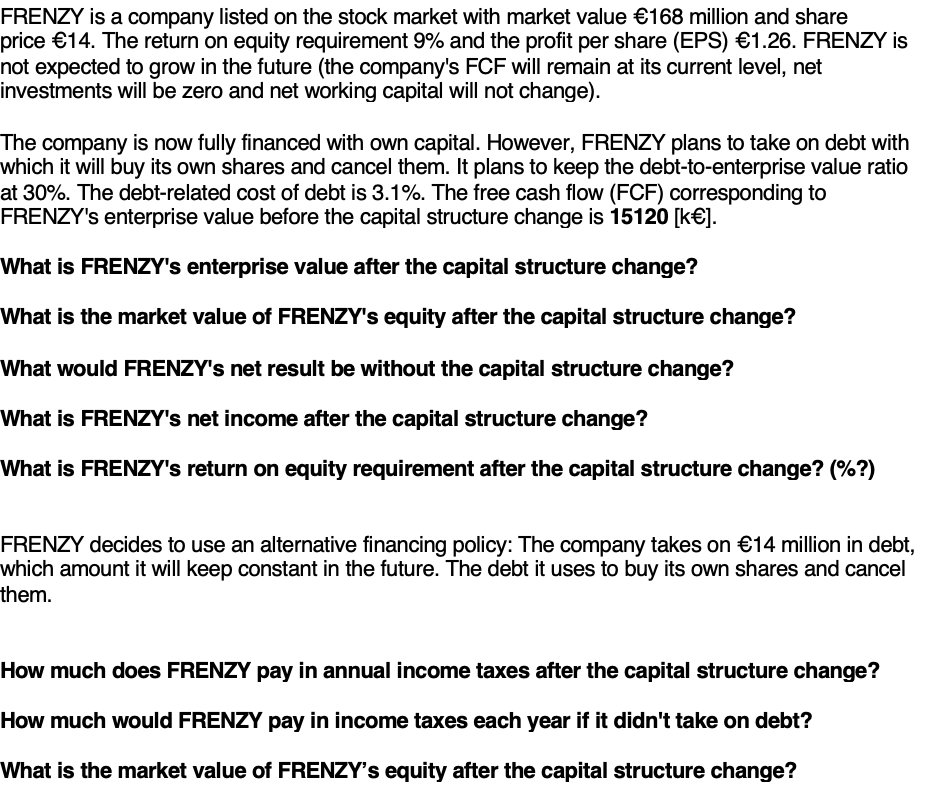

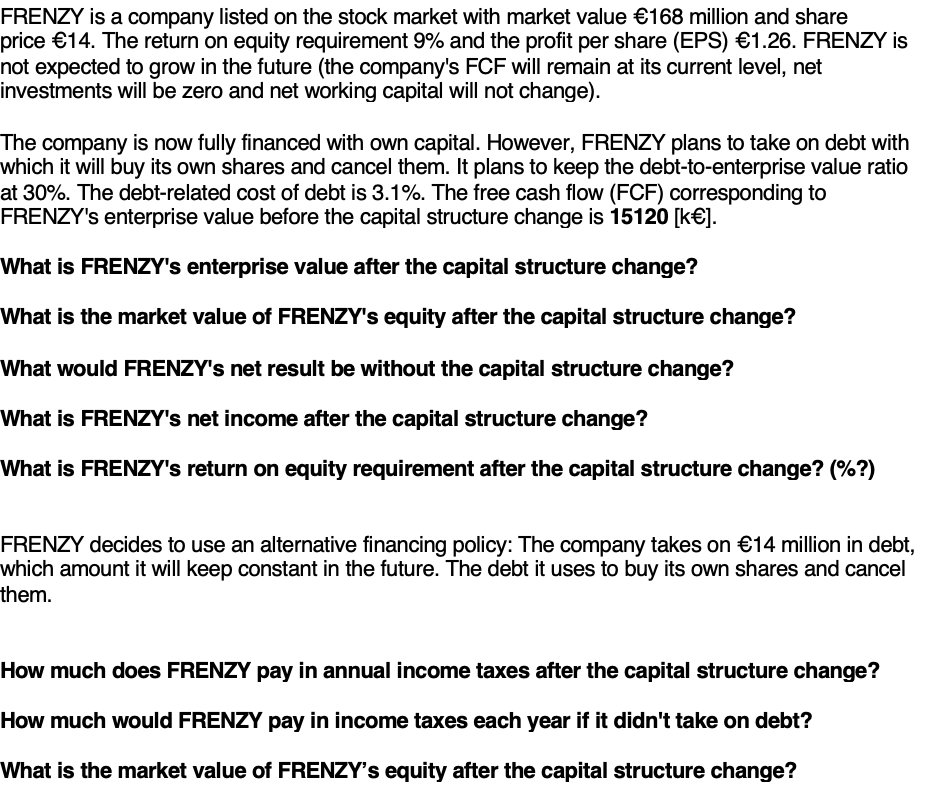

FRENZY is a company listed on the stock market with market value 168 million and share price 14. The return on equity requirement 9% and the profit per share (EPS) 1.26. FRENZY is not expected to grow in the future (the company's FCF will remain at its current level, net investments will be zero and net working capital will not change). The company is now fully financed with own capital. However, FRENZY plans to take on debt with which it will buy its own shares and cancel them. It plans to keep the debt-to-enterprise value ratio at 30%. The debt-related cost of debt is 3.1%. The free cash flow (FCF) corresponding to FRENZY's enterprise value before the capital structure change is 15120[k]. What is FRENZY's enterprise value after the capital structure change? What is the market value of FRENZY's equity after the capital structure change? What would FRENZY's net result be without the capital structure change? What is FRENZY's net income after the capital structure change? What is FRENZY's return on equity requirement after the capital structure change? (\%?) FRENZY decides to use an alternative financing policy: The company takes on 14 million in debt, which amount it will keep constant in the future. The debt it uses to buy its own shares and cancel them. How much does FRENZY pay in annual income taxes after the capital structure change? How much would FRENZY pay in income taxes each year if it didn't take on debt? What is the market value of FRENZY's equity after the capital structure change? FRENZY is a company listed on the stock market with market value 168 million and share price 14. The return on equity requirement 9% and the profit per share (EPS) 1.26. FRENZY is not expected to grow in the future (the company's FCF will remain at its current level, net investments will be zero and net working capital will not change). The company is now fully financed with own capital. However, FRENZY plans to take on debt with which it will buy its own shares and cancel them. It plans to keep the debt-to-enterprise value ratio at 30%. The debt-related cost of debt is 3.1%. The free cash flow (FCF) corresponding to FRENZY's enterprise value before the capital structure change is 15120[k]. What is FRENZY's enterprise value after the capital structure change? What is the market value of FRENZY's equity after the capital structure change? What would FRENZY's net result be without the capital structure change? What is FRENZY's net income after the capital structure change? What is FRENZY's return on equity requirement after the capital structure change? (\%?) FRENZY decides to use an alternative financing policy: The company takes on 14 million in debt, which amount it will keep constant in the future. The debt it uses to buy its own shares and cancel them. How much does FRENZY pay in annual income taxes after the capital structure change? How much would FRENZY pay in income taxes each year if it didn't take on debt? What is the market value of FRENZY's equity after the capital structure change