Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Fred has an IRA. He lost his job in February 2018. Although Fred found another job in August, he did not have enough savings

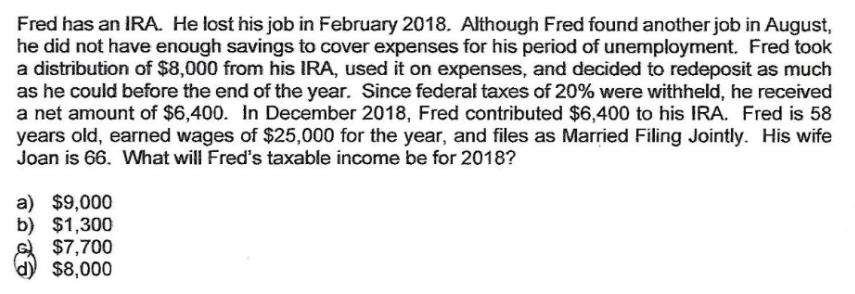

Fred has an IRA. He lost his job in February 2018. Although Fred found another job in August, he did not have enough savings to cover expenses for his period of unemployment. Fred took a distribution of $8,000 from his IRA, used it on expenses, and decided to redeposit as much as he could before the end of the year. Since federal taxes of 20% were withheld, he received a net amount of $6,400. In December 2018, Fred contributed $6,400 to his IRA. Fred is 58 years old, earned wages of $25,000 for the year, and files as Married Filing Jointly. His wife Joan is 66. What will Fred's taxable income be for 2018? a) $9,000 b) $1,300 $7,700 $8,000

Step by Step Solution

★★★★★

3.40 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Answer Option A is correct 9 000 The federal income tax is the tax ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started