Question: In December of each year, Eleanor Young contributes 10% of her gross income to the United Way (a 50% organization). Eleanor, who is in

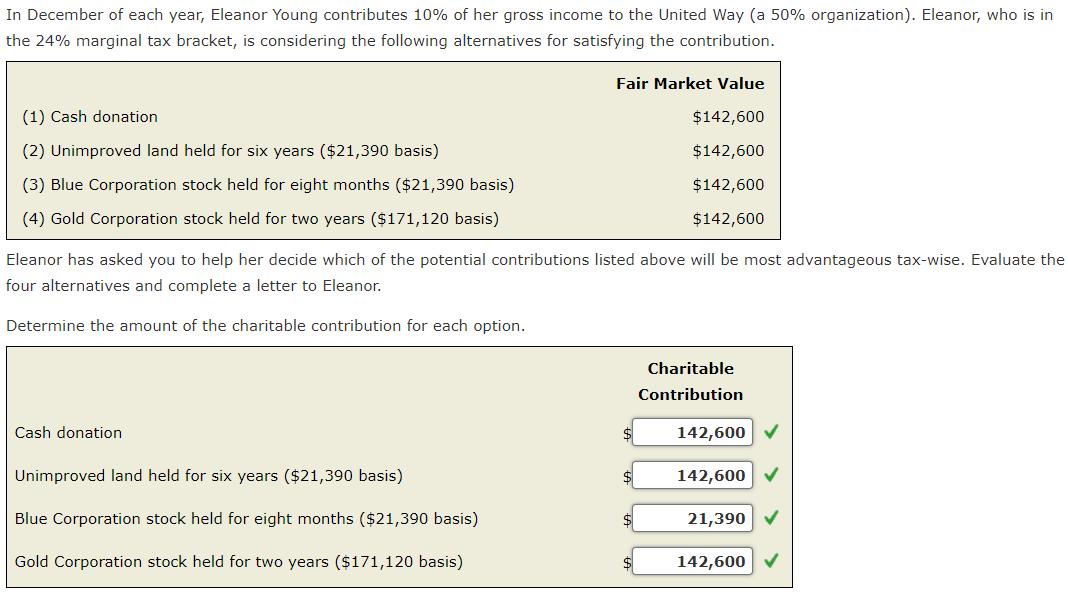

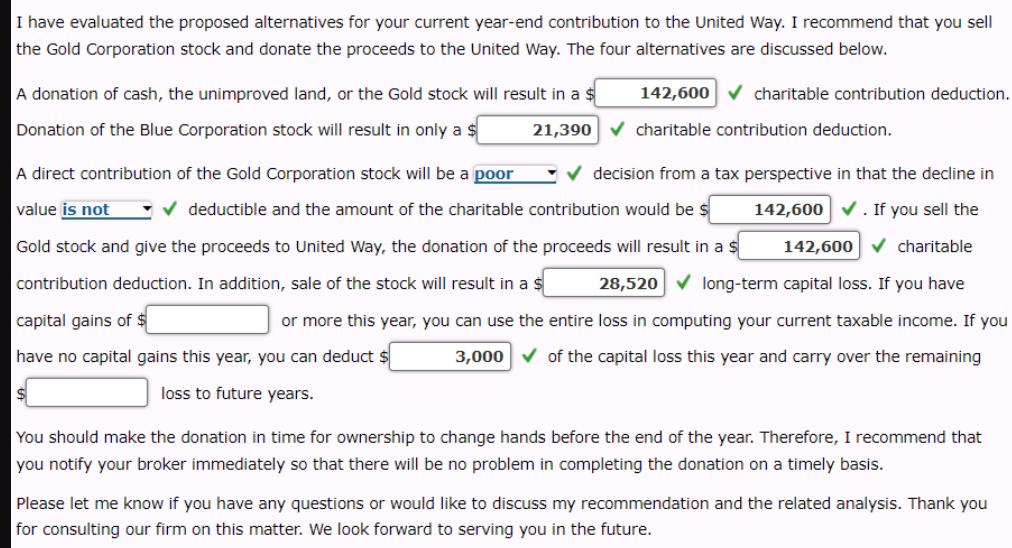

In December of each year, Eleanor Young contributes 10% of her gross income to the United Way (a 50% organization). Eleanor, who is in the 24% marginal tax bracket, is considering the following alternatives for satisfying the contribution. (1) Cash donation (2) Unimproved land held for six years ($21,390 basis) (3) Blue Corporation stock held for eight months ($21,390 basis) (4) Gold Corporation stock held for two years ($171,120 basis) Eleanor has asked you to help her decide which of the potential contributions listed above will be most advantageous tax-wise. Evaluate the four alternatives and complete a letter to Eleanor. Determine the amount of the charitable contribution for each option. Cash donation Fair Market Value $142,600 $142,600 $142,600 $142,600 Unimproved land held for six years ($21,390 basis) Blue Corporation stock held for eight months ($21,390 basis) Gold Corporation stock held for two years ($171,120 basis) $ Charitable Contribution 142,600 142,600 21,390 142,600 I have evaluated the proposed alternatives for your current year-end contribution to the United Way. I recommend that you sell the Gold Corporation stock and donate the proceeds to the United Way. The four alternatives are discussed below. A donation of cash, the unimproved land, or the Gold stock will result in a $ 142,600 charitable contribution deduction. Donation of the Blue Corporation stock will result in only a $ 21,390 charitable contribution deduction. A direct contribution of the Gold Corporation stock will be a poor value is not deductible and the amount of the charitable contribution would be s Gold stock and give the proceeds to United Way, the donation of the proceeds will result in a 28,520 long-term capital loss. If you have contribution deduction. In addition, sale of the stock will result in a $ or more this year, you can use the entire loss in computing your current taxable income. If you 3,000 of the capital loss this year and carry over the remaining capital gains of $ have no capital gains this year, you can deduct $[ $ loss to future years. decision from a tax perspective in that the decline in 142,600 . If you sell the 142,600 charitable You should make the donation in time for ownership to change hands before the end of the year. Therefore, I recommend that you notify your broker immediately so that there will be no problem in completing the donation on a timely basis. Please let me know if you have any questions or would like to discuss my recommendation and the related analysis. Thank you for consulting our firm on this matter. We look forward to serving you in the future.

Step by Step Solution

3.45 Rating (155 Votes )

There are 3 Steps involved in it

Answer Assuming Filing status Single or MFS If you have cap... View full answer

Get step-by-step solutions from verified subject matter experts