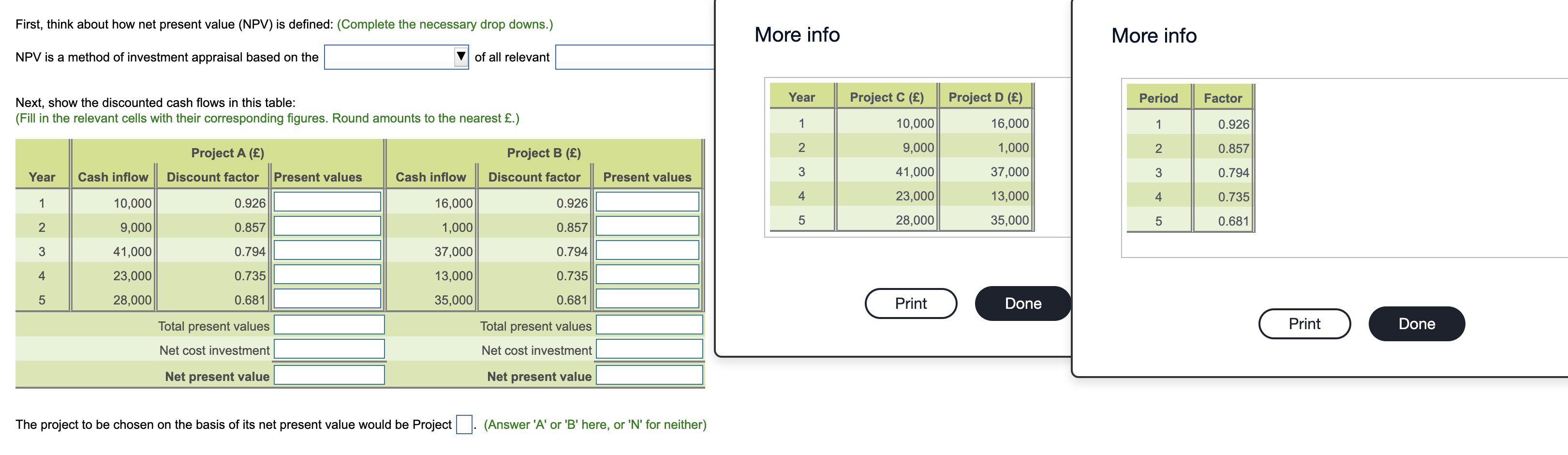

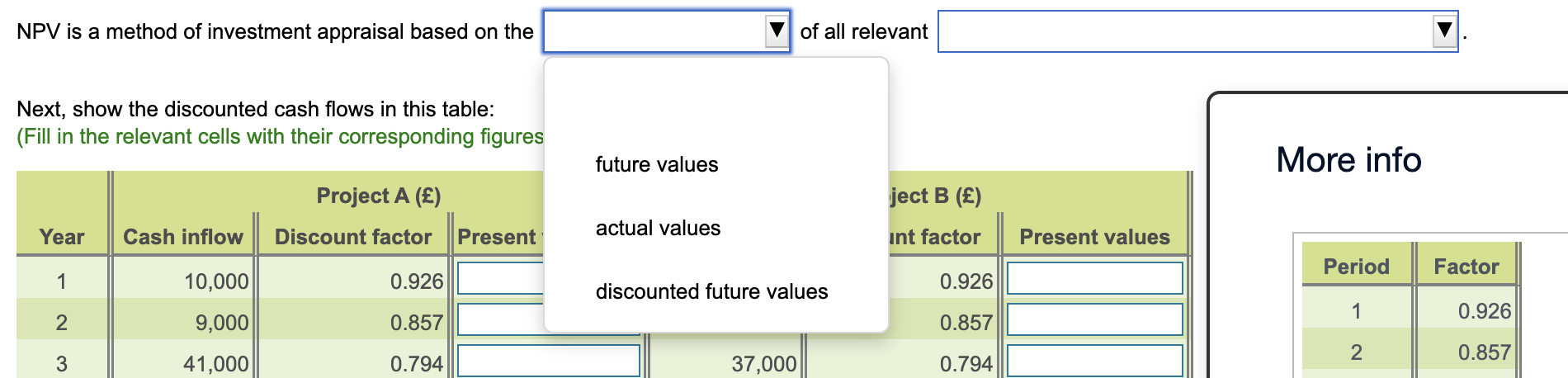

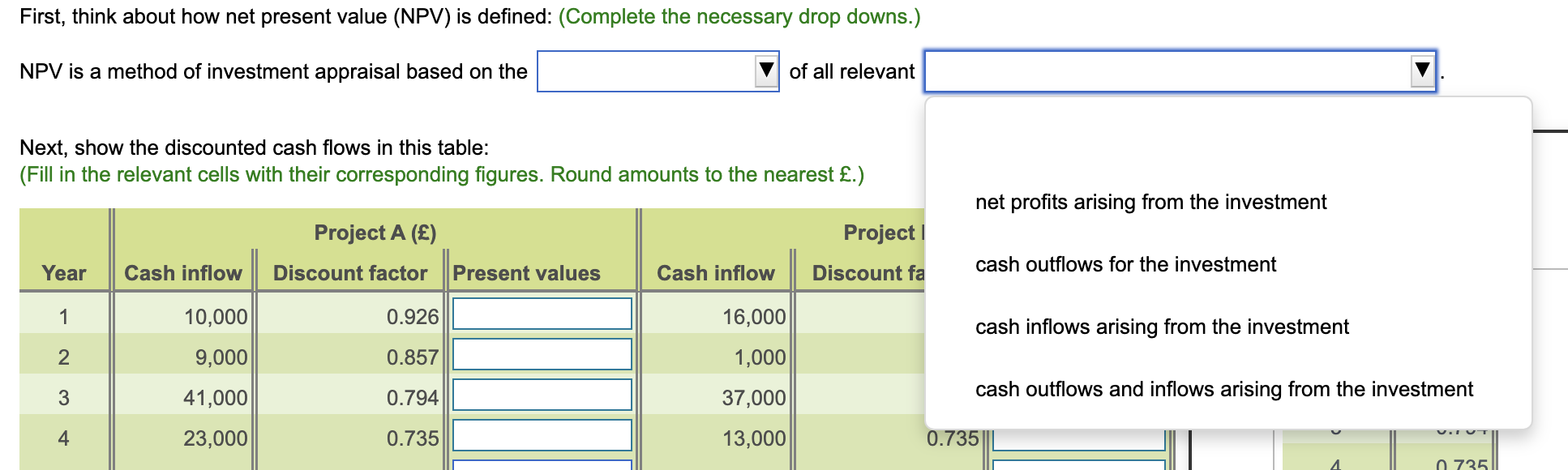

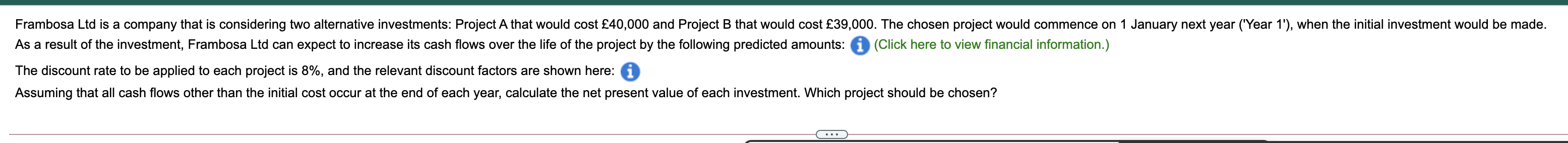

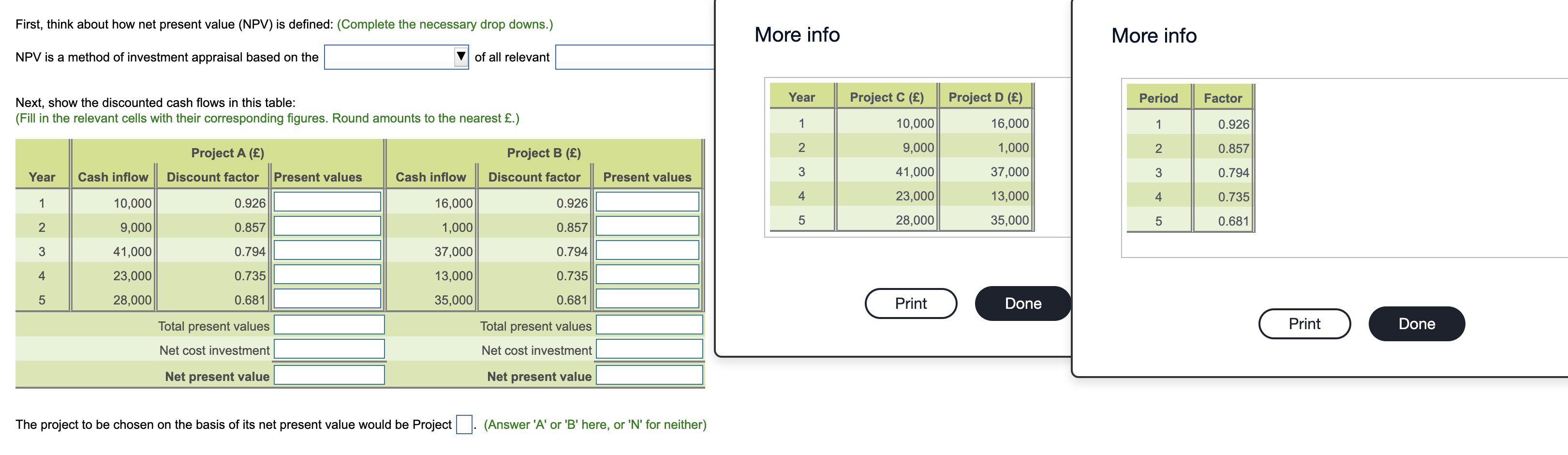

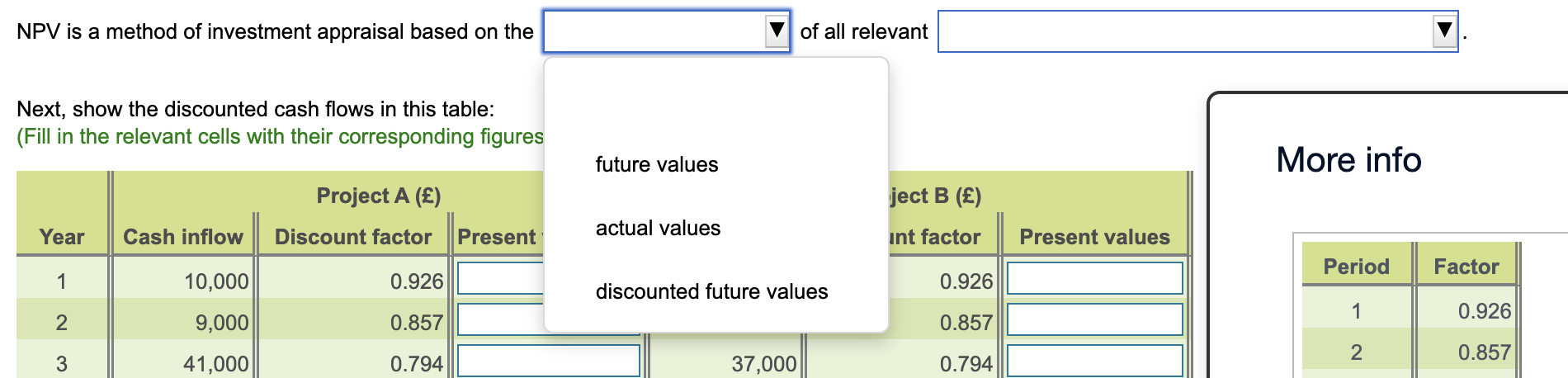

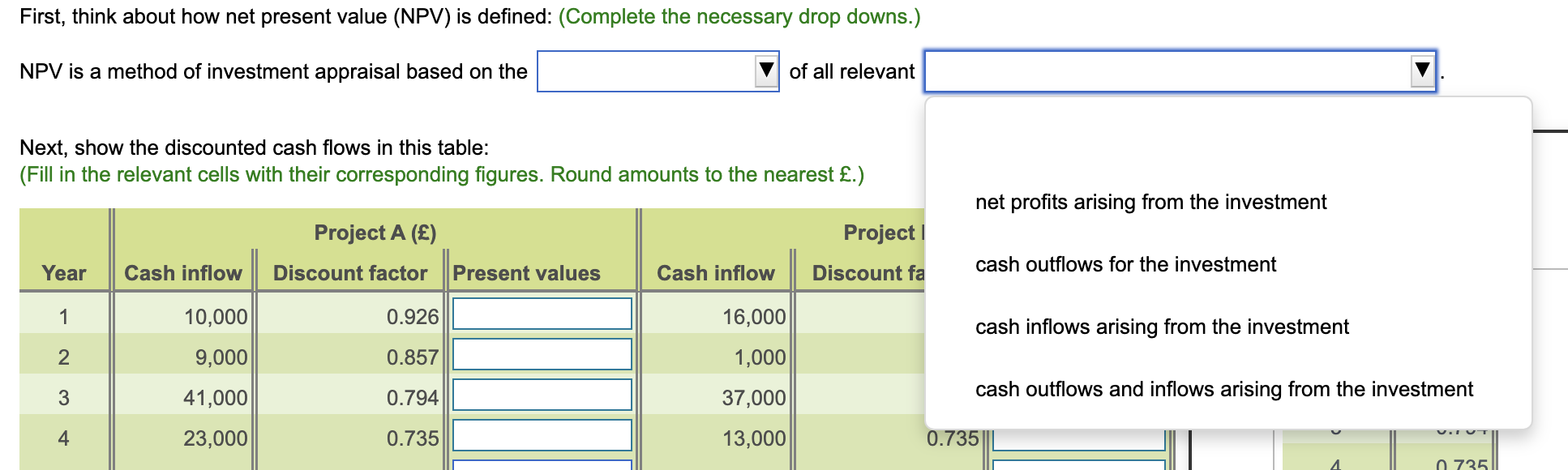

Frambosa Ltd is a company that is considering two alternative investments: Project A that would cost 40,000 and Project B that would cost 39,000. The chosen project would commence on 1 January next year ('Year 1'), when the initial investment would be made. As a result of the investment, Frambosa Ltd can expect to increase its cash flows over the life of the project by the following predicted amounts: (Click here to view financial information.) The discount rate to be applied to each project is 8%, and the relevant discount factors are shown here: i Assuming that all cash flows other than the initial cost occur at the end of each year, calculate the net present value of each investment. Which project should be chosen? First, think about how net present value (NPV) is defined: (Complete the necessary drop downs.) More info More info NPV is a method of investment appraisal based on the of all relevant Year Project C () Project D () Period Factor Next, show the discounted cash flows in this table: (Fill in the relevant cells with their corresponding figures. Round amounts to the nearest .) 1 10,000 16,000 1 0.926 2 9,000 1,000 2 0.857 Project A () Discount factor Project B () Discount factor 3 Year Cash inflow Present values Cash inflow Present values 41,000 37,000 3 0.794 4 23,000 13,000 . 4. 0.735 1 10,000 0.926 16,000 0.926 5 28,000 35,000 5 2 0.681 9,000 0.857 1,000 0.857 3 41,000 0.794 37,000 0.794 4 23,000 0.735 0.735 13,000 35,000 5 28,000 0.681 0.681 Print Done Print Done Total present values Net cost investment Total present values Net cost investment Net present value Net present value The project to be chosen on the basis of its net present value would be Project (Answer 'A' or 'B' here, or 'N' for neither) NPV is a method of investment appraisal based on the of all relevant Next, show the discounted cash flows in this table: (Fill in the relevant cells with their corresponding figures future values More info Project A () ject B () Year actual values Cash inflow Discount factor Present int factor Present values Period Factor 1 10,000 0.926 0.926 discounted future values 1 0.926 2 9,000 0.857 0.857 2. . 0.857 3 41,000 0.794 37,000 0.794 First, think about how net present value (NPV) is defined: (Complete the necessary drop downs.) NPV is a method of investment appraisal based on the of all relevant Next, show the discounted cash flows in this table: (Fill in the relevant cells with their corresponding figures. Round amounts to the nearest .) net profits arising from the investment Project A () Discount factor Project 1 Discount fa Year Cash inflow Present values Cash inflow cash outflows for the investment 1 10,000 0.926 16,000 cash inflows arising from the investment 2 9,000 0.857 1,000 3 41,000 0.794 37,000 cash outflows and inflows arising from the investment V.IVT 4 23,000 0.735 13,000 0.735 n 735