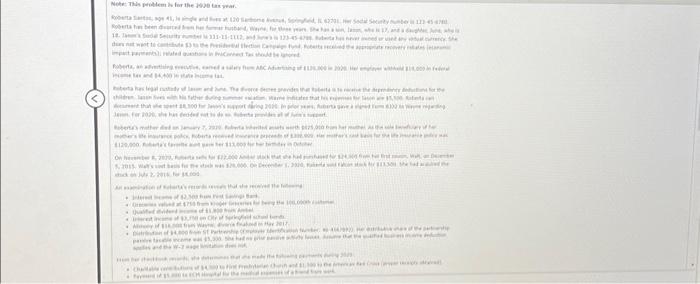

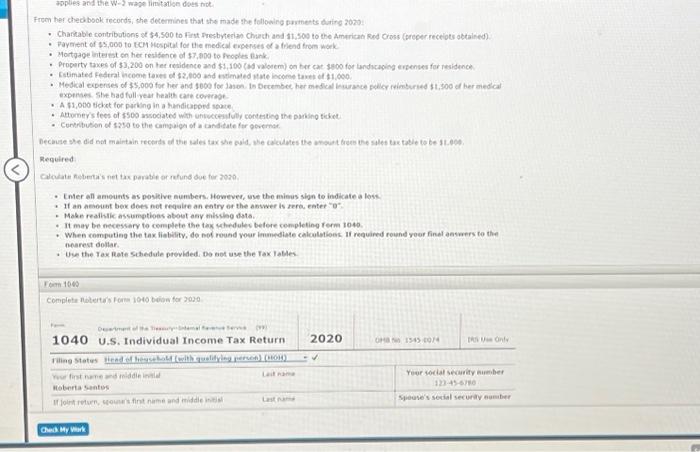

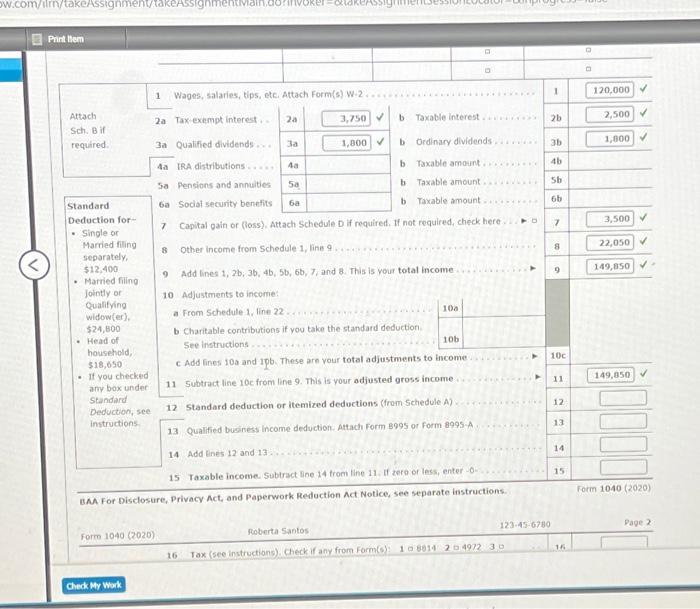

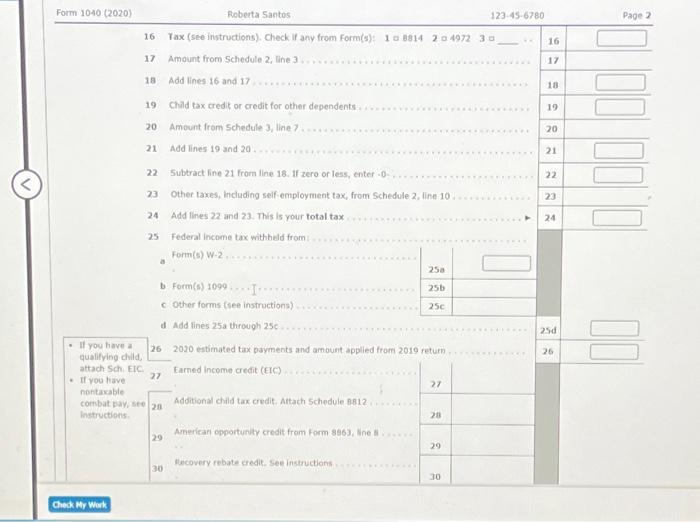

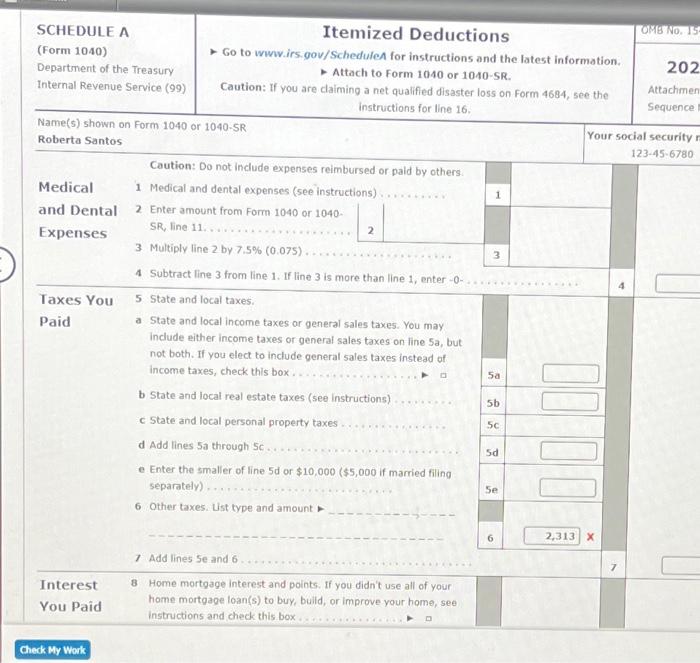

Frger ther chech book tecords, the decermines that she made the foliowing parinets during a020: - Chardable contributions of 54,590 to First Presbyerias Chisth and s1,sos to the Amarisat Rued cross (precer recelots obtalned) - Faytent of \$3,005 to fCH Stespital for the medical evgerses of a friend from wobl. - Mortpage arterst on her resifence of 57,909 to lroshes funk. exprives. stue bad full vear health cate eorerage - A 11,000 ticket for parking in a handicapond state. - Atworneris fees of 1500 associated with unisccesfuly cortesting the parking fikiet - Cenkribubs of 525 to the camgaga of a candidate fer governer. Reguired Ealculati Rsberta' net tak payabie or refund due for zobh. - Enser all ampunts as positive eumbers, Hoverver, use the minus slon to indicate aost. - If an nesoubt bex dees not require an eatry et the envwer is rerac eater "0". - Mak e realitik assampthoes atwot any thistho dots. * It mav be necessary to cermblete the thax mhedules befere cempleting rerm 1040. + When computing the tax liability, de not round your imsnediale calculatioes. If reguired round rour firel aeserers to the finarest doltar. - Uye the Jax Rate sthedule porvided Do wot use the Tax lables Punt trem 1 Wages, salaries, tips, ete. Attach Form(s) W-2 Attach 2a Tax-excmpt interest . Sch. B if \begin{tabular}{|l|r|} \hline 2a & 3,750 \\ \hline 3a & 1,800 \\ \hline 4a & \\ \hline 5a & \\ \hline 6a & \\ \hline \end{tabular} b Taxable interest required 3 a Qualified dividends w. 4a IRA distributions .= Sa Pensions and annuties Standard Deduction for - - Single or Married filing separately, $12,400 - Married filing Jointly or Qualifying widow(er). $24,800 - Head of household, $18,650 - If you checked any box under standard Deduction; see 6a Social security benefits 7 Capital gain or (loss?. instructions 8 Other income from 5chedule 1, line 9. 9 Add lines 1,2b;3b,4b,5b,6b,7, and 8 . This is your total income 10 Adjustments to income: a From Schedule 1, line 22 . b Charitable contributioes if you take the standard deduction See instructions c Add fines 10a and 1pb. These are vour total adjustments to income 11 Subtract line 10 c from line 9 . This is your adjusted gross income 12 Standard deduction or itemized deductions (from Schedule A) 13 Qualified business income deduction, Attach Form 8995 or form 8995 -A 14 Add lines 12 and 13 15 Taxable income. Subtract line is trom tine 11 . If thero or less, enter - - Form 1040(2020) uAA For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see separate instructions. Page 2 form 1040(2020) Poberta 5 antos 123456780 16. 16 Tax (see instructions). Check if any from form(s): 108914204972.30 Form 1040(2020) foberta Santos 123456780 Page 2 16 Tax (see instructions), Check if any from form(s): 1 a 88142049723 a 17. Amount from Schedule 2 , line 3 18. Add lines 16 and 17 19 Child tax credit or credit for other dependents 20 Amount from schedule 3, line? 21 Add lines 19 and 20 22 Subtract line 21 from line 18. If zero or less, enter -0. 23. Other taxes, including seif-employment tax, from Schedule 2, line-10 24 Add lines 22 and 23 . This is your total tax 25 Federal income tax withbeld from a Form(s) W-2 b Frrm(s)1099 c. Other forms (see instructions) of Add lines 25 a through 25c - If you have a qualifying child. 26 attach Schi EIC - If you have nontimable combat pay, see 20 Additional child tax credic, Artach Schedule 8812 instructens 2020 estimated tax payments and amount applied from 2019 retum Earned income credit (EIC) 27 Earned income credit (EIC) 20 Additional child tax credit, Attach Schedule B812 29 Araericarl opportunty credit fram Form 8863, Wne il 30 16 17 18 19 20 21 22 23 24 24 SCHEDULE A (Form 1040) Department of the Treasury Internal Revenue Service (99) Itemized Deductions Go to wwv.irs.gov/SchedufeA for instructions and the latest information. - Attach to Form 1040 or 10405R. Caution: If you are claiming a net qualiffed disaster loss on Form 4684 , see the instructions for line 16 . OM/igNO,15 202 Attachmer Sequence Name(s) shown on Form 1040 or 10405R Roberta Santos Your social security 123456780 Caution: Do not include expenses reimbursed or paid by others. Medical 1 Medical and dental expenses (see instructions) and Dental 2 Enter amount from Form 1040 or 1040. Expenses SR, line 11 3 Multiply line 2 by 7.5%(0.075) 4 Subtract line 3 from line 1. If line 3 is more than line 1, enter -0- Taxes You Paid 5 State and local taxes. a State and local income taxes or general sales taxes. You may include either income taxes or general sales taxes on line 5 a, but not both. If you elect to include general sales taxes instead of income taxes, check this box. b State and local real estate taxes (see instructions) C State and local personal property taxes d Add lines 5 a through 5c e. Enter the smaller of line 5d or $10,000($5,000 if married filing separately) 6 Other taxes. Ust type and amount 7 Add lines Se and 6 Interest 8 Home mortgage interest and points. If you didn't use all of your You Pad home mortgage loan(s) to buy, build, or improve your home, see instructions and check this box 3 4 4 7 Frger ther chech book tecords, the decermines that she made the foliowing parinets during a020: - Chardable contributions of 54,590 to First Presbyerias Chisth and s1,sos to the Amarisat Rued cross (precer recelots obtalned) - Faytent of \$3,005 to fCH Stespital for the medical evgerses of a friend from wobl. - Mortpage arterst on her resifence of 57,909 to lroshes funk. exprives. stue bad full vear health cate eorerage - A 11,000 ticket for parking in a handicapond state. - Atworneris fees of 1500 associated with unisccesfuly cortesting the parking fikiet - Cenkribubs of 525 to the camgaga of a candidate fer governer. Reguired Ealculati Rsberta' net tak payabie or refund due for zobh. - Enser all ampunts as positive eumbers, Hoverver, use the minus slon to indicate aost. - If an nesoubt bex dees not require an eatry et the envwer is rerac eater "0". - Mak e realitik assampthoes atwot any thistho dots. * It mav be necessary to cermblete the thax mhedules befere cempleting rerm 1040. + When computing the tax liability, de not round your imsnediale calculatioes. If reguired round rour firel aeserers to the finarest doltar. - Uye the Jax Rate sthedule porvided Do wot use the Tax lables Punt trem 1 Wages, salaries, tips, ete. Attach Form(s) W-2 Attach 2a Tax-excmpt interest . Sch. B if \begin{tabular}{|l|r|} \hline 2a & 3,750 \\ \hline 3a & 1,800 \\ \hline 4a & \\ \hline 5a & \\ \hline 6a & \\ \hline \end{tabular} b Taxable interest required 3 a Qualified dividends w. 4a IRA distributions .= Sa Pensions and annuties Standard Deduction for - - Single or Married filing separately, $12,400 - Married filing Jointly or Qualifying widow(er). $24,800 - Head of household, $18,650 - If you checked any box under standard Deduction; see 6a Social security benefits 7 Capital gain or (loss?. instructions 8 Other income from 5chedule 1, line 9. 9 Add lines 1,2b;3b,4b,5b,6b,7, and 8 . This is your total income 10 Adjustments to income: a From Schedule 1, line 22 . b Charitable contributioes if you take the standard deduction See instructions c Add fines 10a and 1pb. These are vour total adjustments to income 11 Subtract line 10 c from line 9 . This is your adjusted gross income 12 Standard deduction or itemized deductions (from Schedule A) 13 Qualified business income deduction, Attach Form 8995 or form 8995 -A 14 Add lines 12 and 13 15 Taxable income. Subtract line is trom tine 11 . If thero or less, enter - - Form 1040(2020) uAA For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see separate instructions. Page 2 form 1040(2020) Poberta 5 antos 123456780 16. 16 Tax (see instructions). Check if any from form(s): 108914204972.30 Form 1040(2020) foberta Santos 123456780 Page 2 16 Tax (see instructions), Check if any from form(s): 1 a 88142049723 a 17. Amount from Schedule 2 , line 3 18. Add lines 16 and 17 19 Child tax credit or credit for other dependents 20 Amount from schedule 3, line? 21 Add lines 19 and 20 22 Subtract line 21 from line 18. If zero or less, enter -0. 23. Other taxes, including seif-employment tax, from Schedule 2, line-10 24 Add lines 22 and 23 . This is your total tax 25 Federal income tax withbeld from a Form(s) W-2 b Frrm(s)1099 c. Other forms (see instructions) of Add lines 25 a through 25c - If you have a qualifying child. 26 attach Schi EIC - If you have nontimable combat pay, see 20 Additional child tax credic, Artach Schedule 8812 instructens 2020 estimated tax payments and amount applied from 2019 retum Earned income credit (EIC) 27 Earned income credit (EIC) 20 Additional child tax credit, Attach Schedule B812 29 Araericarl opportunty credit fram Form 8863, Wne il 30 16 17 18 19 20 21 22 23 24 24 SCHEDULE A (Form 1040) Department of the Treasury Internal Revenue Service (99) Itemized Deductions Go to wwv.irs.gov/SchedufeA for instructions and the latest information. - Attach to Form 1040 or 10405R. Caution: If you are claiming a net qualiffed disaster loss on Form 4684 , see the instructions for line 16 . OM/igNO,15 202 Attachmer Sequence Name(s) shown on Form 1040 or 10405R Roberta Santos Your social security 123456780 Caution: Do not include expenses reimbursed or paid by others. Medical 1 Medical and dental expenses (see instructions) and Dental 2 Enter amount from Form 1040 or 1040. Expenses SR, line 11 3 Multiply line 2 by 7.5%(0.075) 4 Subtract line 3 from line 1. If line 3 is more than line 1, enter -0- Taxes You Paid 5 State and local taxes. a State and local income taxes or general sales taxes. You may include either income taxes or general sales taxes on line 5 a, but not both. If you elect to include general sales taxes instead of income taxes, check this box. b State and local real estate taxes (see instructions) C State and local personal property taxes d Add lines 5 a through 5c e. Enter the smaller of line 5d or $10,000($5,000 if married filing separately) 6 Other taxes. Ust type and amount 7 Add lines Se and 6 Interest 8 Home mortgage interest and points. If you didn't use all of your You Pad home mortgage loan(s) to buy, build, or improve your home, see instructions and check this box 3 4 4 7