Answered step by step

Verified Expert Solution

Question

1 Approved Answer

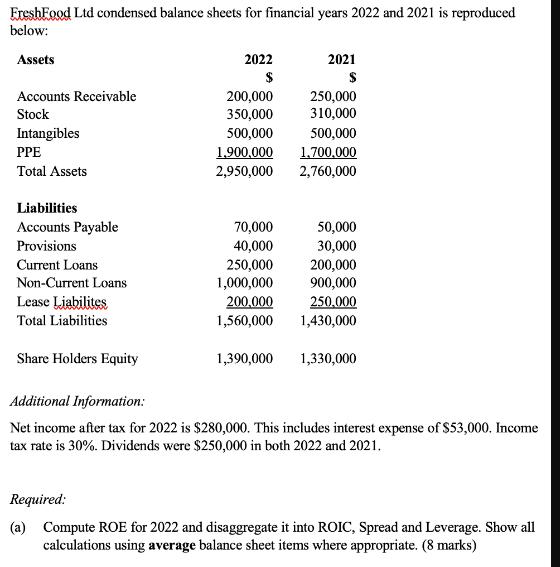

FreshFood Ltd condensed balance sheets for financial years 2022 and 2021 is reproduced below: Assets 2022 2021 $ $ Accounts Receivable 200,000 250,000 Stock

FreshFood Ltd condensed balance sheets for financial years 2022 and 2021 is reproduced below: Assets 2022 2021 $ $ Accounts Receivable 200,000 250,000 Stock 350,000 310,000 Intangibles 500,000 500,000 PPE 1,900,000 1.700.000 Total Assets 2,950,000 2,760,000 Liabilities Accounts Payable 70,000 50,000 Provisions 40,000 30,000 Current Loans 250,000 200,000 Non-Current Loans 1,000,000 900,000 Lease Liabilites 200,000 250,000 Total Liabilities 1,560,000 1,430,000 Share Holders Equity 1,390,000 1,330,000 Additional Information: Net income after tax for 2022 is $280,000. This includes interest expense of $53,000. Income tax rate is 30%. Dividends were $250,000 in both 2022 and 2021. Required: (a) Compute ROE for 2022 and disaggregate it into ROIC, Spread and Leverage. Show all calculations using average balance sheet items where appropriate. (8 marks) (b) Now assume that included in net profit is a non-recurring revenue transaction of $100,000. Would this affect your assessment of the benefits or costs of the financial leverage? Explain why. No calculations are required (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started