Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Francoijs operates a sole proprietorship business as a tow truck driver. He recently borrowed $100,000 from his bank for the purchase of a new

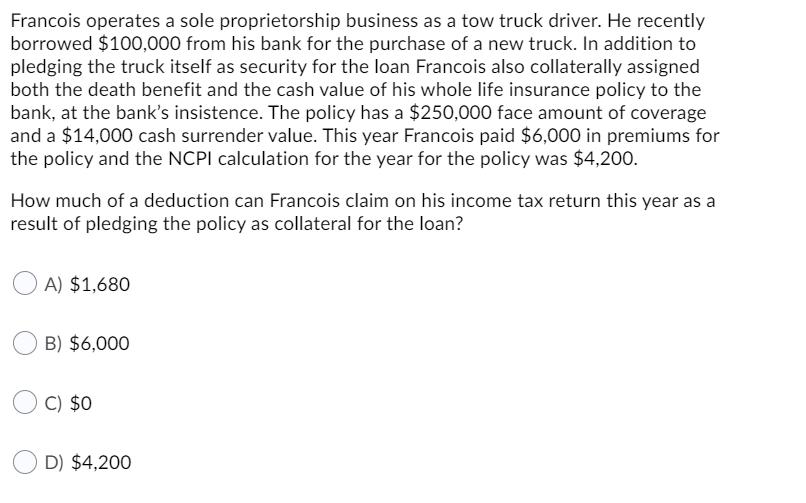

Francoijs operates a sole proprietorship business as a tow truck driver. He recently borrowed $100,000 from his bank for the purchase of a new truck. In addition to pledging the truck itself as security for the loan Francois also collaterally assigned both the death benefit and the cash value of his whole life insurance policy to the bank, at the bank's insistence. The policy has a $250,000 face amount of coverage and a $14,000 cash surrender value. This year Francois paid $6,000 in premiums for the policy and the NCPI calculation for the year for the policy was $4,200. How much of a deduction can Francois claim on his income tax return this year as a result of pledging the policy as collateral for the loan? A) $1,680 B) $6,000 C) $0 D) $4,200

Step by Step Solution

★★★★★

3.44 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

As per given details we assumed question are related to country Canada In Canada premium paid ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started