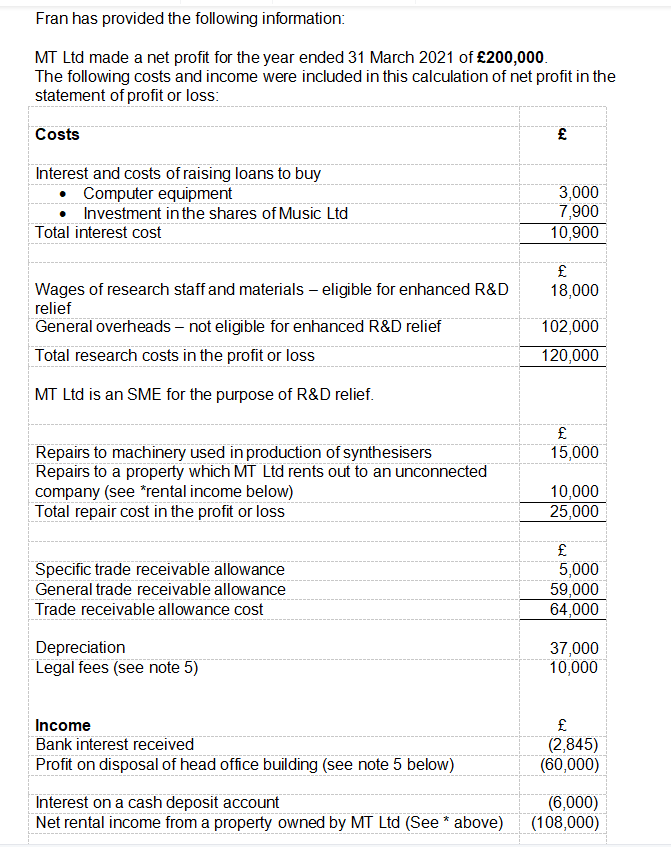

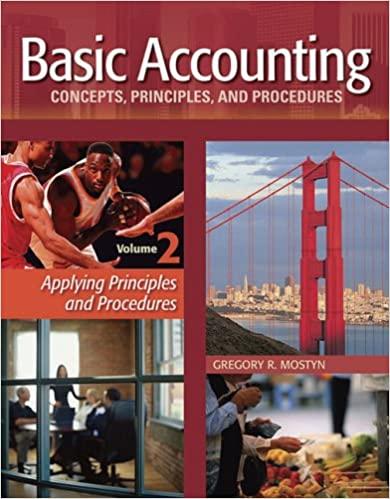

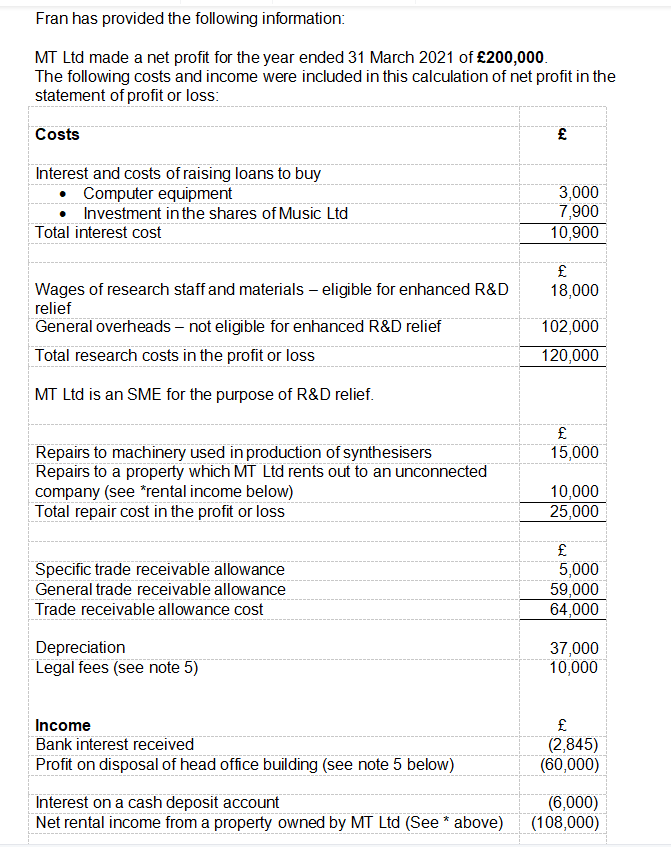

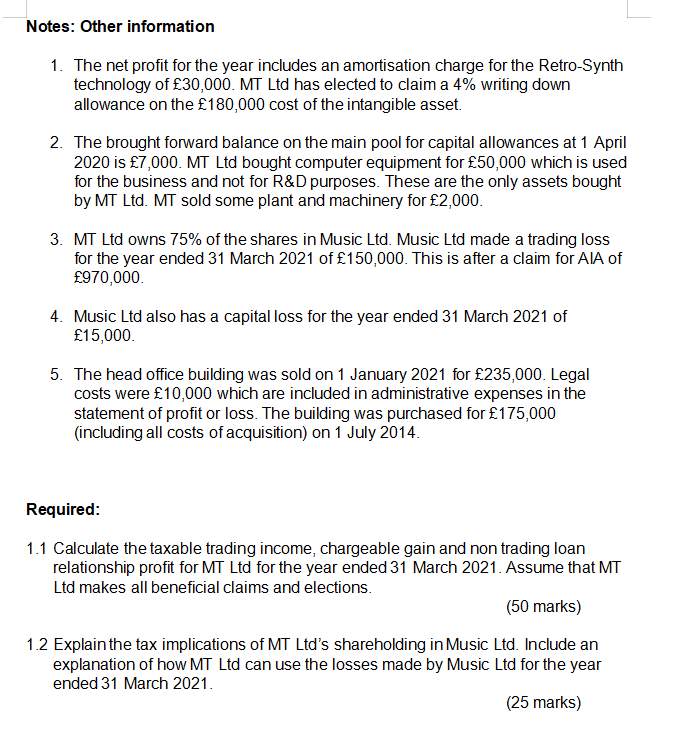

Fran has provided the following information: MT Ltd made a net profit for the year ended 31 March 2021 of 200,000. The following costs and income were included in this calculation of net profit in the statement of profit or loss: Costs Interest and costs of raising loans to buy Computer equipment Investment in the shares of Music Ltd Total interest cost 3,000 7,900 10,900 f 18,000 Wages of research staff and materials - eligible for enhanced R&D relief General overheads - not eligible for enhanced R&D relief Total research costs in the profit or loss 102,000 120,000 MT Ltd is an SME for the purpose of R&D relief. f 15,000 Repairs to machinery used in production of synthesisers Repairs to a property which MT Ltd rents out to an unconnected company (see *rental income below) Total repair cost in the profit or loss 10,000 25,000 Specific trade receivable allowance General trade receivable allowance Trade receivable allowance cost f 5,000 59,000 64,000 Depreciation Legal fees (see note 5) 37,000 10,000 Income Bank interest received Profit on disposal of head office building (see note 5 below) (2,845) (60,000) Interest on a cash deposit account Net rental income from a property owned by MT Ltd (See * above) (6,000) (108,000) * Notes: Other information 1. The net profit for the year includes an amortisation charge for the Retro-Synth technology of 30,000. MT Ltd has elected to claim a 4% writing down allowance on the 180,000 cost of the intangible asset. 2. The brought forward balance on the main pool for capital allowances at 1 April 2020 is 7,000. MT Ltd bought computer equipment for 50,000 which is used for the business and not for R&D purposes. These are the only assets bought by MT Ltd. MT sold some plant and machinery for 2,000. 3. MT Ltd owns 75% of the shares in Music Ltd. Music Ltd made a trading loss for the year ended 31 March 2021 of 150,000. This is after a claim for AIA of 970,000 4. Music Ltd also has a capital loss for the year ended 31 March 2021 of 15,000 5. The head office building was sold on 1 January 2021 for 235,000. Legal costs were 10,000 which are included in administrative expenses in the statement of profit or loss. The building was purchased for 175,000 (including all costs of acquisition) on 1 July 2014. Required: 1.1 Calculate the taxable trading income, chargeable gain and non trading loan relationship profit for MT Ltd for the year ended 31 March 2021. Assume that MT Ltd makes all beneficial claims and elections. (50 marks) 1.2 Explain the tax implications of MT Ltd's shareholding in Music Ltd. Include an explanation of how MT Ltd can use the losses made by Music Ltd for the year ended 31 March 2021. (25 marks) Fran has provided the following information: MT Ltd made a net profit for the year ended 31 March 2021 of 200,000. The following costs and income were included in this calculation of net profit in the statement of profit or loss: Costs Interest and costs of raising loans to buy Computer equipment Investment in the shares of Music Ltd Total interest cost 3,000 7,900 10,900 f 18,000 Wages of research staff and materials - eligible for enhanced R&D relief General overheads - not eligible for enhanced R&D relief Total research costs in the profit or loss 102,000 120,000 MT Ltd is an SME for the purpose of R&D relief. f 15,000 Repairs to machinery used in production of synthesisers Repairs to a property which MT Ltd rents out to an unconnected company (see *rental income below) Total repair cost in the profit or loss 10,000 25,000 Specific trade receivable allowance General trade receivable allowance Trade receivable allowance cost f 5,000 59,000 64,000 Depreciation Legal fees (see note 5) 37,000 10,000 Income Bank interest received Profit on disposal of head office building (see note 5 below) (2,845) (60,000) Interest on a cash deposit account Net rental income from a property owned by MT Ltd (See * above) (6,000) (108,000) * Notes: Other information 1. The net profit for the year includes an amortisation charge for the Retro-Synth technology of 30,000. MT Ltd has elected to claim a 4% writing down allowance on the 180,000 cost of the intangible asset. 2. The brought forward balance on the main pool for capital allowances at 1 April 2020 is 7,000. MT Ltd bought computer equipment for 50,000 which is used for the business and not for R&D purposes. These are the only assets bought by MT Ltd. MT sold some plant and machinery for 2,000. 3. MT Ltd owns 75% of the shares in Music Ltd. Music Ltd made a trading loss for the year ended 31 March 2021 of 150,000. This is after a claim for AIA of 970,000 4. Music Ltd also has a capital loss for the year ended 31 March 2021 of 15,000 5. The head office building was sold on 1 January 2021 for 235,000. Legal costs were 10,000 which are included in administrative expenses in the statement of profit or loss. The building was purchased for 175,000 (including all costs of acquisition) on 1 July 2014. Required: 1.1 Calculate the taxable trading income, chargeable gain and non trading loan relationship profit for MT Ltd for the year ended 31 March 2021. Assume that MT Ltd makes all beneficial claims and elections. (50 marks) 1.2 Explain the tax implications of MT Ltd's shareholding in Music Ltd. Include an explanation of how MT Ltd can use the losses made by Music Ltd for the year ended 31 March 2021. (25 marks)