From the below data, calculate the following:

Below is the information needed:

- Income Statements:

- Balance Sheet

- Cash Flow:

- Supporting Facts & Figures:

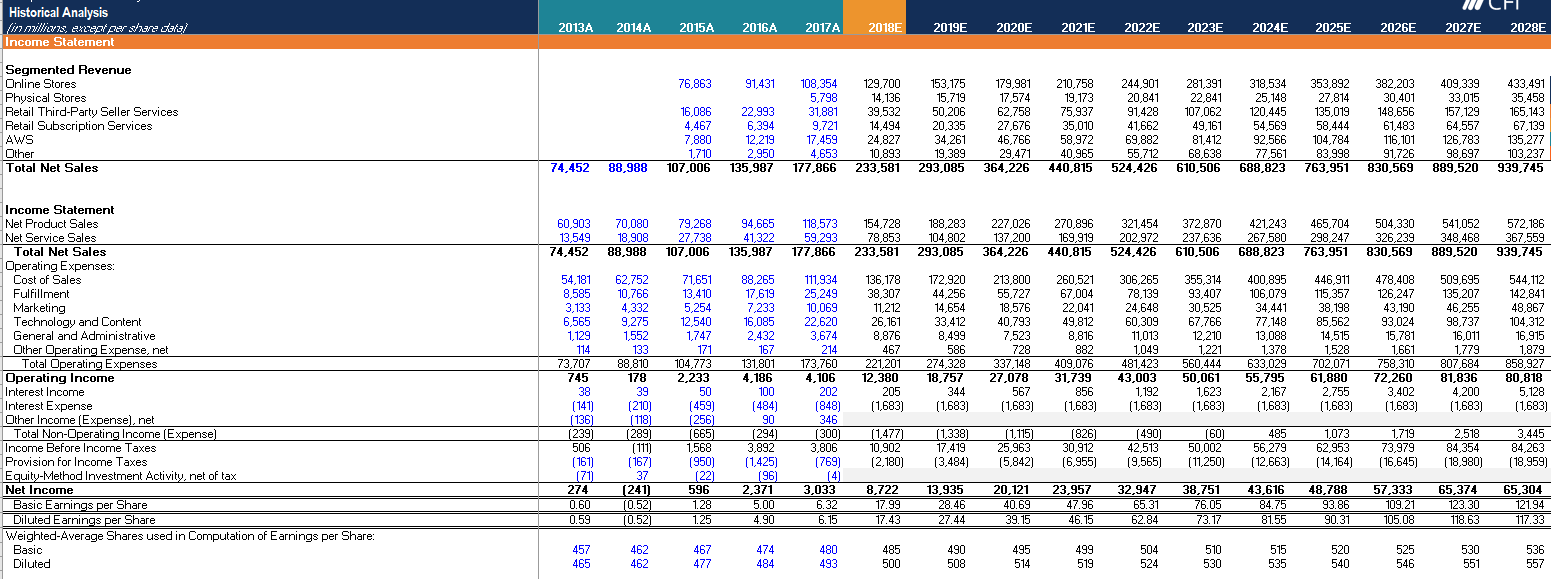

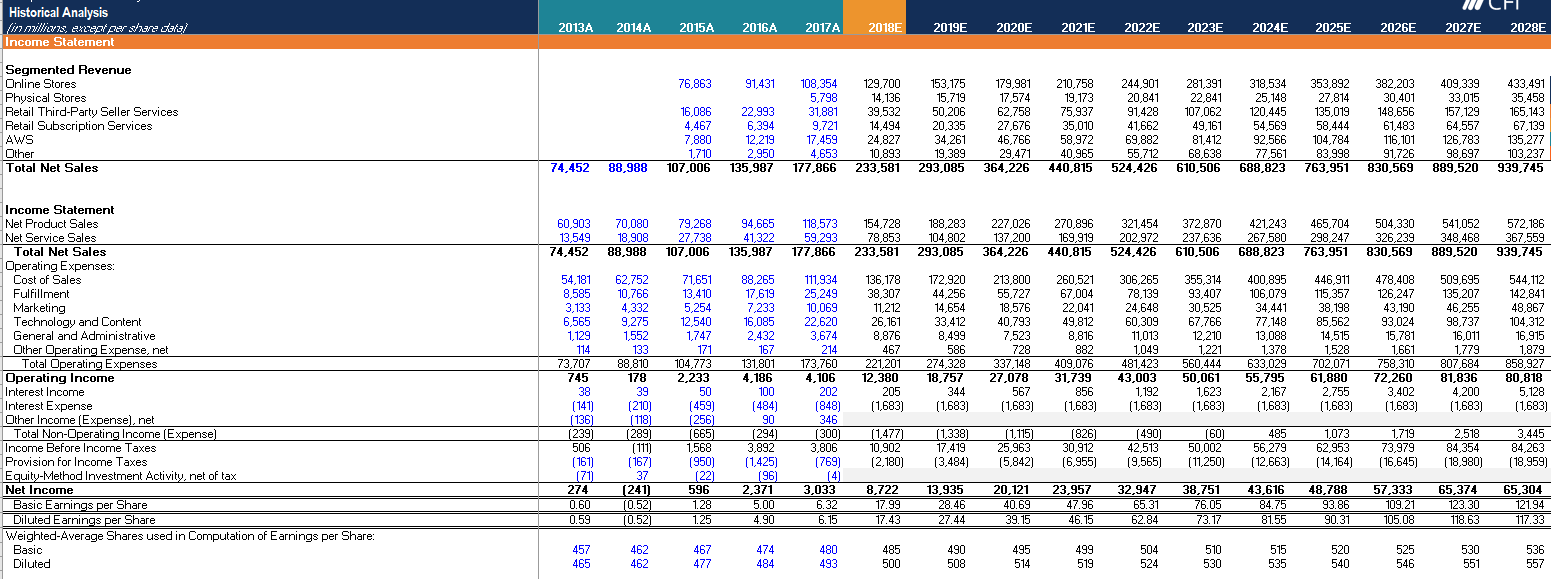

Link the live case with the Historical Analysis section in the Financial Model worksheet and complete the Valuation section. In the consensus case, what is the EBITDA excluding stock-based compensation (SBC) in 2024? 112,115 162,565 126,043 143,079 In the bull case, what is the free cash flow to the firm (FCFF) if all cash CAPEX in 2027? 98,662 114,662 148,361 125,384 NILFI Historical Analysis in vilias 2x2m red/) Income Statement 2013A 2014A 2015A 2016A 2017A 2018E 2019E 2020E 2021E 2022E 2023E 2024E 2025E 2026E 2027E 2028E 76,863 91,431 Segmented Revenue Online Stores Physical Stores Retail Third-Party Seller Services Retail Subscription Services Aws Other Total Net Sales 16,086 4,467 7,880 1,710 107,006 22.993 6,394 12,219 2,950 135,987 108,354 5,798 31,881 9,721 17,459 4,653 177,866 129,700 14,136 39,532 14,494 24,827 10,893 233,581 153,175 15.719 50,206 20.335 34,261 19,389 293,085 179,981 17,574 62.758 27,676 46,766 29,471 364,226 210,758 19,173 75,937 35,010 58,972 40,965 440,815 244,901 20,841 91,428 41,662 69,882 55,712 524,426 281,391 22,841 107,062 49.161 81,412 68,638 610,506 318,534 25,148 120.445 54,569 92,566 77,561 688,823 353,892 27,814 135,019 58.444 104,784 83,998 763,951 382,203 30,401 148,656 61,483 116,101 91,726 830,569 409,339 33,015 157,129 64,557 126.783 98,697 889,520 433,491 35,458 165,143 67,139 135,277 103,237 939,745 74,452 88,988 60.903 13,549 74,452 70,080 18,908 88,988 79,268 27,738 107,006 94,665 41.322 135,987 118,573 59.293 177,866 154,728 78,853 233,581 188,283 104,802 293,085 227,026 137,200 364,226 270,896 169,919 440,815 321,454 202.972 524,426 372,870 237,636 610,506 421,243 267,580 688,823 465,704 298,247 763,951 504.330 326,239 830,569 541,052 348,468 889,520 572,186 367.559 939,745 Income Statement Net Product Sales Net Service Sales Total Net Sales Operating Expenses: Cost of Sales Fulfillment Marketing Technology and Content General and Administrative Other Operating Expense, net Total Operating Expenses Operating Income Interest Income Interest Expense Other Income (Expense), net Total Non-Operating Income (Expense) Income Before Income Taxes Provision for Income Taxes Equity-Method Investment Activity, net of tax Net Income Basic Earnings per Share Diluted Earnings per Share Weighted-Average Shares used in Computation of Earnings per Share: Basic Diluted 54,181 8,585 3,133 6,565 1.129 114 73,707 745 38 (141) (136) (239) 506 (161) (71) 62,752 10,766 4,332 9,275 1,552 133 88,810 178 39 (210) (118) (289) (111) (167) 37 (241) (0.52) (0.52] 71,651 13,410 5,254 12,540 1,747 171 104,773 2,233 50 1459) (256) (665) 1,568 1950) 122) 596 1.28 1.25 88,265 17,619 7,233 16,085 2,432 167 131,801 4,186 100 (484) 90 (294) 3,892 (1,425) (96) 2,371 5.00 4.90 111,934 25,249 10,069 22,620 3,674 214 173,760 4,106 202 (848) 346 (300) 3,806 (769) (4) 3,033 6.32 6.15 136,178 38,307 11,212 26,161 8,876 467 221,201 12,380 205 (1,683) 172.920 44,256 14,654 33,412 8,499 586 274,328 18,757 344 (1,683) 213.800 55,727 18,576 40,793 7,523 728 337,148 27,078 567 (1,683) 260,521 67,004 22,041 49,812 8,816 882 409,076 31,739 856 (1,683) 306,265 78,139 24.648 60,309 11,013 1.049 481,423 43.003 1,192 (1,683) 355,314 93,407 30,525 67,766 12,210 1,221 560.444 50,061 1,623 (1,683) 400,895 106,079 34,441 77,148 13,088 1,378 633,029 55,795 2,167 (1,683) 446.911 115,357 38,198 85,562 14,515 1.528 702,071 61,880 2,755 (1,683) 478,408 126,247 43,190 93,024 15,781 1,661 758,310 72,260 3,402 (1,683) 509,695 135,207 46,255 98,737 16,011 1,779 807,684 81,836 4,200 (1,683) 544,112 142.841 48,867 104,312 16,915 1.879 858,927 80,818 5,128 (1,683) (1,477) 10,902 (2,180) (1,338) 17,419 (3,484) (1.115) 25,963 (5,842) (826) 30,912 (6,955) (490) 42,513 (9,565) (60) 50,002 (11,250) 485 56,279 (12,663) 1,073 62,953 (14,164) 1,719 73,979 (16,645) 2,518 84,354 (18,980) 3,445 84,263 (18,959) 274 0.60 0.59 8,722 17.99 17.43 13,935 28.46 27.44 20,121 40.69 39.15 23,957 47.96 46.15 32,947 65.31 62.84 38,751 76.05 73.17 43,616 84.75 81.55 48,788 93.86 90.31 57,333 109.21 105.08 65,374 123.30 118.63 65,304 121.94 117.33 457 465 462 462 467 477 474 484 480 493 485 500 490 508 495 514 499 519 504 524 510 530 515 535 520 540 525 546 530 551 536 557 Historical Analysis in svillis, 2X22023 Balance Sheet 2013A 2014A 2015A 2016A 2017A 2018E 2019E 2020E 2021E 2022E 2023E 2024E 2025E 2026E 2027E 2028E Current Assets: Cash and Cash Equivalents Marketable Securities Inventories Accounts Receivable, net and other Total Current Assets Property And Equipment, net Goodwill Other Assets Total Assets 8,658 3,789 7,411 4,767 24,625 10.949 2,655 1.930 40,159 14.557 2.859 8,299 5,612 31,327 16.967 3,319 2,892 54,505 15,890 3,918 10,243 6,423 36,474 21,838 3,759 3,373 65,444 19.334 6.647 11,461 8,339 45,781 29, 114 3.784 4,723 83,402 20.522 10,464 16,047 13,164 60,197 48,866 13,350 8,897 131,310 34,434 10.464 21,266 16,639 82,803 55,991 13,360 8,897 161,050 56.746 10.464 27,004 20,877 115,091 68.126 13,360 8,897 205,474 85,626 10.464 33,297 25,874 155,261 82 303 13,360 8,897 259,821 119,232 10.464 40,684 31,400 201,781 102.162 13,360 8,897 326,200 162, 268 10.464 47,828 37,356 257,916 126,796 13,360 8,897 406,969 216,714 10.464 55,487 43,488 326.154 148,211 13,380 8,897 496,642 275,506 10.464 62,434 48,933 397,337 170 417 13,380 8,897 590,031 340.151 10.464 69,792 54,418 474,825 192.749 13,380 8,897 689,851 420,020 10,464 74.710 59,164 564,358 195,917 13,380 8,897 782,551 512,777 10,464 79.596 63,363 666.200 186,403 13,380 8,897 874,880 603,395 10.464 84,739 66,758 765,356 184,171 13,380 8,897 971,804 LIABILITIES AND STOCKHOLDERS' EQUITY Current Liabilities: Accounts Payable Accrued Expenses and Other Unearned Revenue Total Current Liabilities Long-Term Debt Other Long-Term Liabilities Total Liabilities Stockholders' Equity: Common Shares - 477 and 484 Treasury Stock, at Cost Additional Paid-In Capital Accumulated Other Comprehensive Loss Retained Earnings Total Stockholders' Equity Total Liabilities and Stockholders' Equity 15,133 6,688 1,159 22,980 3,191 4.242 30,413 16,459 9,807 1,823 28,089 8,265 7,410 43,764 20,397 10,384 3.118 33,899 8.235 9,926 52,060 25,309 13,739 4,768 43,816 7,694 12,607 64,117 34,616 18,170 5,097 57,883 24,743 20,975 103,601 38,801 23,358 8,409 70,568 24,743 24,207 119,518 49,270 29,309 10,551 89,130 24,743 30,049 143,922 60,752 36,423 13,112 110,287 24,743 35,717 170,747 74,231 44,081 15,869 134,182 24,743 45,331 204,256 87,264 52,443 18,879 158,586 24,743 58,239 241,568 101,240 61,051 21,978 184,269 24,743 71,169 280, 181 113,916 68,882 24,798 207,59 24,743 83,688 316.026 127 339 76,395 27,502 231.236 24,743 95,769 351,748 136,313 83,057 29.900 249,271 24,743 96,307 370,321 145,228 88,952 32,023 266,203 24,743 88.450 379,396 154,611 93,974 33,831 282,416 24,743 84,968 392,128 5 (1.837) 9,573 (185) 2,190 9,746 40,159 5 (1.837) 11,135 (511) 1,949 10,741 54,505 5 (1.837) 13,394 (723) 2,545 13,384 65,444 5 (1,837) 17,186 (985) 4,916 19,285 83,402 5 (1,837) 21,389 (484) 8,636 27,709 131,310 5 (1,837) 26,490 (484) 17,358 41,532 161,050 5 (1.837) 32,575 (484) 31,293 61,552 205,474 5 (1.837) 39,976 (484) 51,415 89,074 259,821 5 (1.837) 48,889 (484) 75,372 121,945 326,200 5 (1,837) 59,398 (484) 108,319 165,402 406,969 5 (1837) 71,706 (484) 147,070 216,461 496,642 5 (1.837) 85,634 (484) 190,687 274,005 590,031 5 (1,837) 100,944 (484) 239,475 338, 103 689,851 5 (1,837) 117,738 (484) 296,808 412,230 782,551 5 (1,837) 135,617 (484) 362,182 495,484 874,880 5 (1.837) 154,506 (484) 427,486 579,677 971,804 Historical Analysis /inswillivis 2x2 Ve 3/3) Cash Flow Statement 2013A 2014A 2015A 2016A 20178 2018E 2019E 2020E 2021E 2022E 2023E 2024E 2025E 2026E 2027E 2028E CASH AND CASH EQUIVALENTS, BEGINNING OF PERIOD 8,084 8,658 14,557 15,890 19,334 20,522 34,434 56,746 85,626 119,232 162,268 216,714 275,506 340,151 420,020 512,777 274 (241) 596 2,371 3,033 8,722 13,935 20,121 23,957 32,947 38,751 43,616 48,788 57,333 65.374 65,304 3,253 1,134 123 4,746 1,497 (128) 6,281 2,119 486 8,116 2,975 (106) 11,478 4,215 (119) 18,569 5,101 (10) 21,277 6,084 0 25,888 7,401 0 31.275 8,913 38,822 10.509 0 48,183 12,308 (20) 56,320 13,928 0 64,758 15,310 0 73,245 16,794 0 74,448 17,879 70,833 18,889 0 0 OPERATING ACTIVITIES: Net Income Adjustments to Reconcile Net Income to Net Cash from Operating Activities: Depreciation of Property and Equipment Stock-Based Compensation Other Non-Cash Operating Expense, net Changes in Operating Assets and Liabilities: Inventories Accounts Receivable, net and other Accounts Payable Accrued Expenses and Other Unearned Revenue Net Cash Provided by (used in) Operating Activities (1.410) (846) 1,888 736 401 5,553 (1,193) (1,039) 1,759 706 741 6,848 (2,187) (1.755) 4.294 913 1,292 12,039 (1,426) (3,367) 5,030 1,724 1,955 17,272 (3,583) (4,786) 7,175 283 738 18,434 (5,219) (3,475) 4,185 5,188 3,312 36,374 (5,738) (4,239) 10,469 5,950 2,142 49,882 (6,293) (4,997) 11,482 7.114 (7,387) (5,527) 13,479 7,659 2,757 75,126 (7.143) (5,956) 13,034 8,361 3,010 93,584 (7.660) (6,132) 13,976 8,608 3,099 111,113 (6,947) (5,445) 12,675 7,832 2,819 124,799 (7,357) (5,486) 13,424 7,513 2,705 139,654 (4,919) (4,745) 8,974 6,662 2,398 155,742 (4,886) (4.199) 8,915 5.895 2,122 165,549 (5,143) (3,395) 9,383 5,022 1,808 2,561 63,277 162,702 (3,444) (4,893) (15,416) (19,344) (24,039) (29,094) 134,612) (36,020) (40,641) (45,073) (41,528) (38,249) (40,409) INVESTING ACTIVITIES: Purchases of Property and Equipment, Including Internal-Use Software and Website Development Proceeds from Property and Equipment Incentives Acquisitions, net of cash acquired, and other Sales (Purchases) of Marketable Securities, net Net Cash Provided by (used in) Investing Activities (5,387) 798 (795) (1,066) (6,450) (7,804) (11,955) 1.067 1,897 (116) (13,972) (3,023) (3,789 (9,876) (27,819) (312) (979) (520) 807 (4,276) (5,065) 0 0 0 0 (15,416) 0 0 0 0 0 0 (19,344) (24,039) (29,094) 0 0 0 (34,612) (36,020) 0 0 0 0 (40,641) (45,073) 0 0 0 0 0 (41,528) (38,249) (40,409) 0 (7,046) 0 (8,225) 0 (10.358) 0 (12,427) 0 (15,936) 0 (20,647) 0 (25,367) 0 (29,936) 0 (34,346) 0 (34,542) 0 (31,675) FINANCING ACTIVITIES: Proceeds (Repayments) from Long-Term Debt and Other Principal Repayments of Capital Lease Obligations Principal Repayments of Finance Lease Obligations Proceeds from Issuing Equity (Common, Treasury, Paid-in, etc) Payment of Dividends Net Cash Provided by (used in) Financing Activities 267 (3,860) (147) 0 163 (775) (5) 0 0 (617) 5,846 (1,285) (135) 0 0 4,426 (1,299) (2,462) (121) 0 0 (3,882) 14,859 (4,799) (200) 0 0 9,860 0 0 0 (7,046) 0 0 (8,225) 0 0 0 0 (10,358) (12,427) 0 0 0 0 0 0 0 0 0 0 0 (15,936) (20,647) (25,367) (29,936) (34,346) (34,542) 0 0 0 (31,675) (3,740) Foreign Currency Effect on Cash and Cash Equivalents Net Increase (Decrease) in Cash and Cash Equivalents 1861 574 (310) 5.899 (374) 1,333 (212) 3,444 713 1,188 13,912 22,312 28,880 33,606 43,036 54,446 58,792 64,645 79,868 92,757 90,619 CASH AND CASH EQUIVALENTS, END OF PERIOD 8,658 14,557 15,890 19,334 20,522 34,434 56,746 85,626 119,232 162,268 216,714 275,506 340,151 420,020 512,777 603,395 Historical Analysis (inwillivis 2*287722 // Supporting Schedules 2013A 2014A 2015A 2016A 2017 A 2018E 2019E 2020E 2021E 2022E 2023E 2024E 2025E 2026E 2027E 2028E 102,162 (38,8221 PP&E Schedule Opening Balance Less: Depreciation Plus: Capex Plus: PP&E Acquired Under Capital/Financing Leases Plus: Other Net Additions Closing Balance 10,949 (4,746) 4,893 4,751 1,120 16,967 16,967 (6,281) 4,589 5,353 1,210 21,838 21,838 (8.116) 6,737 6,593 2,062 29,114 29,114 (11,478) 10,058 12,643 8,529 48,866 48,866 (18,569) 15,416 10,278 0 55,991 55.991 (21,277) 19,344 14,068 0 68,126 68,126 (25,888) 24.039 16,026 0 82,303 82 303 (31,275) 29,094 22,041 0 102, 162 126,796 (48,183) 36,020 33,578 0 148,211 34,612 28,843 0 126,796 148,211 (56,320) 40,641 37 885 0 170,417 170,417 (64,758) 45,073 42,017 0 192,749 192,749 (73,245) 41,528 34.884 0 195,917 195,917 (74,448) 38,249 26,686 186,403 (70,833) 40,409 28,192 0 184,171 0 10.949 186,403 APRE 27 B3/vne Tree 17.949 59.991 148211 1247 192,49 24,743 Debt Schedule Opening Balance Plus: Additions (repayments), net Closing Balance 3.191 5,074 8,265 8,265 (30) 8,235 8,235 (541) 7,694 7,694 17,049 24,743 0 24,743 0 24,743 24,743 0 24,743 24,743 0 24,743 24,743 0 24,743 24,743 0 24,743 24,743 0 24,743 24,743 0 24,743 24,743 0 24,743 24,743 0 24.743 24,743 0 24,743 3,191 24,743 2017-Tam Day 17 Blazer 141 Interest Expense Interest Rate 210 3.7% 459 5.6% 484 6.1% 848 5.2% 1,683 6.8% 1,683 6.8% 1,683 6.8% 1,683 6.8% 1,683 6.8% 1,683 6.8% 1,683 6.8% 1,683 6.8% 1,683 6.8% 1,683 6.8% 1,683 6.8% Capital Leases Schedule Opening Balance (Total) Less: Principal Repayments Plus: Net Additions Closing Balance (Total) 1,301 (780) 2,452 2,973 2,973 (1,420) 4.751 6,304 6,304 (2,583) 5,353 9,074 9,074 (4,007) 6,593 11,660 11,660 (4,999) 12,643 19,304 19,304 (7,046) 10,278 22,536 22,536 (8,225) 14,068 28,378 28,378 (10,358) 16,026 34,046 34,046 (12,427) 22.041 43,660 43,660 (15,936) 28,843 56,568 56,568 (20,647) 33,578 69,498 69,498 (25,367) 37,885 82,017 82,017 (29,936) 42,017 94,098 94,098 (34,346) 34,884 94,636 94,636 (34,542) 26,686 86,779 86,779 (31,675) 28,192 83,297 Arvu/ hyvi Olusia7 Fixe 2.99 474 9074 11.47