Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Fred Morris invests in a stock that will pay dividends of $4.00 at the end of the first year; $4.40 at the end of

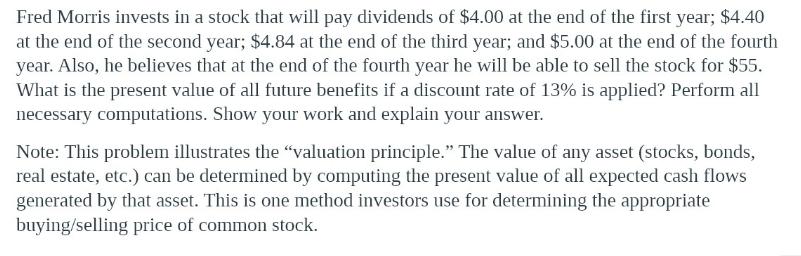

Fred Morris invests in a stock that will pay dividends of $4.00 at the end of the first year; $4.40 at the end of the second year; $4.84 at the end of the third year; and $5.00 at the end of the fourth year. Also, he believes that at the end of the fourth year he will be able to sell the stock for $55. What is the present value of all future benefits if a discount rate of 13% is applied? Perform all necessary computations. Show your work and explain your answer. Note: This problem illustrates the "valuation principle." The value of any asset (stocks, bonds, real estate, etc.) can be determined by computing the present value of all expected cash flows generated by that asset. This is one method investors use for determining the appropriate buying/selling price of common stock.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the present value of all future benefits we need to discount each future c...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started