Question

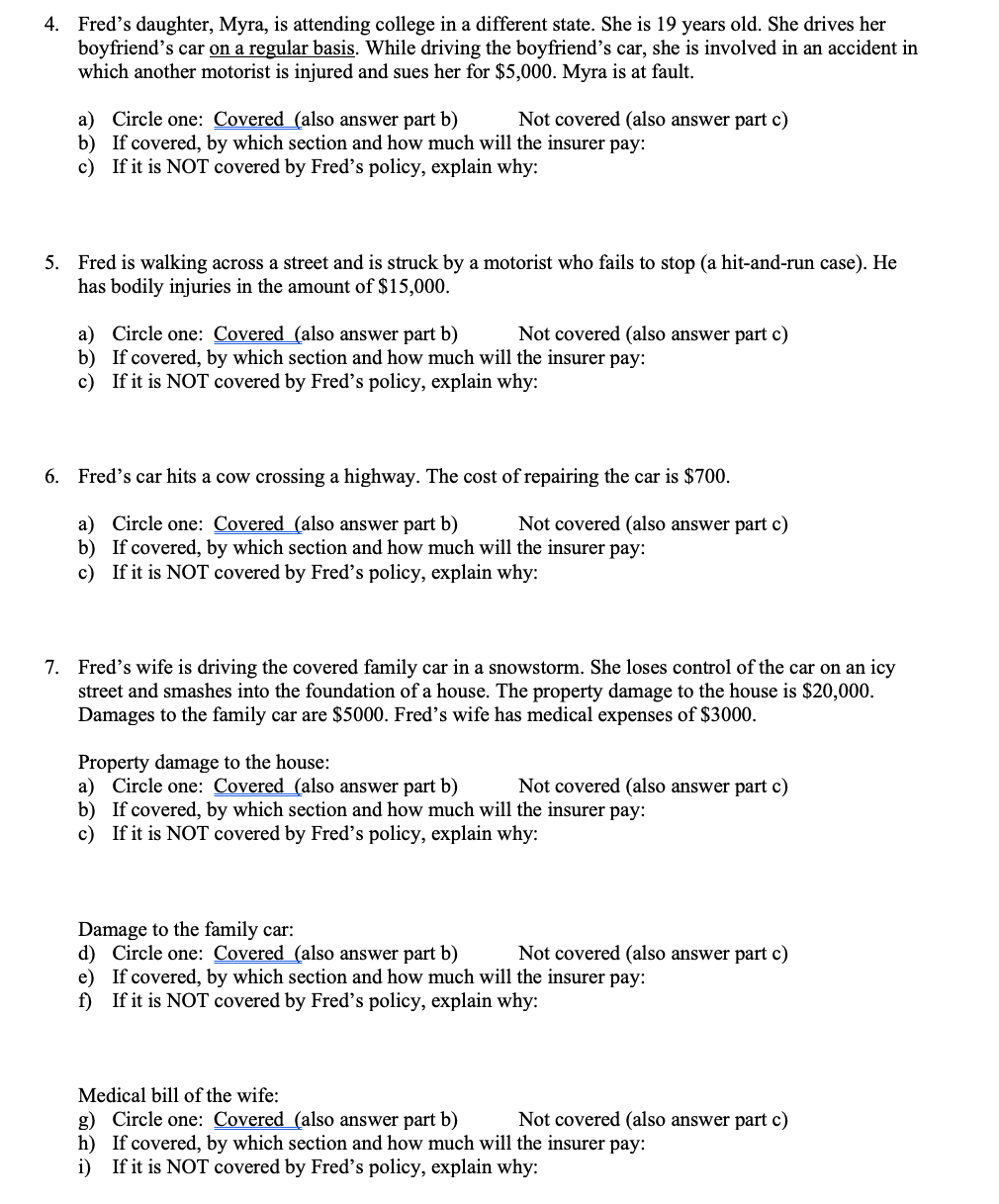

Fred has one car and has a PAP with the following coverages: Liability coverages: split limit 100/300/50 Medical payments coverage: $5000 each person Uninsured motorists

Fred has one car and has a PAP with the following coverages:

Liability coverages: split limit 100/300/50

Medical payments coverage: $5000 each person

Uninsured motorists coverage: $25,000 each person

Collision loss: $250 deductible

Other-than-collision loss: $100 deductible

With respect to each of the following situations, determine whether the loss is covered, by which section of the policy and how much Freds insurer will pay. If Freds policy does NOT cover such loss, then briefly explain why. In situations where Freds policy may apply on an excess basis (in order words, other policies are considered primary coverages), ignore the primary coverage. Assume that each situation is a separate event.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started