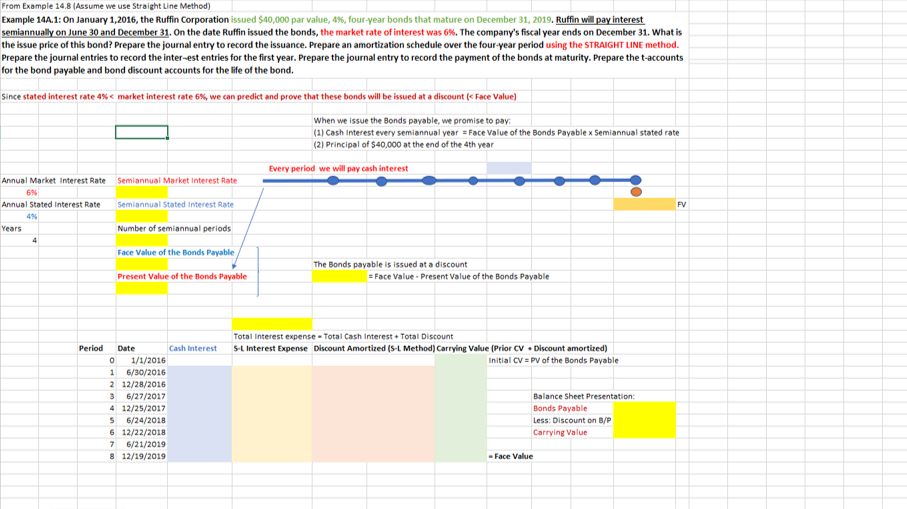

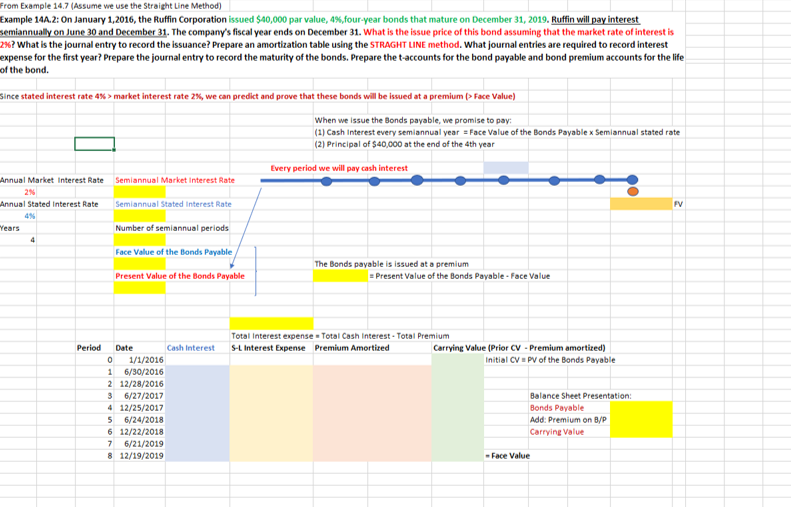

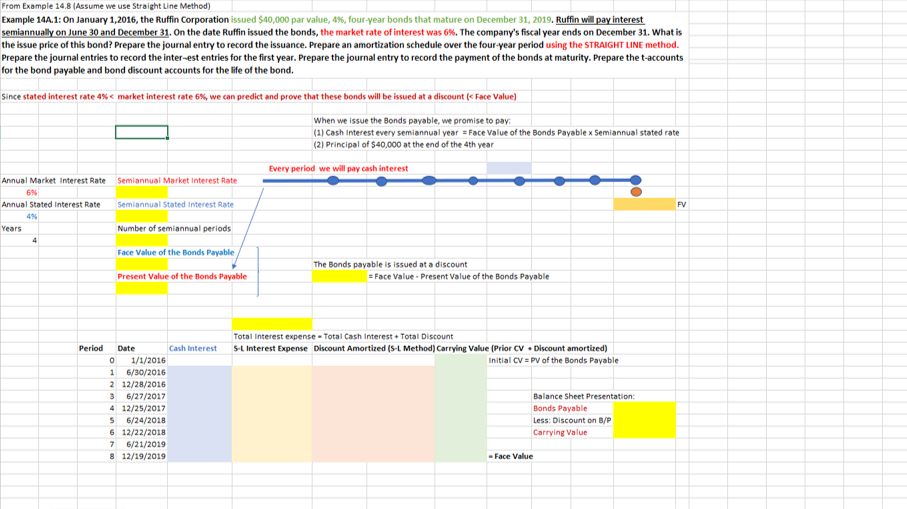

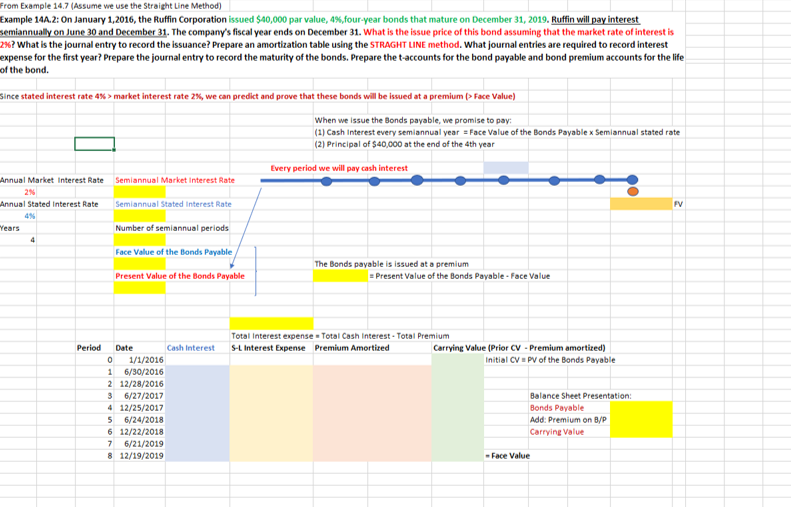

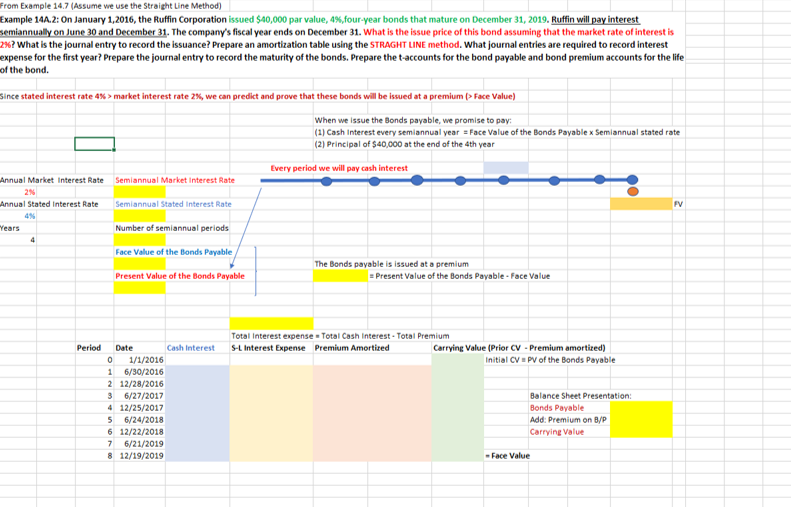

From Example 14.8 (Assume we use Straight Line Method) Example 14A.1: On January 1,2016, the Ruffin Corporation issued $40,000 par value, 4%, four-year bonds that mature on December 31, 2019. Ruffin will pay interest semiannually on June 30 and December 31. On the date Ruffin issued the bonds, the market rate of interest was 6%. The company's fiscal year ends on December 31. What is the issue price of this bond? Prepare the journal entry to record the issuance. Prepare an amortization schedule over the four-year period using the STRAIGHT LINE method. Prepare the journal entries to record the inter-est entries for the first year. Prepare the journal entry to record the payment of the bonds at maturity. Prepare the t-accounts for the bond payable and bond discount accounts for the life of the bond. Since stated interest rate 4% market interest rate 2%, we can predict and prove that these bonds will be issued at a premium > Face Value) When we issue the Bonds payable, we promise to pay (1) Cash Interest every semiannual year = Face Value of the Bonds Payable x Semiannual stated rate (2) Principal of $40,000 at the end of the 4th year Every period we will pay cash interest Annual Market Interest Rate Semiannual Market Interest Rate 2 Annual Stated Interest Rate Semiannual Stated Interest Rate FV 4 Years Number of semiannual periods 4 Face Value of the Bonds Payable Present Value of the Bonds Payable The Bonds payable is issued at a premium = Present Value of the Bonds Payable-Face Value Period Total Interest expense - Total Cash Interest - Total Premium S-L Interest Expense Premium Amortired Carrying Value (Prior CV - Premium amortized) Initial CV = PV of the Bonds Payable Date Cash Interest 0 1/1/2016 1 6/30/2016 2 12/28/2016 3 6/27/2017 4 12/25/2017 56/24/2018 6 12/22/2018 7 6/21/2019 8 12/19/2019 Balance Sheet Presentation Bonds Payable Add: Premium on B/P Carrying Value - Face Value From Example 14.7 (Assume we use the Straight Line Method) Example 144.2: On January 1, 2016, the Ruffin Corporation issued $40,000 par value, 4% four-year bonds that mature on December 31, 2019. Ruffin will pay interest semiannually on June 30 and December 31. The company's fiscal year ends on December 31. What is the issue price of this bond assuming that the market rate of interestis 2%? What is the journal entry to record the issuance? Prepare an amortization table using the STRAGHT LINE method. What journal entries are required to record interest expense for the first year? Prepare the journal entry to record the maturity of the bonds. Prepare the t-accounts for the bond payable and bond premium accounts for the life of the bond. Since stated interest rate 4% > market interest rate 2%, we can predict and prove that these bonds will be issued at a premium > Face Value) When we issue the Bonds payable, we promise to pay (1) Cash Interest every semiannual year = Face Value of the Bonds Payable x Semiannual stated rate (2) Principal of $40,000 at the end of the 4th year Every period we will pay cash interest Annual Market Interest Rate Semiannual Market Interest Rate 2 Annual Stated Interest Rate Semiannual Stated Interest Rate FV 4 Years Number of semiannual periods 4 Face Value of the Bonds Payable Present Value of the Bonds Payable The Bonds payable is issued at a premium = Present Value of the Bonds Payable-Face Value Period Total Interest expense - Total Cash Interest - Total Premium S-L Interest Expense Premium Amortired Carrying Value (Prior CV - Premium amortized) Initial CV = PV of the Bonds Payable Date Cash Interest 0 1/1/2016 1 6/30/2016 2 12/28/2016 3 6/27/2017 4 12/25/2017 56/24/2018 6 12/22/2018 7 6/21/2019 8 12/19/2019 Balance Sheet Presentation Bonds Payable Add: Premium on B/P Carrying Value - Face Value From Example 14.8 (Assume we use Straight Line Method) Example 14A.1: On January 1,2016, the Ruffin Corporation issued $40,000 par value, 4%, four-year bonds that mature on December 31, 2019. Ruffin will pay interest semiannually on June 30 and December 31. On the date Ruffin issued the bonds, the market rate of interest was 6%. The company's fiscal year ends on December 31. What is the issue price of this bond? Prepare the journal entry to record the issuance. Prepare an amortization schedule over the four-year period using the STRAIGHT LINE method. Prepare the journal entries to record the inter-est entries for the first year. Prepare the journal entry to record the payment of the bonds at maturity. Prepare the t-accounts for the bond payable and bond discount accounts for the life of the bond. Since stated interest rate 4% market interest rate 2%, we can predict and prove that these bonds will be issued at a premium > Face Value) When we issue the Bonds payable, we promise to pay (1) Cash Interest every semiannual year = Face Value of the Bonds Payable x Semiannual stated rate (2) Principal of $40,000 at the end of the 4th year Every period we will pay cash interest Annual Market Interest Rate Semiannual Market Interest Rate 2 Annual Stated Interest Rate Semiannual Stated Interest Rate FV 4 Years Number of semiannual periods 4 Face Value of the Bonds Payable Present Value of the Bonds Payable The Bonds payable is issued at a premium = Present Value of the Bonds Payable-Face Value Period Total Interest expense - Total Cash Interest - Total Premium S-L Interest Expense Premium Amortired Carrying Value (Prior CV - Premium amortized) Initial CV = PV of the Bonds Payable Date Cash Interest 0 1/1/2016 1 6/30/2016 2 12/28/2016 3 6/27/2017 4 12/25/2017 56/24/2018 6 12/22/2018 7 6/21/2019 8 12/19/2019 Balance Sheet Presentation Bonds Payable Add: Premium on B/P Carrying Value - Face Value From Example 14.7 (Assume we use the Straight Line Method) Example 144.2: On January 1, 2016, the Ruffin Corporation issued $40,000 par value, 4% four-year bonds that mature on December 31, 2019. Ruffin will pay interest semiannually on June 30 and December 31. The company's fiscal year ends on December 31. What is the issue price of this bond assuming that the market rate of interestis 2%? What is the journal entry to record the issuance? Prepare an amortization table using the STRAGHT LINE method. What journal entries are required to record interest expense for the first year? Prepare the journal entry to record the maturity of the bonds. Prepare the t-accounts for the bond payable and bond premium accounts for the life of the bond. Since stated interest rate 4% > market interest rate 2%, we can predict and prove that these bonds will be issued at a premium > Face Value) When we issue the Bonds payable, we promise to pay (1) Cash Interest every semiannual year = Face Value of the Bonds Payable x Semiannual stated rate (2) Principal of $40,000 at the end of the 4th year Every period we will pay cash interest Annual Market Interest Rate Semiannual Market Interest Rate 2 Annual Stated Interest Rate Semiannual Stated Interest Rate FV 4 Years Number of semiannual periods 4 Face Value of the Bonds Payable Present Value of the Bonds Payable The Bonds payable is issued at a premium = Present Value of the Bonds Payable-Face Value Period Total Interest expense - Total Cash Interest - Total Premium S-L Interest Expense Premium Amortired Carrying Value (Prior CV - Premium amortized) Initial CV = PV of the Bonds Payable Date Cash Interest 0 1/1/2016 1 6/30/2016 2 12/28/2016 3 6/27/2017 4 12/25/2017 56/24/2018 6 12/22/2018 7 6/21/2019 8 12/19/2019 Balance Sheet Presentation Bonds Payable Add: Premium on B/P Carrying Value - Face Value