Question: Fraser Co. is considering a change to its cost structure. Below is the data relating to the current structure as well as the proposed

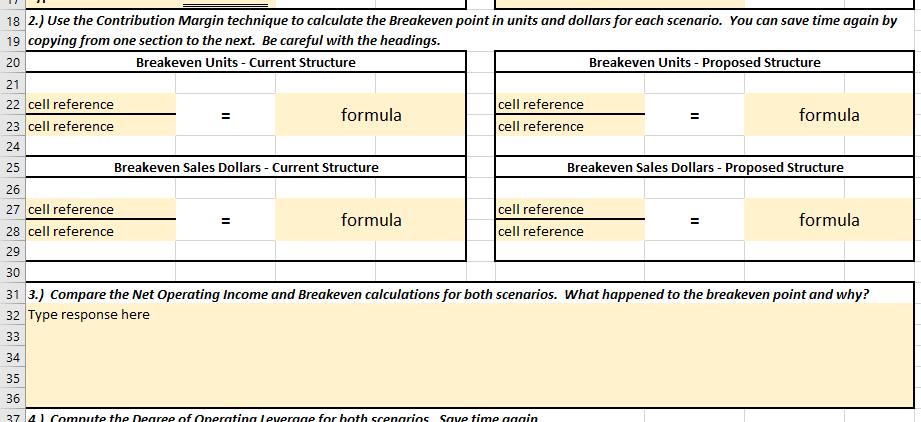

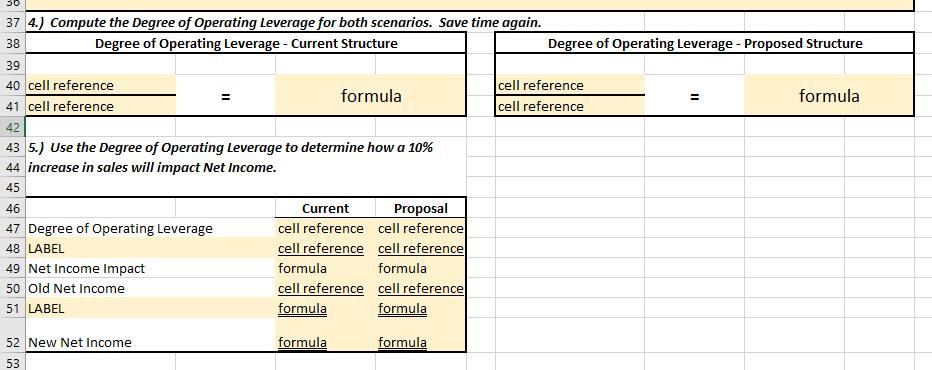

Fraser Co. is considering a change to its cost structure. Below is the data relating to the current structure as well as the proposed change. Current Structure Proposed Structure Unit Sales Sales Price Per Unit Total Variable Costs (based on 20,000 units) Total Fixed Costs 1.) Prepare a CVP Statement for each cost structure. Incorporate cell references and formulas where indicated. You can instantly create the CVP Statement for the Proposed Structure, by copying and pasting your completed CVP Statement for the Current Structure. Make sure all highlighted areas are completed. Try to avoid the headings when copying. You want to keep the Proposed Structure heading. 20,000 Unit Sales 20,000 100 Sales Price Per Unit $ 100 $ 400,000 $900,000 Total Variable Costs (based on 20,000 units $700,000 Total Fixed Costs $600,000 CVP Statement - Current Structure CVP Statement - Proposed Structure Total Per Unit % of Sales Type a Label Here Type a Label Here formula cell reference formula cell reference formula formula Type a Label Here formula formula formula Type a Label Here cell reference Type a Label Here formula 18 2.) Use the Contribution Margin technique to calculate the Breakeven point in units and dollars for each scenario. You can save time again by 19 copying from one section to the next. Be careful with the headings. Breakeven Units - Current Structure Breakeven Units - Proposed Structure 20 21 cell reference cell reference 22 cell reference formula formula 23 cell reference 24 Breakeven Sales Dollars - Current Structure Breakeven Sales Dollars - Proposed Structure 25 26 27 cell reference 28 cell reference cell reference cell ref formula formula %D %3D nce 29 30 31 3.) Compare the Net Operating Income and Breakeven calculations for both scenarios. What happened to the breakeven point and why? 32 Type response here 33 34 35 36 37 41 Compute the Dearee of Oneratina Levergge for both scenarios Save time aggin 30 37 4.) Compute the Degree of Operating Leverage for both scenarios. Save time again. Degree of Operating Leverage - Current Structure Degree of Operating Leverage - Proposed Structure 38 39 cell reference cell reference 40 cell reference formula formula %3D 41 cell reference 42 43 5.) Use the Degree of Operating Leverage to determine how a 10% 44 increase in sales will impact Net Income. 45 Proposal cell reference cell reference cell reference cell reference 46 Current 47 Degree of Operating Leverage 48 LABEL 49 Net Income Impact 50 Old Net Income 51 LABEL formula formula cell reference cell reference formula formula 52 New Net Income formula formula 53

Step by Step Solution

3.38 Rating (157 Votes )

There are 3 Steps involved in it

Since there are multiple parts to the question I have answered the first four Part 1 The CVP structu... View full answer

Get step-by-step solutions from verified subject matter experts