Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Frank Ltd. is a public corporation, and has a December 31 fiscal year-end. There are currently 400,000 issued and outstanding no par value common

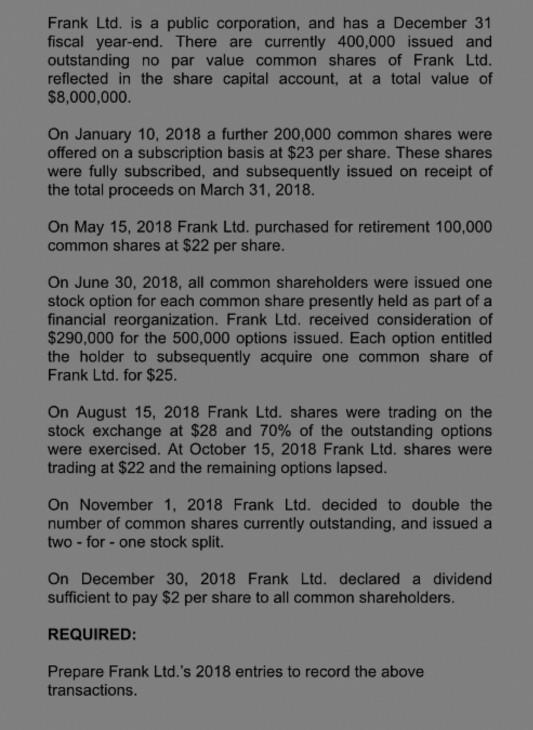

Frank Ltd. is a public corporation, and has a December 31 fiscal year-end. There are currently 400,000 issued and outstanding no par value common shares of Frank Ltd. reflected in the share capital account, at a total value of $8,000,000. On January 10, 2018 a further 200,000 common shares were offered on a subscription basis at $23 per share. These shares were fully subscribed, and subsequently issued on receipt of the total proceeds on March 31, 2018. On May 15, 2018 Frank Ltd. purchased for retirement 100,000 common shares at $22 per share. On June 30, 2018, all common shareholders were issued one stock option for each common share presently held as part of a financial reorganization. Frank Ltd. received consideration of $290,000 for the 500,000 options issued. Each option entitled the holder to subsequently acquire one common share of Frank Ltd. for $25. On August 15, 2018 Frank Ltd. shares were trading on the stock exchange at $28 and 70% of the outstanding options were exercised. At October 15, 2018 Frank Ltd. shares were trading at $22 and the remaining options lapsed. On November 1, 2018 Frank Ltd. decided to double the number of common shares currently outstanding, and issued a two - for - one stock split. On December 30, 2018 Frank Ltd. declared a dividend sufficient to pay $2 per share to all common shareholders. REQUIRED: Prepare Frank Ltd.'s 2018 entries to record the above transactions.

Step by Step Solution

★★★★★

3.36 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Date Entry Dr Amount Cr Amount March 31 2018 CashBank Ac 4600000 Share Capital Ac 4600000 Being entr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started