Question

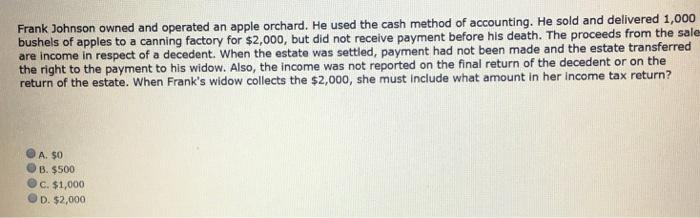

Frank Johnson owned and operated an apple orchard. He used the cash method of accounting. He sold and delivered 1,000 bushels of apples to

Frank Johnson owned and operated an apple orchard. He used the cash method of accounting. He sold and delivered 1,000 bushels of apples to a canning factory for $2,000, but did not receive payment before his death. The proceeds from the sale are income in respect of a decedent. When the estate was settled, payment had not been made and the estate transferred the right to the payment to his widow. Also, the income was not reported on the final return of the decedent or on the return of the estate. When Frank's widow collects the $2,000, she must Include what amount in her income tax return? A. $0 B. $500 C. $1,000 D. $2,000

Step by Step Solution

3.49 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Opti...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Essentials Of Federal Taxation 2018

Authors: Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver

9th Edition

1260007642, 978-1260150292, 1260150291, 978-1260007640

Students also viewed these Law questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App