Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Francine has employment income of 95 000$ for the years 2021. She also has received 6 000$ of allowance to travel and 3 000$

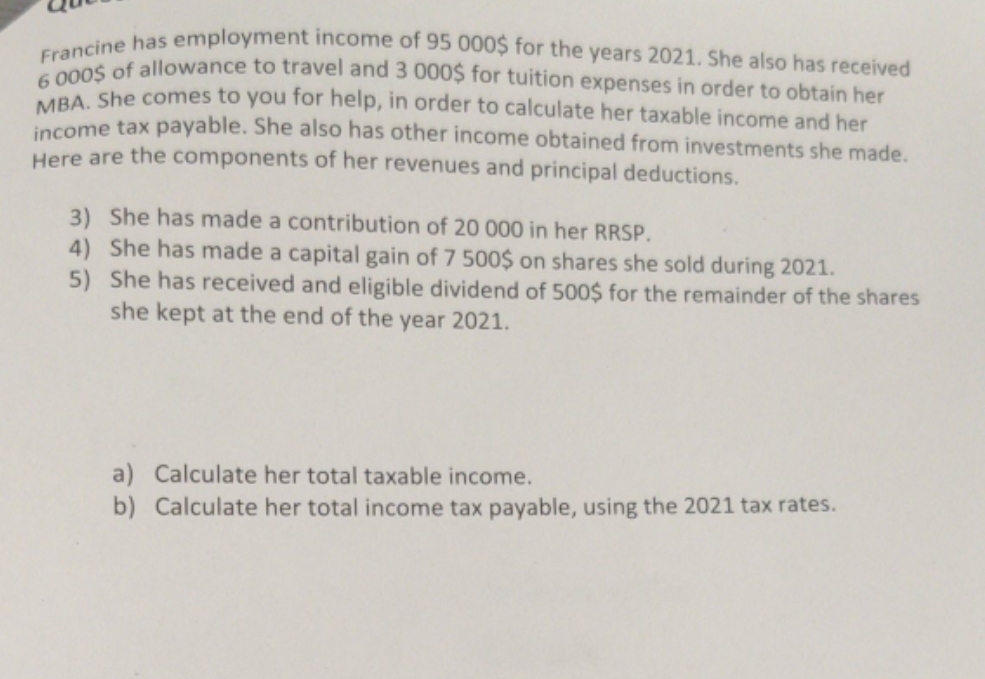

Francine has employment income of 95 000$ for the years 2021. She also has received 6 000$ of allowance to travel and 3 000$ for tuition expenses in order to obtain her MBA. She comes to you for help, in order to calculate her taxable income and her income tax payable. She also has other income obtained from investments she made. Here are the components of her revenues and principal deductions. 3) She has made a contribution of 20 000 in her RRSP. 4) She has made a capital gain of 7 500$ on shares she sold during 2021. 5) She has received and eligible dividend of 500$ for the remainder of the shares she kept at the end of the year 2021. a) Calculate her total taxable income. b) Calculate her total income tax payable, using the 2021 tax rates.

Step by Step Solution

★★★★★

3.34 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Francines Taxable Income and Income Tax Payable 2021 a Total Taxable Income Employment Income 95000 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started