Answered step by step

Verified Expert Solution

Question

1 Approved Answer

From my industry research on Chester, I've learned that senior management intends to fully fund a new technology purchase by issuing 75,000 shares of stock

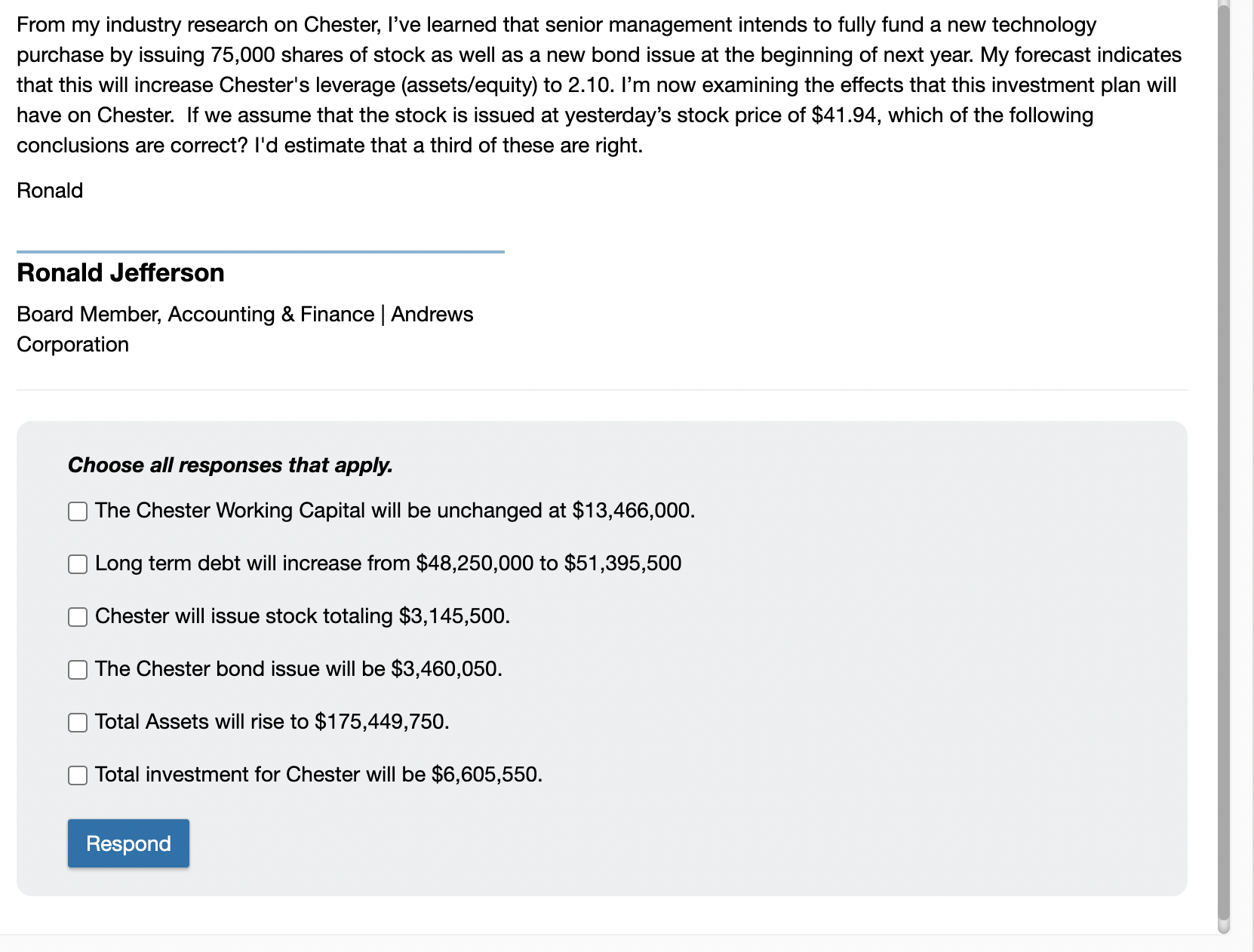

From my industry research on Chester, I've learned that senior management intends to fully fund a new technology purchase by issuing 75,000 shares of stock as well as a new bond issue at the beginning of next year. My forecast indicates that this will increase Chester's leverage (assets/equity) to 2.10. I'm now examining the effects that this investment plan will have on Chester. If we assume that the stock is issued at yesterday's stock price of $41.94, which of the following conclusions are correct? I'd estimate that a third of these are right. Ronald Ronald Jefferson Board Member, Accounting \& Finance | Andrews Corporation Choose all responses that apply. The Chester Working Capital will be unchanged at $13,466,000. Long term debt will increase from $48,250,000 to $51,395,500 Chester will issue stock totaling $3,145,500. The Chester bond issue will be $3,460,050. Total Assets will rise to $175,449,750. Total investment for Chester will be $6,605,550

From my industry research on Chester, I've learned that senior management intends to fully fund a new technology purchase by issuing 75,000 shares of stock as well as a new bond issue at the beginning of next year. My forecast indicates that this will increase Chester's leverage (assets/equity) to 2.10. I'm now examining the effects that this investment plan will have on Chester. If we assume that the stock is issued at yesterday's stock price of $41.94, which of the following conclusions are correct? I'd estimate that a third of these are right. Ronald Ronald Jefferson Board Member, Accounting \& Finance | Andrews Corporation Choose all responses that apply. The Chester Working Capital will be unchanged at $13,466,000. Long term debt will increase from $48,250,000 to $51,395,500 Chester will issue stock totaling $3,145,500. The Chester bond issue will be $3,460,050. Total Assets will rise to $175,449,750. Total investment for Chester will be $6,605,550 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started