Question

From above information A company has the following ratios: Current ratio - .85 Inventory to Sales Conversion Period 180 days Sales to Cash Conversion Period

From above information

A company has the following ratios:

Current ratio - .85 Inventory to Sales Conversion Period 180 days Sales to Cash Conversion Period 65 days Purchases to Payments Conversion Period - 7 days The accountant also reports that the gross profit margin is 15% and the next profit margin is 3%.

Now you are being provided with this additional information on the company.

The company also has a bank line of credit that allows the company to borrow any shortfall it might have in cash. Interest on the loan is 10%. Assume the loan remained constant throughout the year. The company likes to keep no less than $25,000 in its bank account. Assume that outstanding accounts payable are all related to inventory purchases.

The company has $1,200,000 of equity and $140,000 in retained earnings at the end of the year.

Sales in the most recent year were $2,600,000.

Ignore income tax for purposes of this problem.

Build a balance sheet and income statement financial model.

What is the company's return on investment?

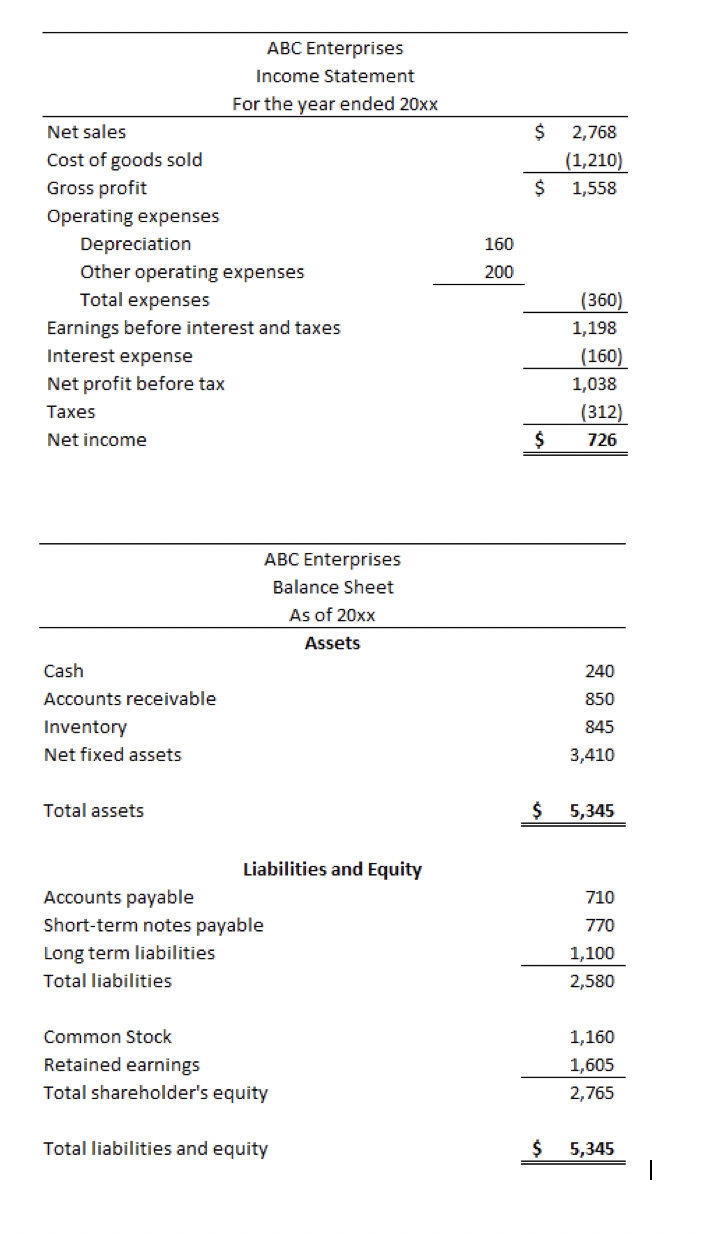

$ 2,768 (1,210) 1,558 $ ABC Enterprises Income Statement For the year ended 20xx Net sales Cost of goods sold Gross profit Operating expenses Depreciation Other operating expenses Total expenses Earnings before interest and taxes Interest expense Net profit before tax Taxes Net income 160 200 (360) 1,198 (160) 1,038 (312) 726 $ ABC Enterprises Balance Sheet As of 20xx Assets 240 850 Cash Accounts receivable Inventory Net fixed assets 845 3,410 Total assets $ 5,345 710 Liabilities and Equity Accounts payable Short-term notes payable Long term liabilities Total liabilities 770 1,100 2,580 Common Stock Retained earnings Total shareholder's equity 1,160 1,605 2,765 Total liabilities and equity $ 5,345Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started