Answered step by step

Verified Expert Solution

Question

1 Approved Answer

from B-D, handwritten please Question 5 a. State the main difference between a bond and a regular loan. [2] b. Find the book value of

from B-D, handwritten please

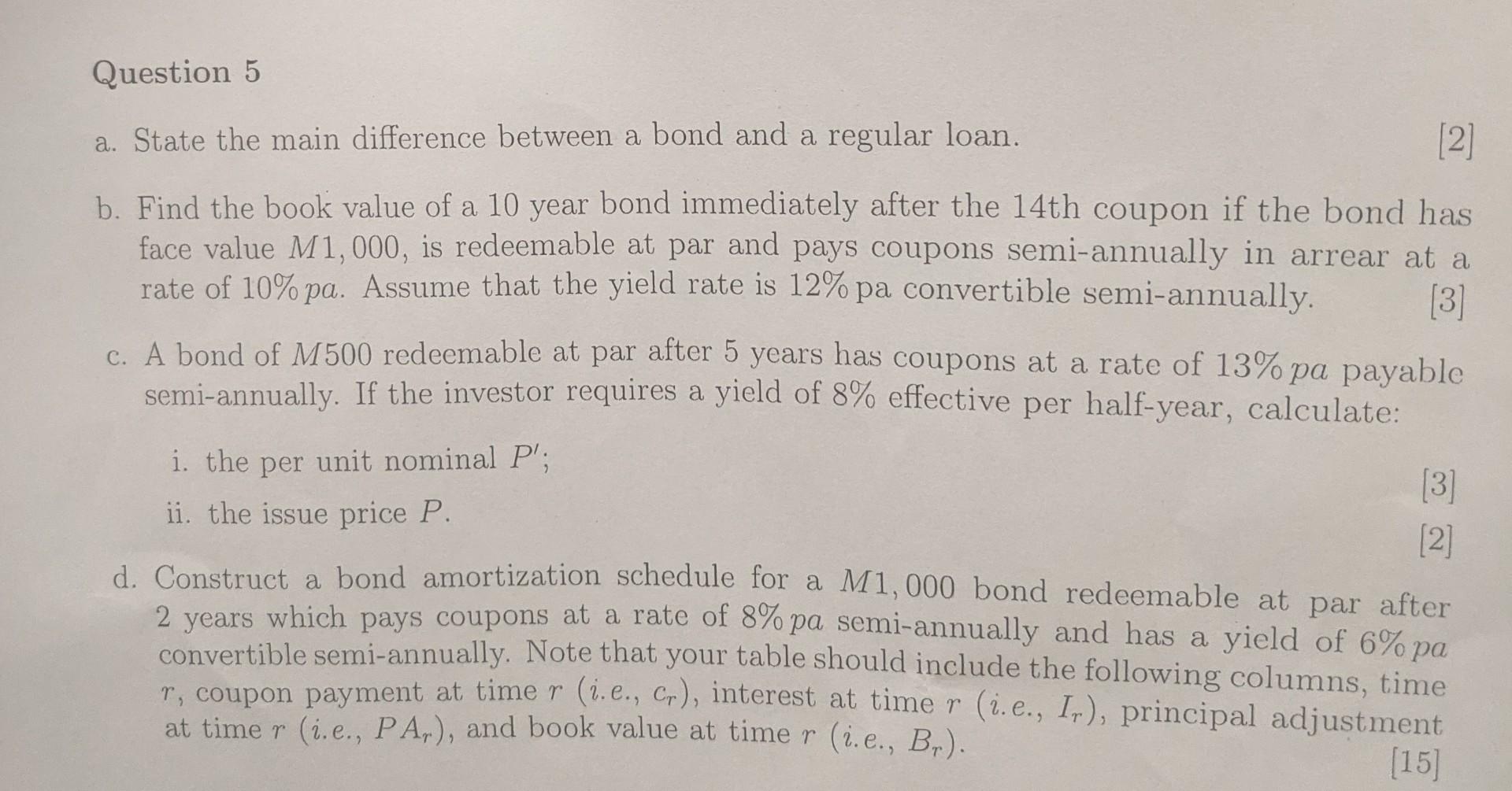

Question 5 a. State the main difference between a bond and a regular loan. [2] b. Find the book value of a 10 year bond immediately after the 14th coupon if the bond has face value M1, 000, is redeemable at par and pays coupons semi-annually in arrear at a rate of 10% pa. Assume that the yield rate is 12% pa convertible semi-annually. [3] c. A bond of M500 redeemable at par after 5 years has coupons at a rate of 13% pa payable semi-annually. If the investor requires a yield of 8% effective per half-year, calculate: i. the per unit nominal P'; ii. the issue price P. [3] [2] d. Construct a bond amortization schedule for a M1,000 bond redeemable at par after 2 years which pays coupons at a rate of 8% pa semi-annually and has a yield of 6% pa convertible semi-annually. Note that your table should include the following columns, time r, coupon payment at time r (i.e., Cr), interest at time r (i.e., Ir), principal adjustment at time r (i.e., PA,), and book value at time r (i.e., Br). [15]Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started