Answered step by step

Verified Expert Solution

Question

1 Approved Answer

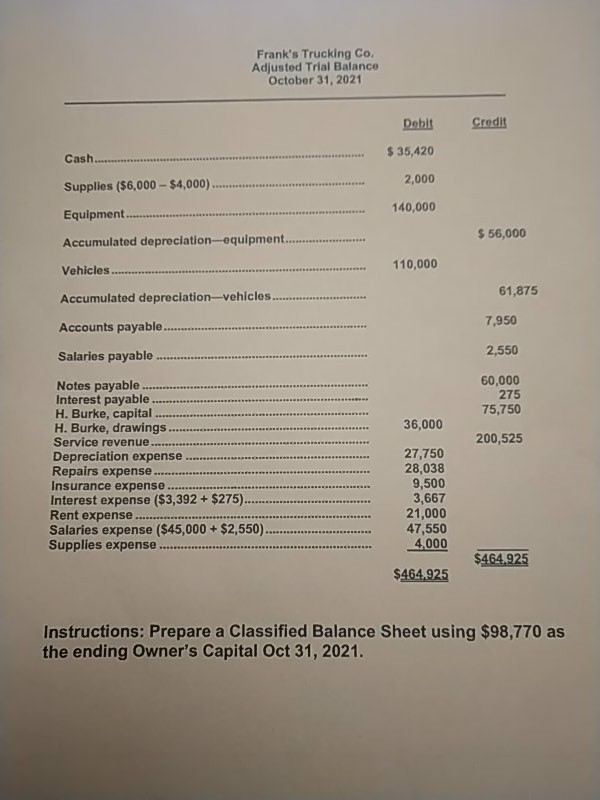

Frank's Trucking Co. Adjusted Trial Balance October 31, 2021 Dobit Credit $ 35,420 Cash. Supplies ($6,000 - $4,000).... 2,000 Equipment...... 140,000 $ 56,000 Accumulated depreciation

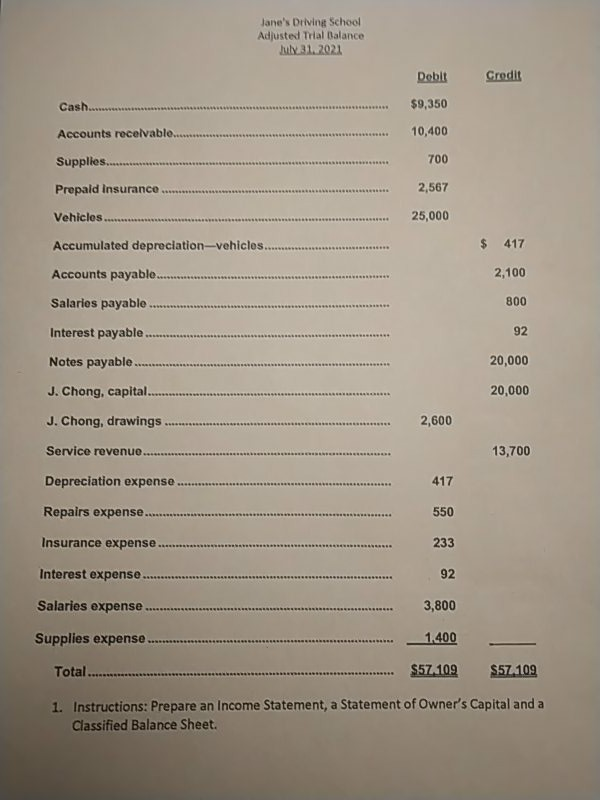

Frank's Trucking Co. Adjusted Trial Balance October 31, 2021 Dobit Credit $ 35,420 Cash. Supplies ($6,000 - $4,000).... 2,000 Equipment...... 140,000 $ 56,000 Accumulated depreciation equipment... Vehicles.. 110,000 61,875 Accumulated depreciation-vehicles................ Accounts payable.. 7,950 Salaries payable 2,550 60,000 275 75,750 36,000 200,525 Notes payable... Interest payable. H. Burke, capital ......... H. Burke, drawings ....- Service revenue Depreciation expense.... Repairs expense.... Insurance expense ........ Interest expense ($3,392 + $275).......... Rent expense..... Salaries expense ($45,000 + $2,550)...... Supplies expense ... 27,750 28,038 9,500 3,667 21,000 47,550 4.000 $464.925 $464.925 Instructions: Prepare a Classified Balance Sheet using $98,770 as the ending Owner's Capital Oct 31, 2021. Jane's Driving School Adjusted Trial Balance July 31.2021 Debit Credit Cash... $9,350 Accounts receivable............... 10,400 Supplies......... 700 Prepaid Insurance ....... 2,567 Vehicles. 25,000 Accumulated depreciation-vehicles............ $ 417 Accounts payable... 2,100 Salaries payable.... 800 Interest payable...... 92 Notes payable..... 20,000 J. Chong, capital.... 20,000 J. Chong, drawings. 2,600 Service revenue...... 13,700 Depreciation expense .......... 417 Repairs expense....... Insurance expense........ 233 Interest expense ............... 92 Salaries expense................ 3,800 Supplies expense ..................... ... ........................ 1,400 Total.............. .. ........... $57,109 1. Instructions: Prepare an Income Statement, a Statement of Owner's Capital and a Classified Balance Sheet $57 109

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started