Answered step by step

Verified Expert Solution

Question

1 Approved Answer

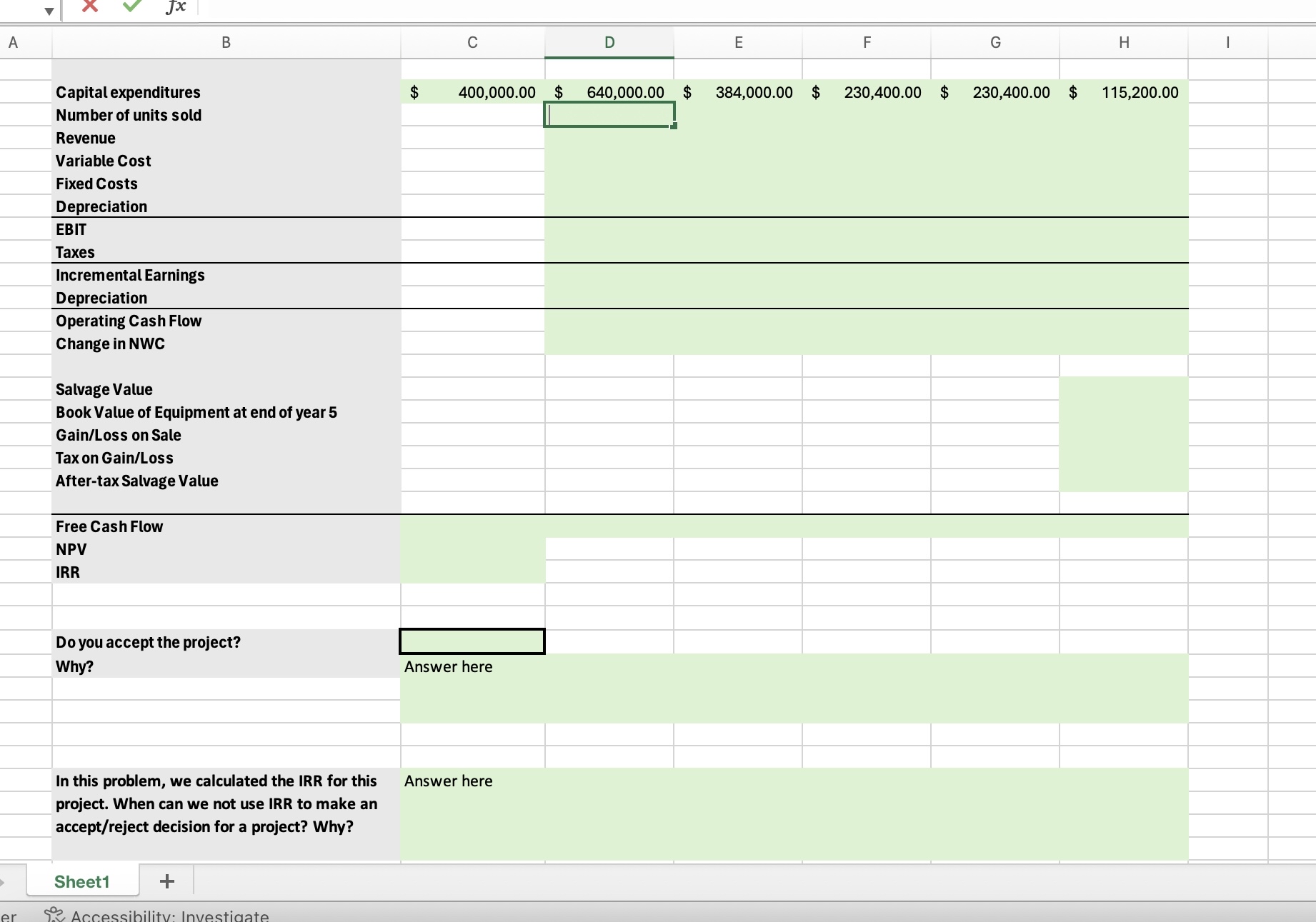

Free Cash Flow and NPV Problem: The managers of YETI are deciding whether to create a new solar powered cup that will both produce heat

Free Cash Flow and NPV Problem: The managers of YETI are deciding whether to create a new solar powered cup that will both produce heat and chill your drink. The preliminary R&D for this project costed $ and investment to update their current manufacturing equipment to produce these cups will cost $ The manufacturing updates will be depreciated using a fiveyear MACRS life and management expects to sell the updated manufacturing equipment at the end of year for a salvage value of $ Projected sales in annual units for the next year will be and are expect to grow at per year. The price of the solar powered cup will be set at $ In order to produce these cups, YETI incurs a variable cost of $ per cup and has an annual fixed cost increase of $ Net working capital initially increases by $ but decreases by $ per year until it is back at its original value at the end of year Assuming a discount rate of and a tax rate of Fill out the following fields and determine whether management accept or reject this project based upon the NPV decision model. Use references and NPVIRR formulas in your computation.

R&D Cost $

Manufacturing Update $

Units Sold in first year

Price per unit $

Cost per unit $

Annual Fixed Cost $

Tax Rate

Discount Rate

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started