Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Frandsen company closes its accounts on 31 December each year. On 1 January 2016 they have taken a three year lease on a computer

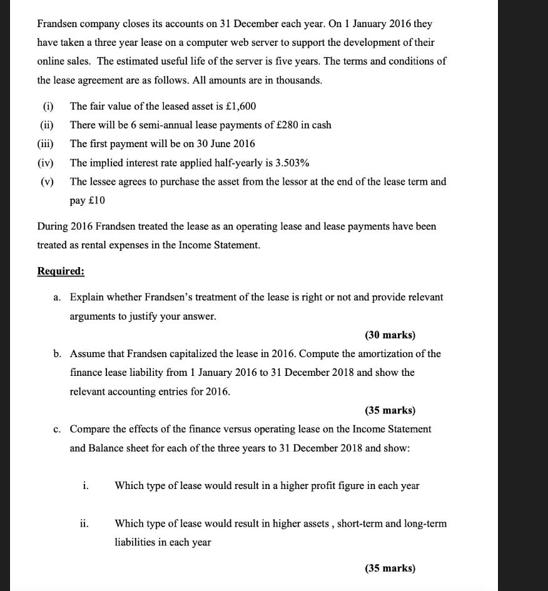

Frandsen company closes its accounts on 31 December each year. On 1 January 2016 they have taken a three year lease on a computer web server to support the development of their online sales. The estimated useful life of the server is five years. The terms and conditions of the lease agreement are as follows. All amounts are in thousands. (i) The fair value of the leased asset is 1,600 (ii) There will be 6 semi-annual lease payments of 280 in cash (iii) The first payment will be on 30 June 2016 (iv) The implied interest rate applied half-yearly is 3.503% (v) The lessee agrees to purchase the asset from the lessor at the end of the lease term and pay 10 During 2016 Frandsen treated the lease as an operating lease and lease payments have been treated as rental expenses in the Income Statement. Required: a. Explain whether Frandsen's treatment of the lease is right or not and provide relevant arguments to justify your answer. (30 marks) b. Assume that Frandsen capitalized the lease in 2016. Compute the amortization of the finance lease liability from 1 January 2016 to 31 December 2018 and show the relevant accounting entries for 2016. (35 marks) c. Compare the effects of the finance versus operating lease on the Income Statement and Balance sheet for each of the three years to 31 December 2018 and show: i. Which type of lease would result in a higher profit figure in each year Which type of lease would result in higher assets, short-term and long-term liabilities in each year (35 marks)

Step by Step Solution

★★★★★

3.49 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

a Treatment of the Lease Frandsens treatment of the lease as an operating lease is not appropriate based on the criteria outlined in IFRS 16 Leases According to IFRS 16 a lease should be classified as ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started