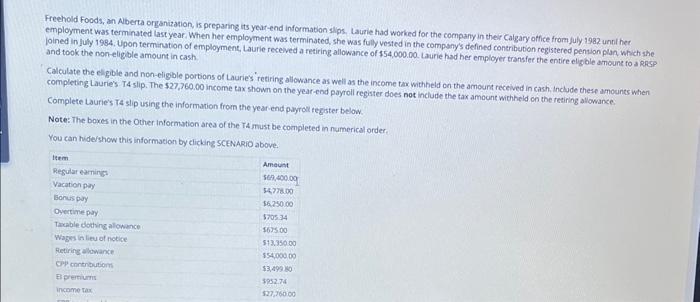

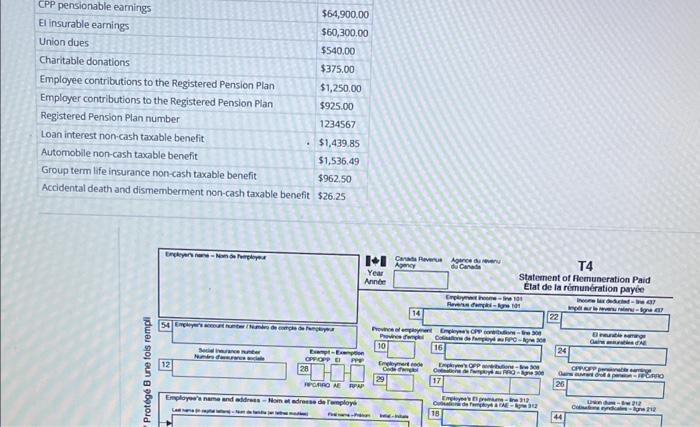

Freehold Foods, an Aberta organization, is preparing its year-end information slips. Laurie had worked for the company in their Caigary office frore july 1982 unni her employment was terminated last year. When her employment was terminated, she was fully vested in the company's defined contribution registered pention plan which she Joined in July 1934. Ugon termination of employment, Laurie receved a retiring allowance of $54,000.00. Laurie had her employer transfer the entife eligble ameune fo a Rrep and took the non-eligible amount in cash. Calculate the eilgible and non-eligble portions of Laurie's retiring allowance as well as the income tax witheld on the amount received in cash. Include these amouints when . completing Lauries T4 slip. The $27,360.00 income tax shown on the year-end payroll register does not include the tax amount withheld on the retiring allowance. Complete Lauries T4 slip using the information from the yearend payrow tegister below. Note: The baxes in the Other information area of the TA must be completed in numerical order. You can hide/show this information by clicking SCENARIO above. \begin{tabular}{|l|l|} \hline El insurable earnings & $64,900.00 \\ \hline Union dues & $60,300.00 \\ \hline Charitable donations & $540.00 \\ \hline Employee contributions to the Registered Pension Plan & $375.00 \\ \hline Employer contributions to the Registered Pension Plan & $1,250.00 \\ \hline Registered Pension Plan number & $925.00 \\ \hline Loan interest non-cash taxable benefit & 1234567 \\ \hline Automobile non-cash taxable benefit & $1,439.85 \\ \hline Group term life insurance non-cash taxable benefit & $1,536.49 \\ \hline Accidental death and dismemberment non-cash taxable benefit & $26.25 \\ \hline \end{tabular} Freehold Foods, an Aberta organization, is preparing its year-end information slips. Laurie had worked for the company in their Caigary office frore july 1982 unni her employment was terminated last year. When her employment was terminated, she was fully vested in the company's defined contribution registered pention plan which she Joined in July 1934. Ugon termination of employment, Laurie receved a retiring allowance of $54,000.00. Laurie had her employer transfer the entife eligble ameune fo a Rrep and took the non-eligible amount in cash. Calculate the eilgible and non-eligble portions of Laurie's retiring allowance as well as the income tax witheld on the amount received in cash. Include these amouints when . completing Lauries T4 slip. The $27,360.00 income tax shown on the year-end payroll register does not include the tax amount withheld on the retiring allowance. Complete Lauries T4 slip using the information from the yearend payrow tegister below. Note: The baxes in the Other information area of the TA must be completed in numerical order. You can hide/show this information by clicking SCENARIO above. \begin{tabular}{|l|l|} \hline El insurable earnings & $64,900.00 \\ \hline Union dues & $60,300.00 \\ \hline Charitable donations & $540.00 \\ \hline Employee contributions to the Registered Pension Plan & $375.00 \\ \hline Employer contributions to the Registered Pension Plan & $1,250.00 \\ \hline Registered Pension Plan number & $925.00 \\ \hline Loan interest non-cash taxable benefit & 1234567 \\ \hline Automobile non-cash taxable benefit & $1,439.85 \\ \hline Group term life insurance non-cash taxable benefit & $1,536.49 \\ \hline Accidental death and dismemberment non-cash taxable benefit & $26.25 \\ \hline \end{tabular}