Answered step by step

Verified Expert Solution

Question

1 Approved Answer

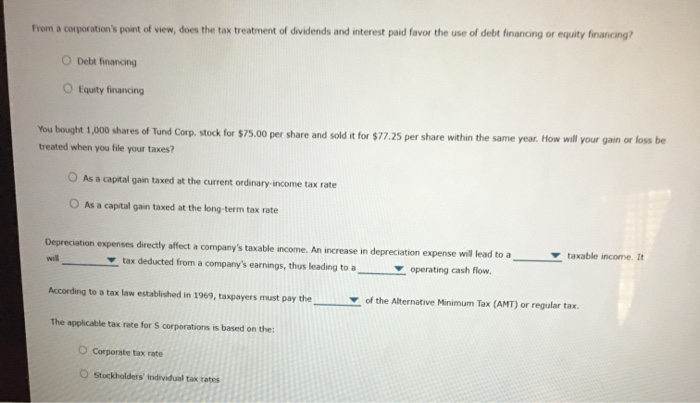

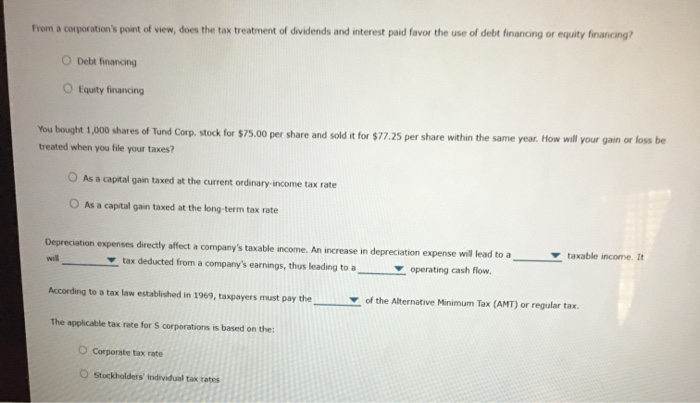

From a corporation's point of view, does the tax treatment of dividends and interest paid favor the use of debt financing or equity financing ?

From a corporation's point of view, does the tax treatment of dividends and interest paid favor the use of debt financing or equity financing ?

From a corporation's point of view, does the tax treatment of dividends and interest paid favor the use of debt financing or equity financing? Debt financing Equity financing You bought 1,000 shares of Tund Corp. stock for $75.00 per share and sold it for $77.25 per share within the same year. How will your gain or loss be treated when you file your taxes? As a capital gain taxed at the current ordinary income tax rate As a capital gain taxed at the long-term tax rate Depreciation expenses directly affect a company's taxable income. An increase in depreciation expense will lead to a tax deducted from a company's earnings, thus leading to a operating cash flow. taxable income. It According to a tax law established in 1969, taxpayers must pay the of the Alternative Minimum Tax (AMT) or regular tax. The applicable tax rate for corporation is based on the: Corporate tax rate Stockholders individual tax rates

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started