Answered step by step

Verified Expert Solution

Question

1 Approved Answer

FreemanCare Inc, which maintains and runs health maintenance organizations, has a price/book value ratio of 4. It plans to merge with NewcombCare Inc, a

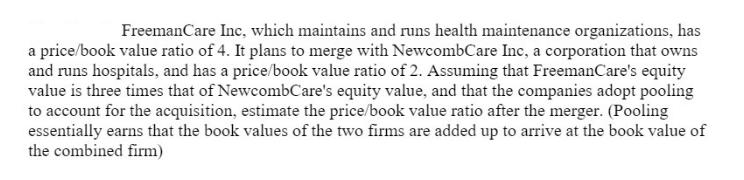

FreemanCare Inc, which maintains and runs health maintenance organizations, has a price/book value ratio of 4. It plans to merge with NewcombCare Inc, a corporation that owns and runs hospitals, and has a price/book value ratio of 2. Assuming that FreemanCare's equity value is three times that of NewcombCare's equity value, and that the companies adopt pooling to account for the acquisition, estimate the price/book value ratio after the merger. (Pooling essentially earns that the book values of the two firms are added up to arrive at the book value of the combined firm)

Step by Step Solution

★★★★★

3.40 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION To estimate the pricebook value ratio after the merger we need to calculate the combined equity value and book value of the merged entity Lets assume the equity value of NewcombCare Inc is re...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started