Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Fresh Food Catering Ltd's capital expenditure for the current year for new equipment was $108,900. Current liabilities and non-current liabilities were $68,600 and $475,700

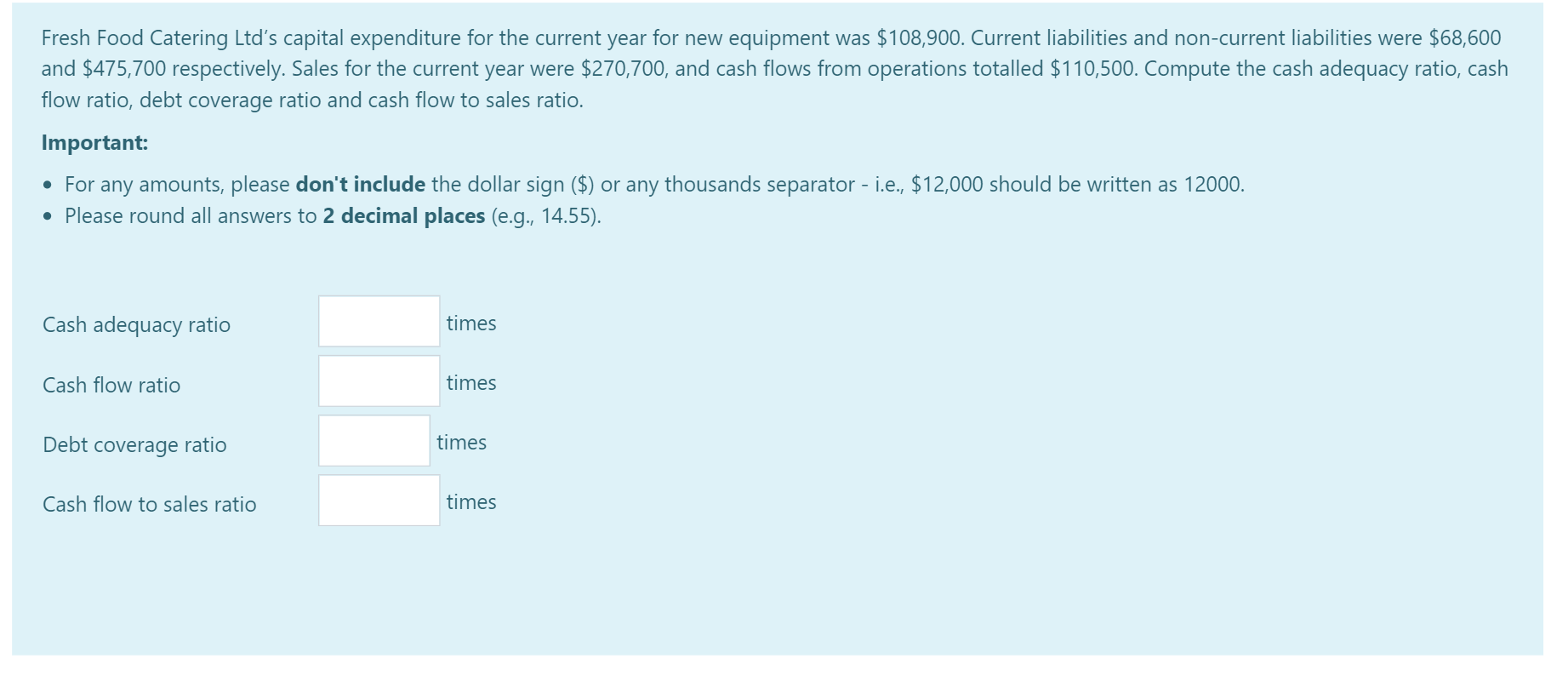

Fresh Food Catering Ltd's capital expenditure for the current year for new equipment was $108,900. Current liabilities and non-current liabilities were $68,600 and $475,700 respectively. Sales for the current year were $270,700, and cash flows from operations totalled $110,500. Compute the cash adequacy ratio, cash flow ratio, debt coverage ratio and cash flow to sales ratio. Important: For any amounts, please don't include the dollar sign ($) or any thousands separator - i.e., $12,000 should be written as 12000. Please round all answers to 2 decimal places (e.g., 14.55). Cash adequacy ratio times Cash flow ratio times Debt coverage ratio Cash flow to sales ratio times times

Step by Step Solution

★★★★★

3.53 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

0 cash ademacy Ratio cash flow from operation In thegiven case Cash adequacy Ratio cashflo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started