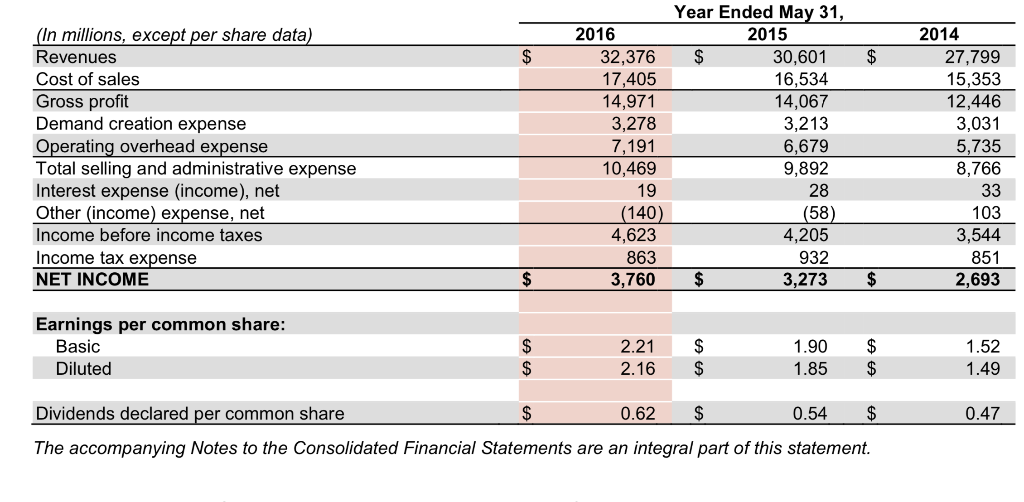

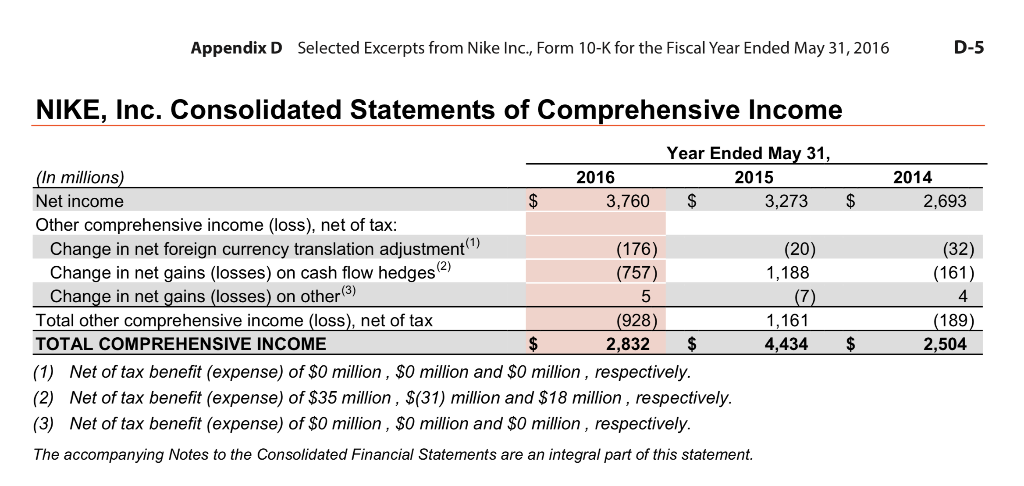

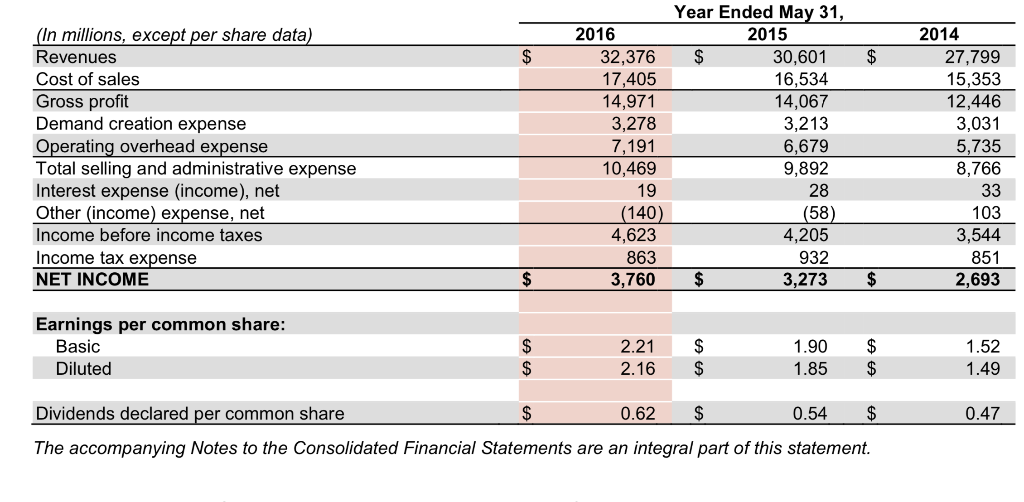

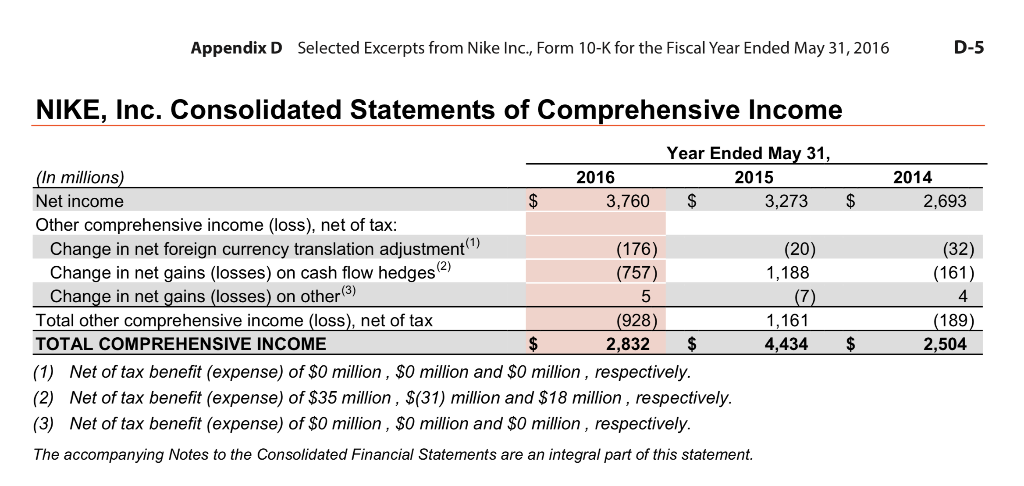

Free Cash Flow The financial statements for Nike, Inc., are provided in Appendix D. a Determine the free cash flow for the most recent fiscal year. Assume that 90% of the additions to property, plant, and equipment were used to maintain productive capacity. Round to the nearest thousand dollars. in millions) b. How might a lender use free cash flow to determine whether or not to give Nike, Inc., a loan? Free cash flow is often used to measure the financial strength of a business. The more free cash flow that a business has, the easier it will be for the company to pay the interest on the loan and repay the loan principal. c. Would you feel comfortable giving Nike a loan, based on the free cash flow calculated in (a)? Yes Nike's free cash flow is extremely strong and is well in excess of the capital expenditures necessary to maintain capacity $ (In millions, except per share data) Revenues Cost of sales Gross profit Demand creation expense Operating overhead expense Total selling and administrative expense ative expense Interest expense (income), net Other (income) expense, net Income before income taxes Income tax expense NET INCOME Year Ended May 31, 2016 2015 32,376 $ 30,601 17,405 16,534 14,971 14,067 3,278 3,213 7,191 6,679 10,469 9,892 28 (140) (58) 4,623 4,205 863 932 3,760 $ 3,273 2014 27,799 15,353 12,446 3,031 5,735 8,766 33 103 3,544 851 2,693 19 $ $ Earnings per common share: Basic Diluted 2.21 2.16 $ S 1.90 1.85 $ $ 1.52 1.49 0.47 Dividends declared per common share 0.62 $ 0.54 $ The accompanying Notes to the Consolidated Financial Statements are an integral part of this statement. Appendix D Selected Excerpts from Nike Inc., Form 10-K for the Fiscal Year Ended May 31, 2016 D-5 NIKE, Inc. Consolidated Statements of Comprehensive Income 2014 2,693 $ (32) (161) Year Ended May 31, (In millions) 2016 2015 Net income $ 3,760 $ 3,273 Other comprehensive income (loss), net of tax: Change in net foreign currency translation adjustment") (176) (20) Change in net gains (losses) on cash flow hedges) (757) 1,188 Change in net gains (losses) on other(3) Total other comprehensive income (loss), net of tax (928) 1,161 TOTAL COMPREHENSIVE INCOME $ 2,832 $ 4,434 (1) Net of tax benefit (expense) of $0 million. $0 million and $0 million, respectively. (2) Net of tax benefit (expense) of $35 million . $(31) million and $18 million, respectively. (3) Net of tax benefit (expense) of $0 million, $0 million and $0 million, respectively. The accompanying Notes to the Consolidated Financial Statements are an integral part of this statement. (189) $ 2,504