Answered step by step

Verified Expert Solution

Question

1 Approved Answer

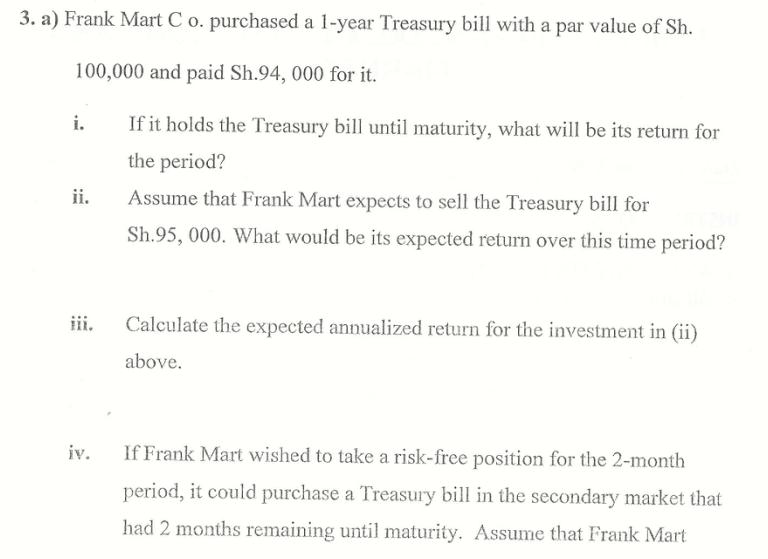

Frank Mart C o. purchased a 1-year Treasury bill with a par value of Sh. 100,000 and paid Sh.94, 000 for it. i. ii.

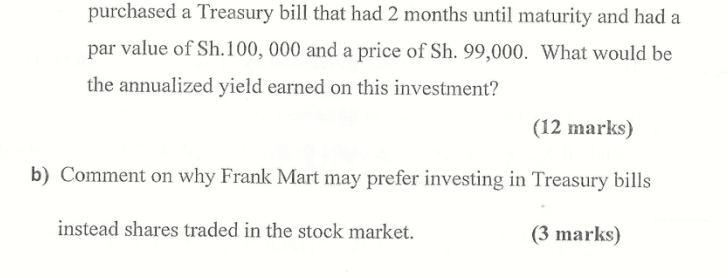

Frank Mart C o. purchased a 1-year Treasury bill with a par value of Sh. 100,000 and paid Sh.94, 000 for it. i. ii. iii. iv. If it holds the Treasury bill until maturity, what will be its return for the period? Assume that Frank Mart expects to sell the Treasury bill for Sh.95, 000. What would be its expected return over this time period? Calculate the expected annualized return for the investment in (ii) above. If Frank Mart wished to take a risk-free position for the 2-month period, it could purchase a Treasury bill in the secondary market that had 2 months remaining until maturity. Assume that Frank Mart purchased a Treasury bill that had 2 months until maturity and had a par value of Sh.100, 000 and a price of Sh. 99,000. What would be the annualized yield earned on this investment? (12 marks) b) Comment on why Frank Mart may prefer investing in Treasury bills instead shares traded in the stock market. (3 marks)

Step by Step Solution

★★★★★

3.51 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below a i The return for the period will be 6 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started