Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(from Peter) MMPA, here is some info about pricing and the business. I need your analysis regarding how these should be recognized. I understand

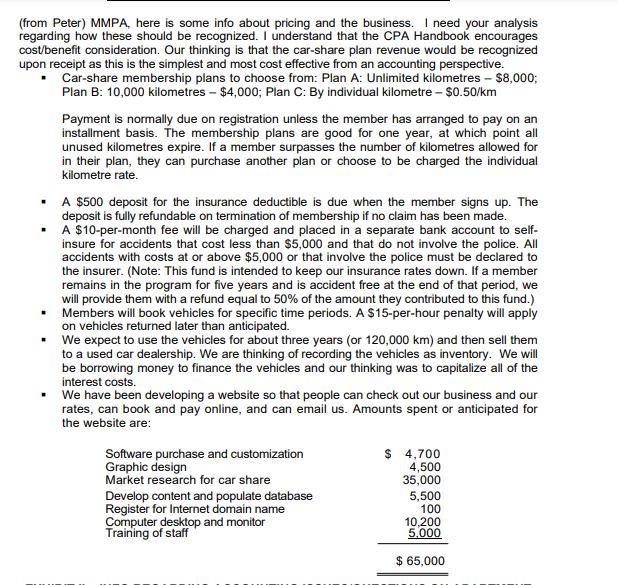

(from Peter) MMPA, here is some info about pricing and the business. I need your analysis regarding how these should be recognized. I understand that the CPA Handbook encourages cost/benefit consideration. Our thinking is that the car-share plan revenue would be recognized upon receipt as this is the simplest and most cost effective from an accounting perspective. Car-share membership plans to choose from: Plan A: Unlimited kilometres - $8,000; Plan B: 10,000 kilometres - $4,000; Plan C: By individual kilometre $0.50/km Payment is normally due on registration unless the member has arranged to pay on an installment basis. The membership plans are good for one year, at which point all unused kilometres expire. If a member surpasses the number of kilometres allowed for in their plan, they can purchase another plan or choose to be charged the individual kilometre rate. A $500 deposit for the insurance deductible is due when the member signs up. The deposit is fully refundable on termination of membership if no claim has been made. A $10-per-month fee will be charged and placed in a separate bank account to self- insure for accidents that cost less than $5,000 and that do not involve the police. All accidents with costs at or above $5,000 or that involve the police must be declared to the insurer. (Note: This fund is intended to keep our insurance rates down. If a member remains in the program for five years and is accident free at the end of that period, we will provide them with a refund equal to 50% of the amount they contributed to this fund.) Members will book vehicles for specific time periods. A $15-per-hour penalty will apply on vehicles returned later than anticipated. We expect to use the vehicles for about three years (or 120,000 km) and then sell them to a used car dealership. We are thinking of recording the vehicles as inventory. We will be borrowing money to finance the vehicles and our thinking was to capitalize all of the interest costs. We have been developing a website so that people can check out our business and our rates, can book and pay online, and can email us. Amounts spent or anticipated for the website are: Software purchase and customization Graphic design Market research for car share $ 4,700 4,500 35,000 Develop content and populate database Register for Internet domain name Computer desktop and monitor Training of staff 5,500 100 10,200 5.000 $ 65,000

Step by Step Solution

★★★★★

3.50 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Debit Credit Purchased a twoyear insurance policy 6400 Purchased three models XR sweepers 18000 Transportation fee 1200 Machines sold to Walmart 24000 Machines sold to Queensway 14000 5 of 18000 Sold ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 1 attachment)

628323a5d0239_88252.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started