Question

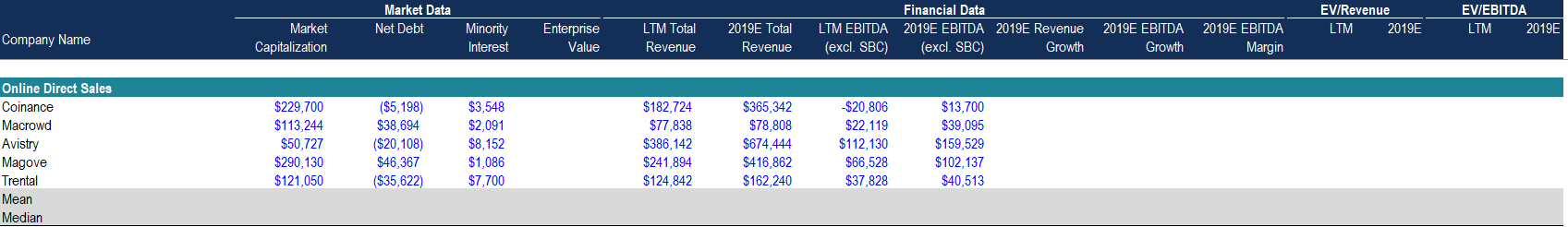

From the above data: 1. What is the mean 2019E EV/Revenue multiple in the Online Direct Sales comps group in 2019? 0.6x 1.1x 1.2x 0.8x

From the above data:

1. What is the mean 2019E EV/Revenue multiple in the Online Direct Sales comps group in 2019?

0.6x

1.1x

1.2x

0.8x

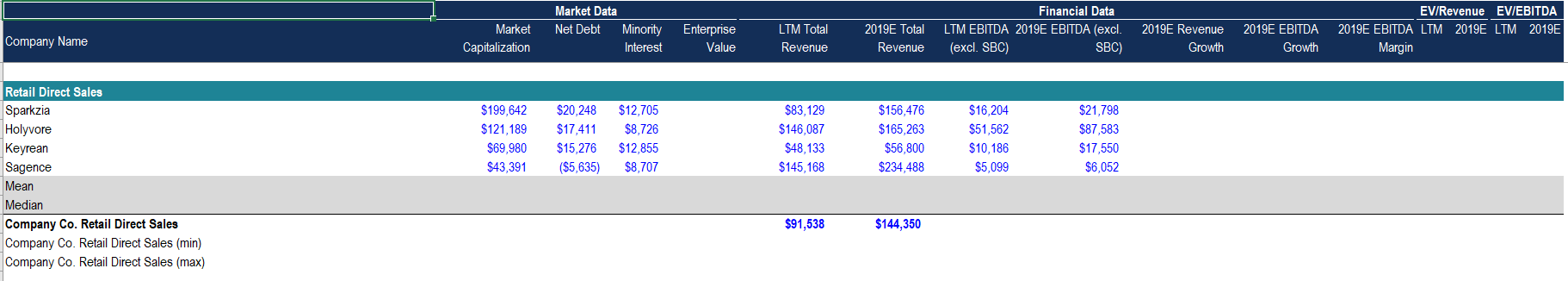

2. What is Company Co.'s enterprise value in the Service Package segment based on 2019E total revenue and 2019E mean EV/Revenue multiple?

104,184

184,314

191,032

110,275

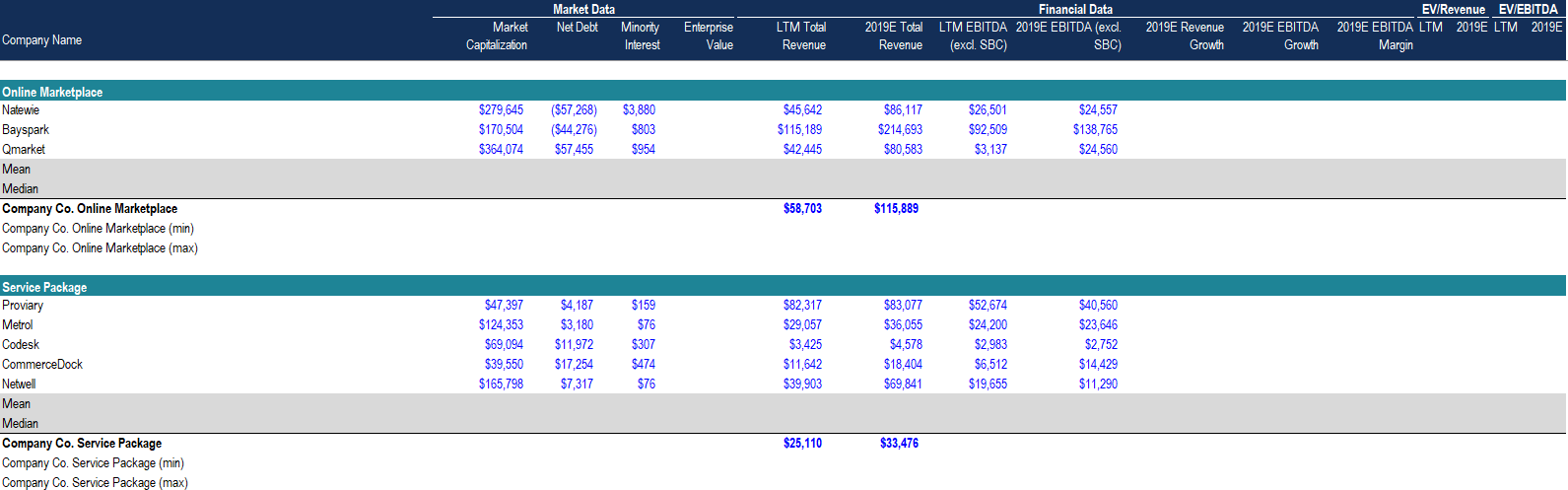

3. What is Company Co.'s total enterprise value calculated based on 2019E revenue and 2019E mean EV/Revenue multiple?

862,632

953,141

788,531

802,836

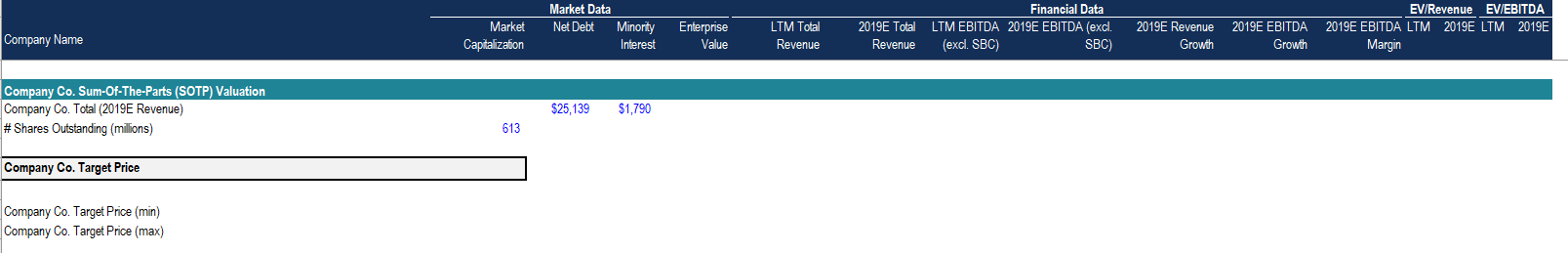

4. What is Company Co.'s target price calculated based on 2019E revenue and 2019E mean EV/Revenue multiple?

1,363

1,511

1,266

1,242

Market Data Net Debt EV/Revenue LTM 2019E EV/EBITDA LTM 2019E Market Capitalization Company Name Minority Interest Financial Data LTM EBITDA 2019E EBITDA 2019E Revenue (excl. SBC) (excl. SBC) Growth Enterprise Value LTM Total Revenue 2019E Total Revenue 2019E EBITDA 2019E EBITDA Growth Margin Online Direct Sales Coinance Macrowd Avistry Magove Trental $229,700 $113,244 $50,727 $290,130 $121,050 ($5,198) $38,694 ($20,108) $46,367 ($35,622) $3,548 $2,091 $8,152 $1,086 $7,700 $182,724 $77,838 $386,142 $241,894 $124,842 $365,342 $78,808 $674,444 $416,862 $162,240 $20,806 $22,119 $112,130 $66,528 $37,828 $13,700 $39,095 $159,529 $102,137 $40,513 Mean Median Market Data Net Debt Minority Interest Market Capitalization Enterprise Value Company Name LTM Total Revenue Financial Data LTM EBITDA 2019E EBITDA (excl. (excl. SBC) SBC) 2019E Total Revenue 2019E Revenue Growth EV/Revenue EV/EBITDA 2019E EBITDA LTM 2019E LTM 2019E Margin 2019E EBITDA Growth $199,642 $121,189 $69,980 $43,391 $20.248 $17,411 $15,276 ($5,635) $12,705 $8,726 $12,855 $8,707 $83,129 $146,087 $48,133 $145,168 $156,476 $165,263 $56,800 $234,488 $16,204 $51,562 $10,186 $5,099 $21,798 $87,583 $17,550 $6,052 Retail Direct Sales Sparkzia Holyvore Keyrean Sagence Mean Median Company Co. Retail Direct Sales Company Co. Retail Direct Sales (min) Company Co. Retail Direct Sales (max) $91,538 $144,350 Market Data Net Debt Minority Interest Market Capitalization Enterprise Value Company Name Financial Data 2019E Total LTM EBITDA 2019E EBITDA (excl. Revenue (excl. SBC) SBC) LTM Total Revenue 2019E Revenue Growth EV/Revenue EV/EBITDA 2019E EBITDA LTM 2019E LTM 2019E Margin 2019E EBITDA Growth $279,645 $170,504 $364,074 ($57,268) (544,276) $57,455 $3,880 $803 $954 $45,642 $115,189 $42.445 $86,117 $214,693 $80,583 $26,501 $92,509 $3,137 $24,557 $138,765 $24,560 Online Marketplace Natewie Bayspark Qmarket Mean Median Company Co. Online Marketplace Company Co. Online Marketplace (min) Company Co. Online Marketplace (max) $58,703 $115,889 Service Package Proviary Metrol Codesk Commerce Dock Netwell $47,397 $124,353 $69,094 $39,550 $165,798 $4,187 $3,180 $11.972 $17,254 $7,317 $159 $76 $307 $474 $76 $82,317 $29,057 $3,425 $11,642 $39,903 $83,077 $36,055 $4,578 $18,404 $69,841 $52,674 $24,200 $2,983 $6,512 $19,655 $40,560 $23,646 $2,752 $14,429 $11,290 Mean $25.110 $33,476 Median Company Co. Service Package Company Co. Service Package (min) Company Co. Service Package (max) Market Data Net Debt Minority Interest Market Capitalization Enterprise Value Company Name Financial Data 2019E Total LTM EBITDA 2019E EBITDA (excl. Revenue (excl. SBC) SBC) LTM Total Revenue EV/Revenue EV/EBITDA 2019E EBITDA 2019E EBITDA LTM 2019E LTM 2019E Growth Margin 2019E Revenue Growth Company Co. Sum-Of-The-Parts (SOTP) Valuation Company Co. Total (2019E Revenue) # Shares Outstanding (milions) $25,139 $1,790 613 Company Co. Target Price Company Co. Target Price (min) Company Co. Target Price (max)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started