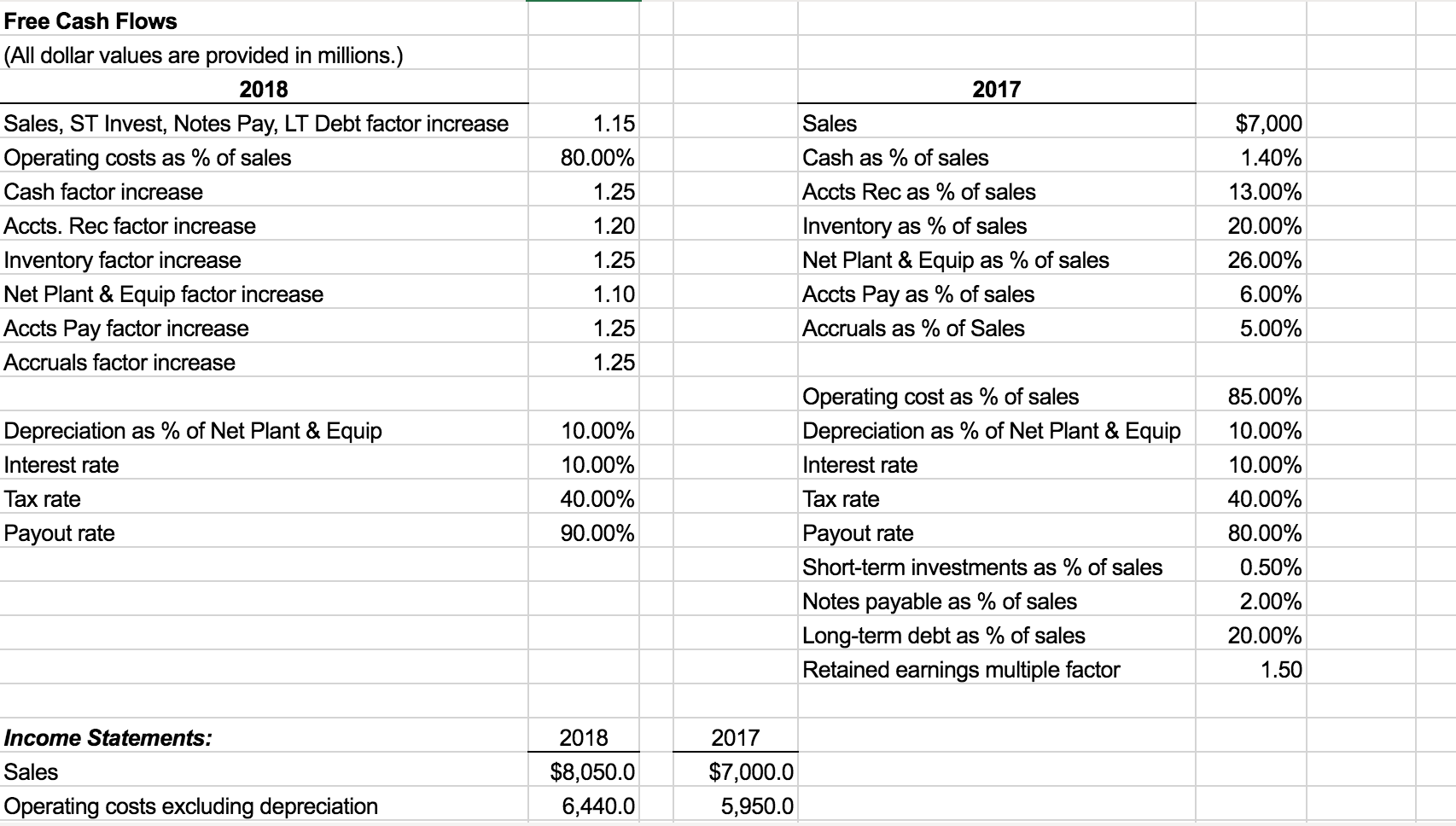

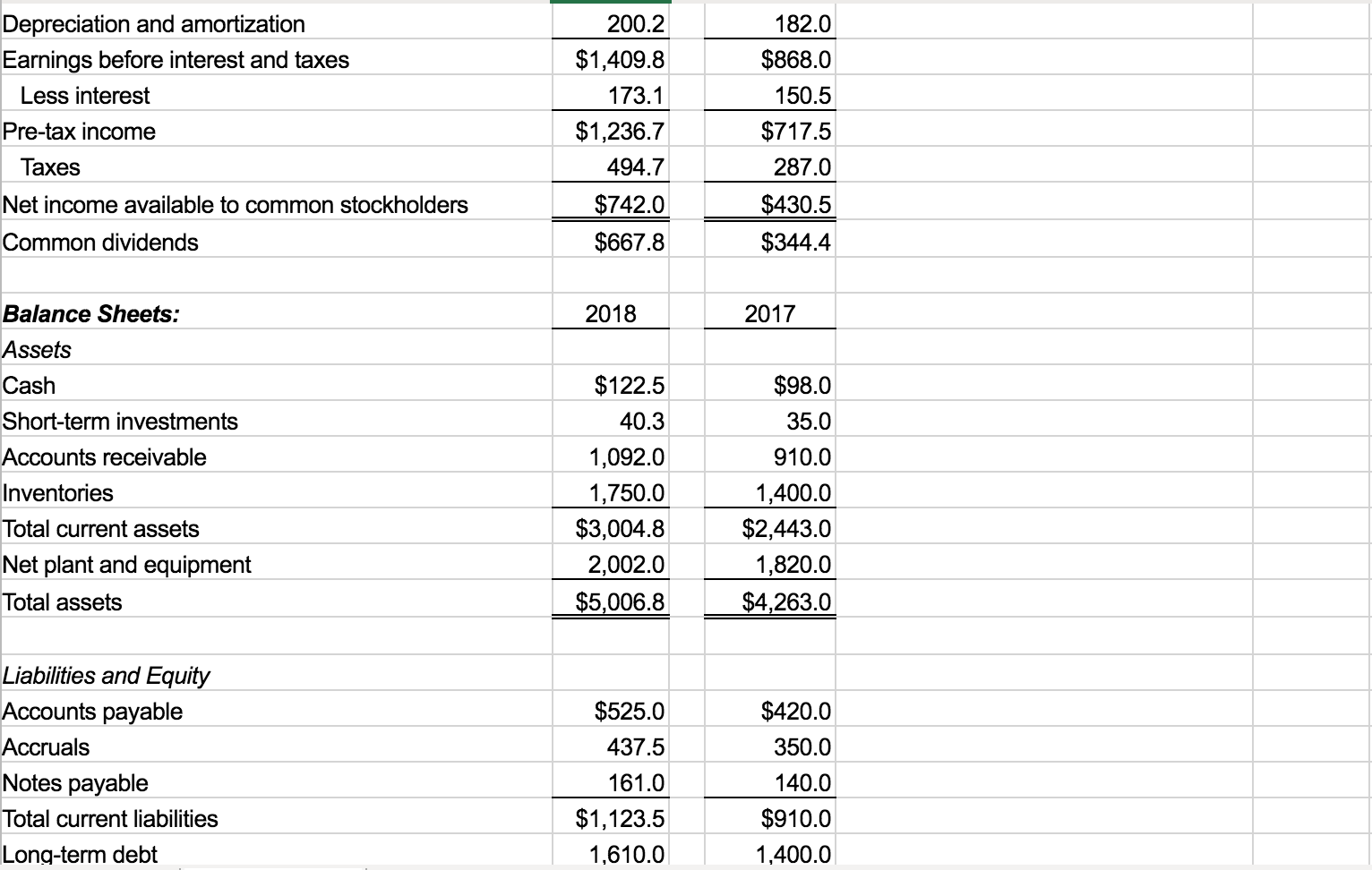

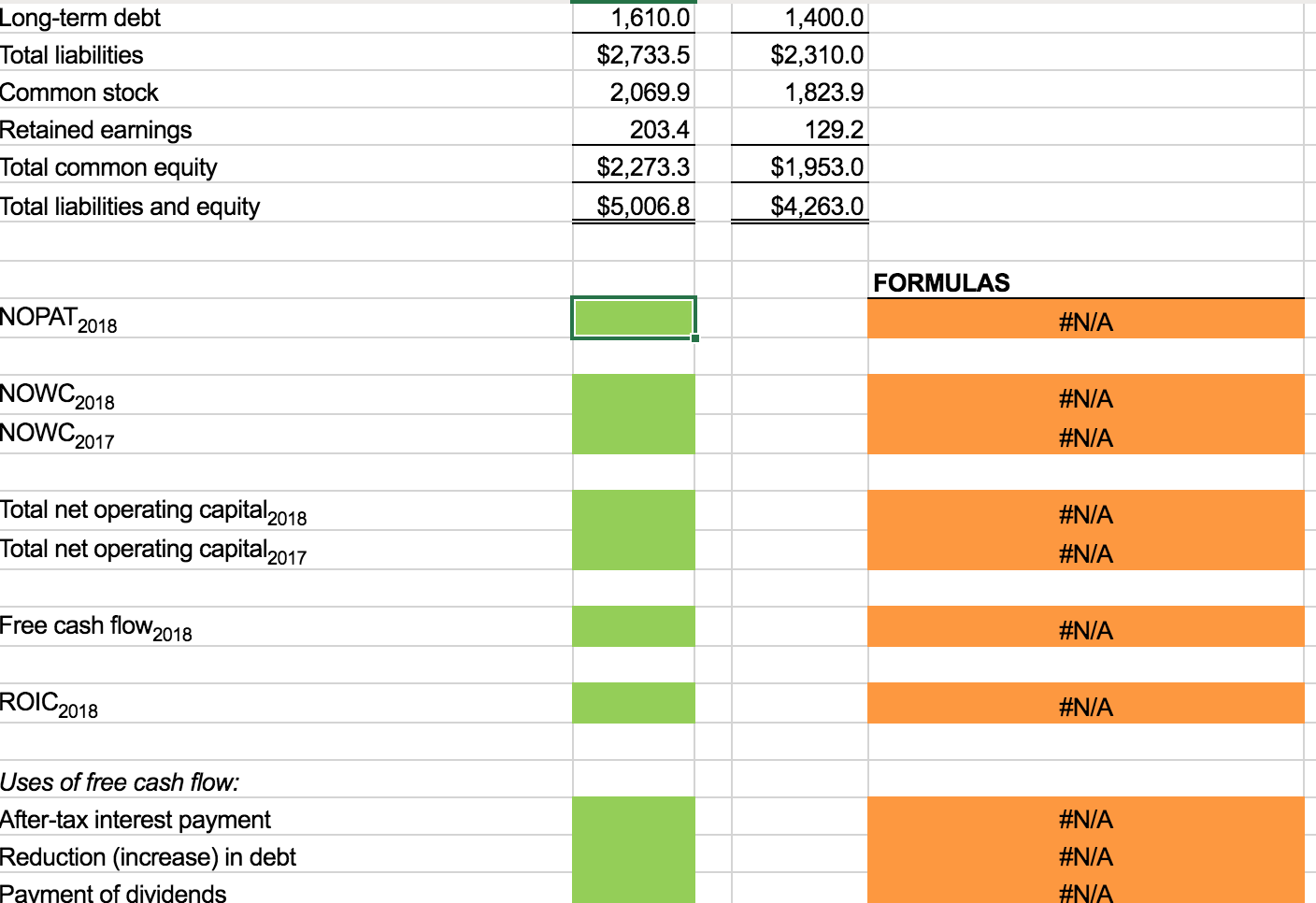

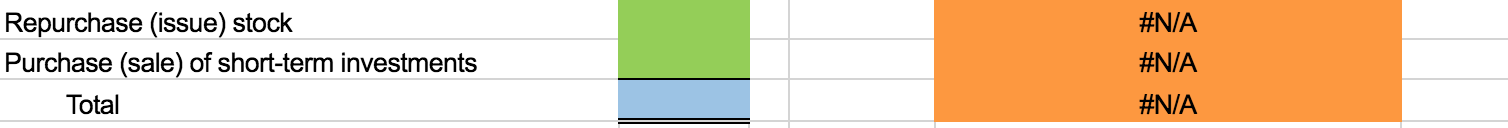

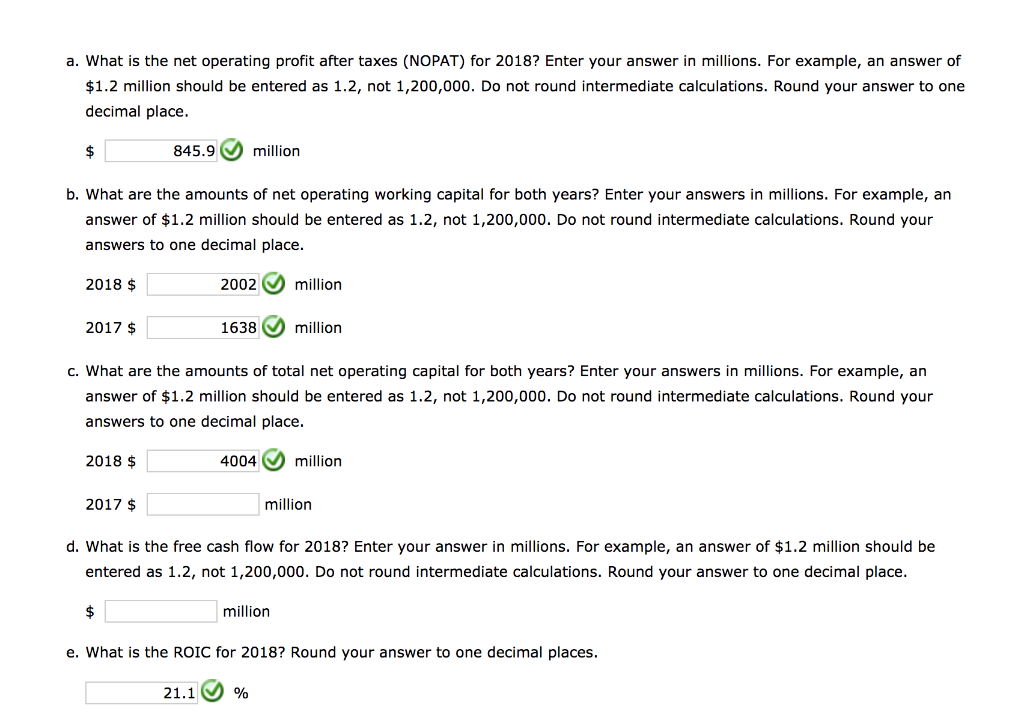

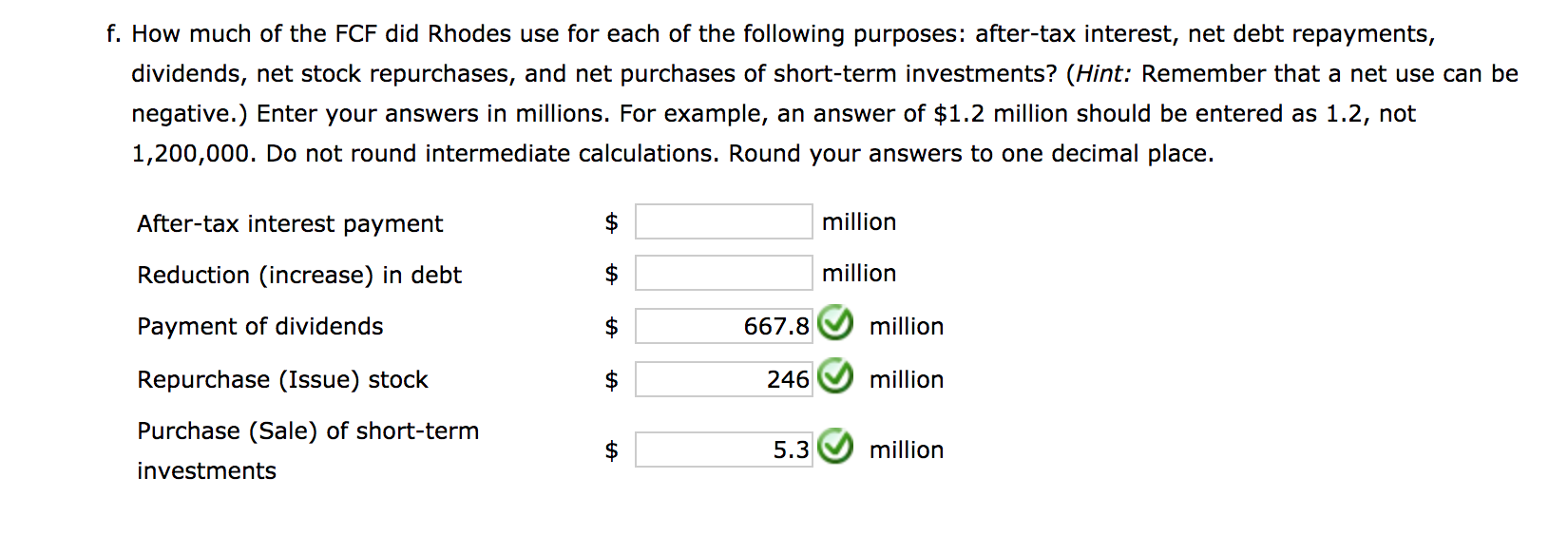

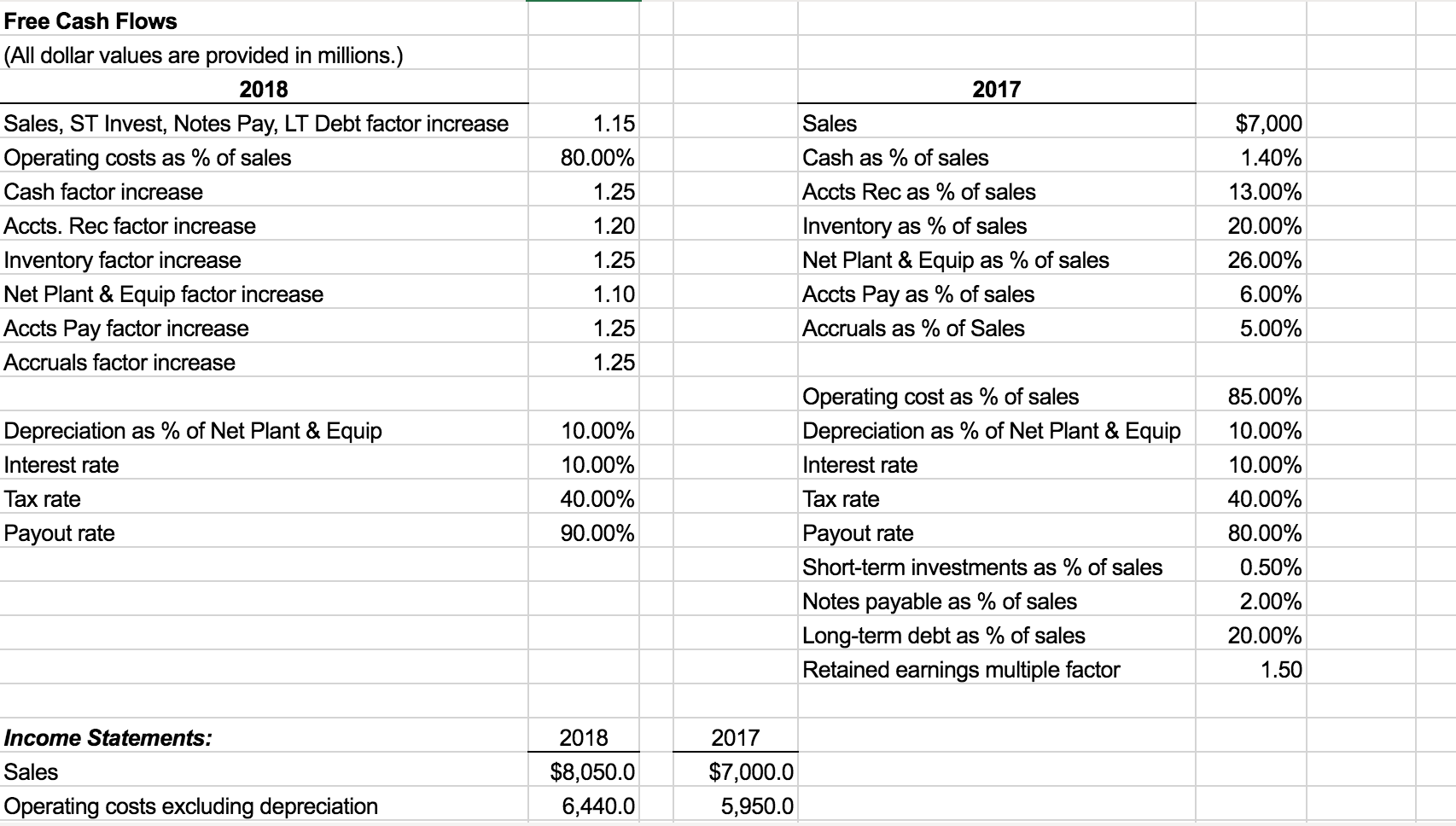

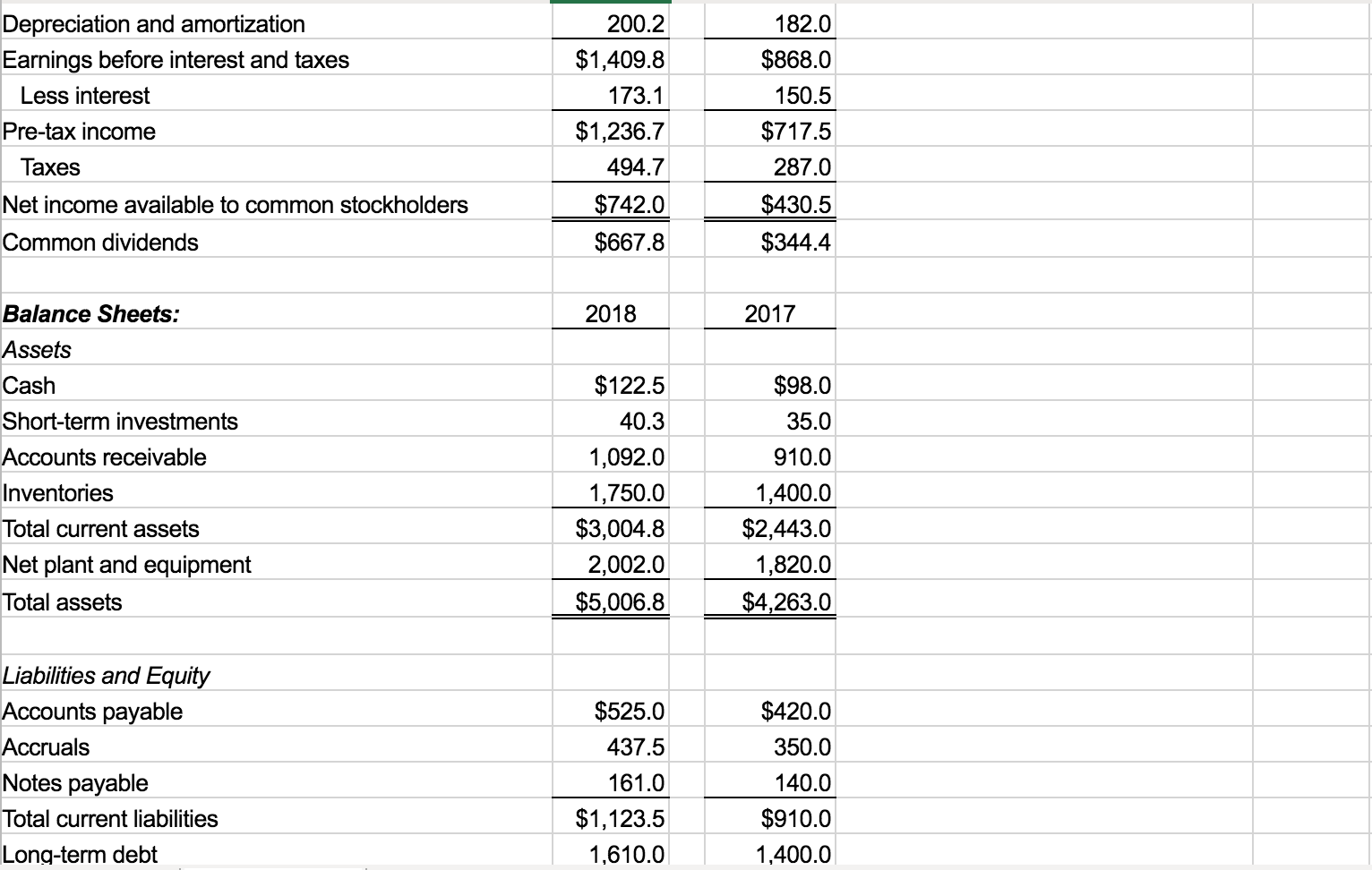

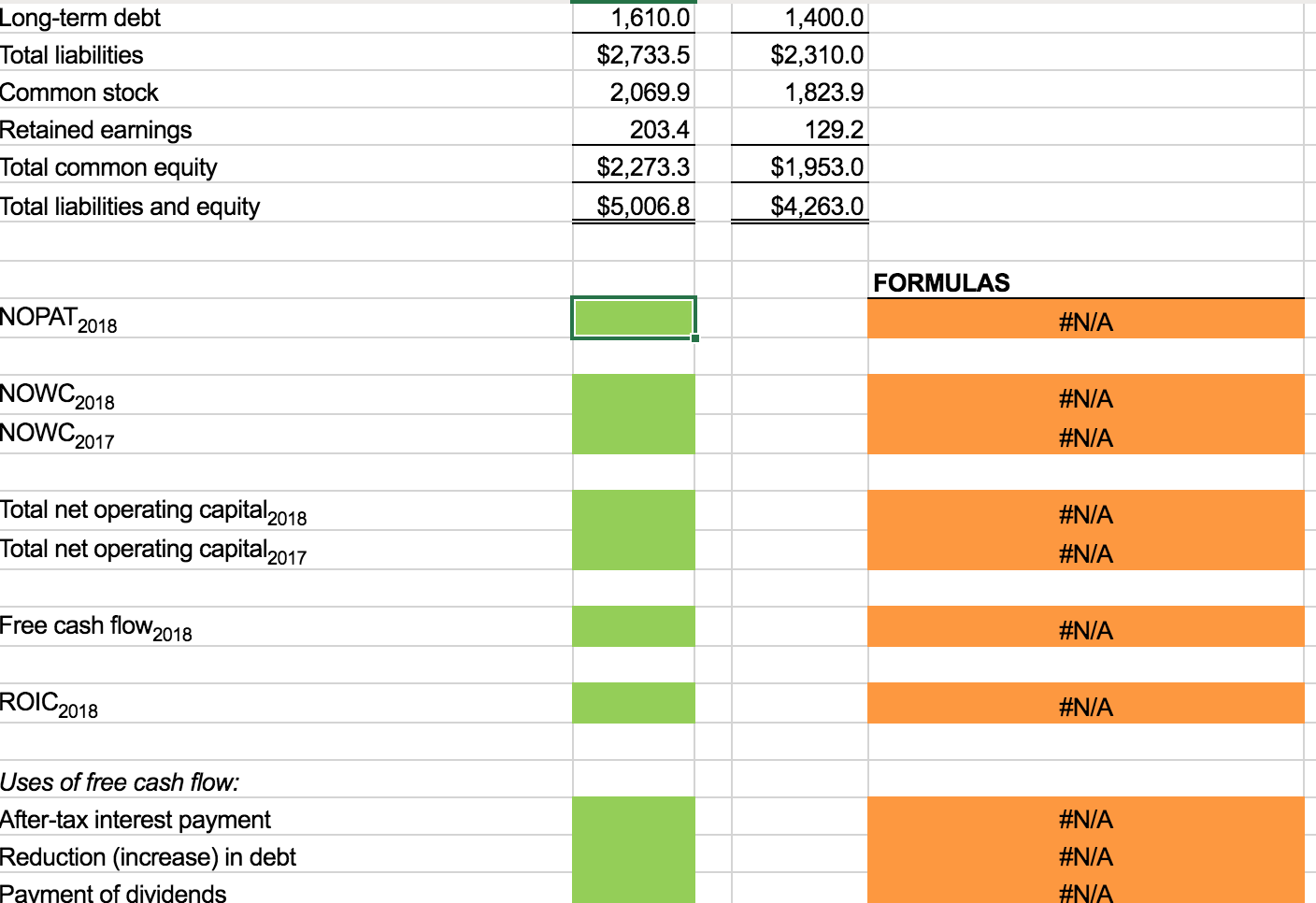

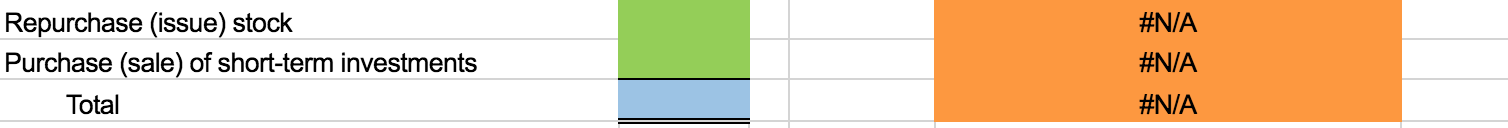

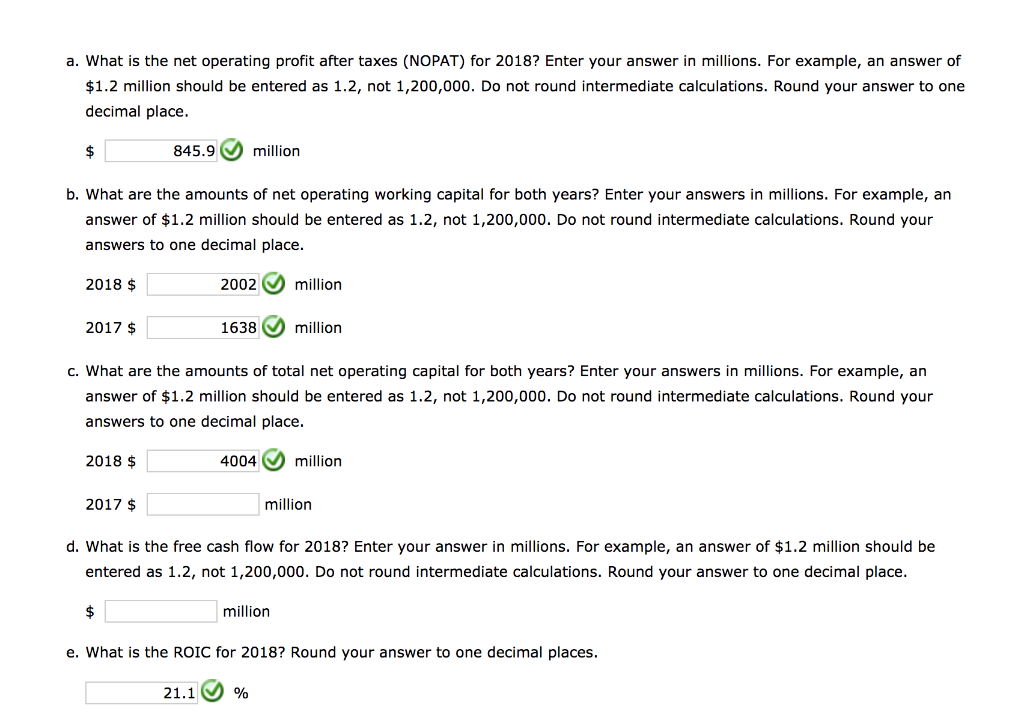

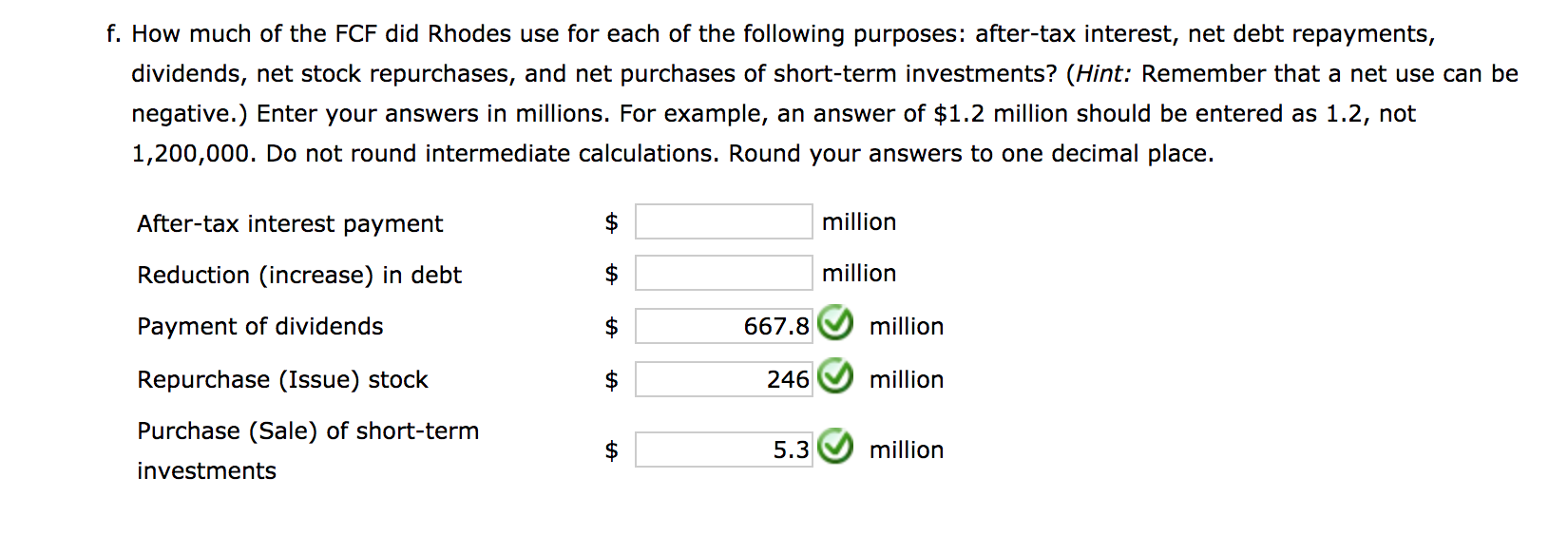

Free Cash Flows (All dollar values are provided in millions.) 2018 2017 Sales $7,000 Sales, ST Invest, Notes Pay, LT Debt factor increase 1.15 Operating costs as % of sales 80.00% Cash as % of sales 1.40% 13.00% Cash factor increase 1.25 Accts Rec as % of sales |Inventory as % of sales Net Plant & Equip Accts. Rec factor increase 1.20 20.00% Inventory factor increase 26.00% 1.25 as % of sales 1.10 Net Plant & Equip factor increase Accts Pay as % of sales 6.00% Accts Pay factor increase 1.25 Accruals as % of Sales 5.00% Accruals factor increase 1.25 Operating cost as % of sales 85.00% Depreciation as % of Net Plant & Equip 10.00% Depreciation as % of Net Plant & Equip 10.00% Interest rate 10.00% Interest rate 10.00% Tax rate 40.00% Tax rate 40.00% 90.00% 80.00% Payout rate Payout rate Short-term investments as % of sales 0.50% 2.00% Notes payable as % of sales Long-term debt as % of sales 20.00% Retained earnings multiple factor 1.50 Income Statements: 2018 2017 $8,050.0 $7,000.0 Sales 5,950.0 Operating costs excluding depreciation 6,440.0 Depreciation and amortization 200.2 182.0 $1,409.8 $868.0 Earnings before interest and taxes Less interest 173.1 150.5 $1,236.7 $717.5 Pre-tax income es 494.7 287.0 $430.5 $742.0 Net income available to common stockholders $344.4 $667.8 Common dividends 2017 Balance Sheets: 2018 Assets $122.5 $98.0 Cash Short-term investments 40.3 35.0 1,092.0 Accounts receivable 910.0 Inventories 1,750.0 1,400.0 $3,004.8 $2,443.0 Total current assets Net plant and equipment 2,002.0 $5,006.8 1,820.0 $4,263.0 Total assets Liabilities and Equity Accounts payable $525.0 $420.0 ccruals 437.5 350.0 Notes payable 161.0 140.0 $1,123.5 $910.0 Total current liabilities Long-term debt 1,610.0 1,400.0 Long-term debt 1,610.0 1,400.0 $2,733.5 $2,310.0 Total liabilities Common stock 2,069.9 1,823.9 Retained earnings 203.4 129.2 Total common equity $2,273.3 $1,953.0 Total liabilities and equity $5,006.8 $4,263.0 FORMULAS NOPAI 2018 #N/A NOWC2018 NOWC2017 #N/A #N/A Total net operating capital2018 Total net operating capital2017 #N/A #N/A Free cash flow2018 #N/A ROIC2018 #/ Uses of free cash flow After-tax interest payment #N/A Reduction (increase) in debt #N/A Pavment of dividends #N/A Repurchase (issue) stock Purchase (sale) of short-term investments #N/A #N/A Total #N/A a. What is the net operating profit after taxes (NOPAT) for 2018? Enter your answer in millions. For example, an answer of $1.2 million should be entered as 1.2, not 1,200,000. Do not round intermediate calculations. Round your answer to one decimal place $ 845.9 million b. What are the amounts of net operating working capital for both years? Enter your answers in millions. For example, an answer of $1.2 million should be entered as 1.2, not 1,200,000. Do not round intermediate calculations. Round your answers to one decimal place. 2018 $ million 2002 2017 $ 1638 million c. What are the amounts of total net operating capital for both years? Enter your answers in millions. For example, an answer of $1.2 million should be entered as 1.2, not 1,200,000. Do not round intermediate calculations. Round your answers to one decimal place. 4004 million 2018 2017 $ million d. What is the free cash flow for 2018? Enter your answer in millions. For example, an answer of $1.2 million should be entered as 1.2, not 1,200,000. Do not round intermediate calculations. Round your answer to one decimal place. million $ e. What is the ROIC for 2018? Round your answer to one decimal places 21.1 f. How much of the FCF did Rhodes use for each of the following purposes: after-tax interest, net debt repayments, dividends, net stock repurchases, and net purchases of short-term investments? (Hint: Remember that a net use can be negative.) Enter your answers in millions. For example, an answer of $1.2 million should be entered as 1.2, not 1,200,000. Do not round intermediate calculations. Round your answers to one decimal place. After-tax interest payment million million Reduction (increase) in debt 667.8 million Payment of dividends million Repurchase (Issue) stock 246 Purchase (Sale) of short-term million $ 5.3 investments