Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Freddy, the owner of Legal Lives (Pty) Ltd (from here on known as the company'), a company specialising in legal counselling and other legal

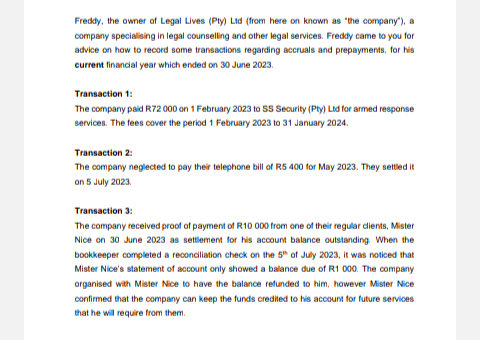

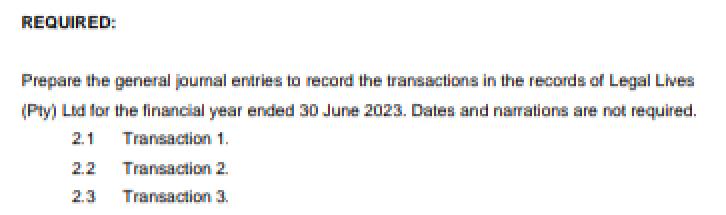

Freddy, the owner of Legal Lives (Pty) Ltd (from here on known as "the company'), a company specialising in legal counselling and other legal services. Freddy came to you for advice on how to record some transactions regarding accruals and prepayments, for his current financial year which ended on 30 June 2023. Transaction 1: The company paid R72 000 on 1 February 2023 to SS Security (Pty) Ltd for armed response services. The fees cover the period 1 February 2023 to 31 January 2024. Transaction 2: The company neglected to pay their telephone bill of R5 400 for May 2023. They settled it on 5 July 2023 Transaction 3: The company received proof of payment of R10 000 from one of their regular clients, Mister Nice on 30 June 2023 as settlement for his account balance outstanding. When the bookkeeper completed a reconciliation check on the 5th of July 2023, it was noticed that Mister Nice's statement of account only showed a balance due of R1 000. The company organised with Mister Nice to have the balance refunded to him, however Mister Nice confirmed that the company can keep the funds credited to his account for future services that he will require from them. REQUIRED: Prepare the general journal entries to record the transactions in the records of Legal Lives (Pty) Ltd for the financial year ended 30 June 2023. Dates and narrations are not required. 2.1 Transaction 1. 2.2 Transaction 2. 2.3 Transaction 3.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started