Frank and George are friends finishing their Finance major. They have been planning in starting-up a business firm which will develop a new software.

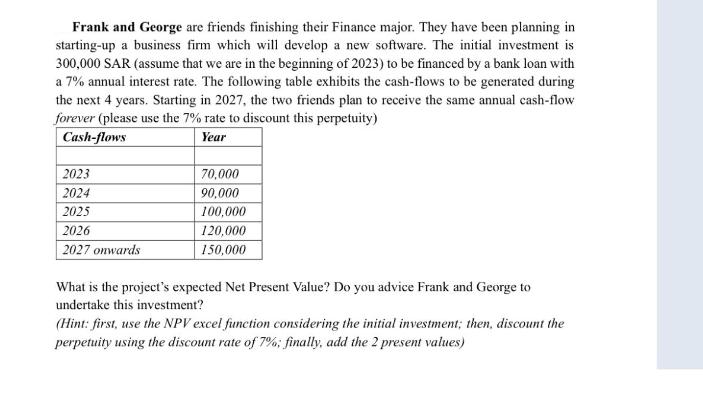

Frank and George are friends finishing their Finance major. They have been planning in starting-up a business firm which will develop a new software. The initial investment is 300,000 SAR (assume that we are in the beginning of 2023) to be financed by a bank loan with a 7% annual interest rate. The following table exhibits the cash-flows to be generated during the next 4 years. Starting in 2027, the two friends plan to receive the same annual cash-flow forever (please use the 7% rate to discount this perpetuity) Cash-flows Year 2023 2024 2025 2026 2027 onwards 70,000 90,000 100,000 120,000 150,000 What is the project's expected Net Present Value? Do you advice Frank and George to undertake this investment? (Hint: first, use the NPV excel function considering the initial investment; then, discount the perpetuity using the discount rate of 7%; finally, add the 2 present values)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer To calculate the projects expected Net Present Value NPV we need to discount each cash flow t...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started